“Persistence beats timing. Execution beats luck. Not immediately, but eventually.”

Naval Ravikant

“Over a long enough time horizon, positioning beats predicting.”

Shane Parrish

“I never have the faintest idea what the stock market is going to do in the next six months, or the next year, or the next two.”

Warren Buffett

Below are the indices we track for this newsletter.

| Data Series | 3 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years |

| Russell 3000 | -3.25% | 12.39% | 20.46% | 9.38% | 9.14% | 11.28% |

| S&P 500 | -3.27% | 13.07% | 21.62% | 10.15% | 9.92% | 11.91% |

| Russell 2000 | -5.13% | 2.54% | 8.93% | 7.16% | 2.40% | 6.65% |

| Russell 2000 Value | -2.96% | -0.53% | 7.84% | 13.32% | 2.59% | 6.19% |

| MSCI World ex USA (net div.) | -4.10% | 6.73% | 24.00% | 6.07% | 3.44% | 3.84% |

| MSCI World ex USA Small Cap (net div.) | -3.48% | 1.83% | 17.32% | 1.85% | 1.28% | 4.13% |

| MSCI Emerging (net div.) | -2.93% | 1.82% | 11.70% | -1.73% | 0.55% | 2.07% |

| Bloomberg U.S. T Bond 1-5 Years | 0.17% | 1.12% | 2.07% | -1.88% | 0.90% | 0.79% |

| ICE BofA 1-Year US T Note | 1.21% | 2.90% | 3.68% | 0.60% | 1.46% | 1.00% |

Stock markets gave back some of the gains from earlier in the year this last quarter. The US Stock market posted negative returns for the quarter and outperformed international developed markets but underperformed emerging markets. International developed markets also posted negative returns for the quarter and underperformed both US and emerging markets. Emerging markets posted negative returns for the quarter and outperformed both US and international developed markets. Finally, interest rates increased across all bond maturities in the US Treasury market for the quarter.

The Perils of Market Timing in the Stock Market

Introduction

The stock market is a place where many go to grow their wealth. With recent headlines of a possible recession, a government shutdown and consumer savings waning, some are advocating getting out of the market. Some believe they can outsmart it by “timing” their buys and sells perfectly to make even more money. Nobel laureates such as Markowitz, Sharpe, Fama, Tobin, and Merton have done extensive research on this topic. Their findings? Trying to time the market is risky and usually doesn’t work out.

1. What is Market Timing?

Market timing means attempting to buy stocks (and other securities) at their lowest points and sell them at their highest points, based on predictions about future market movements. This might sound smart in theory, but in practice, it’s very difficult.

2. Why is Market Timing a Bad Idea? Extensive research has led to the following theories:

-

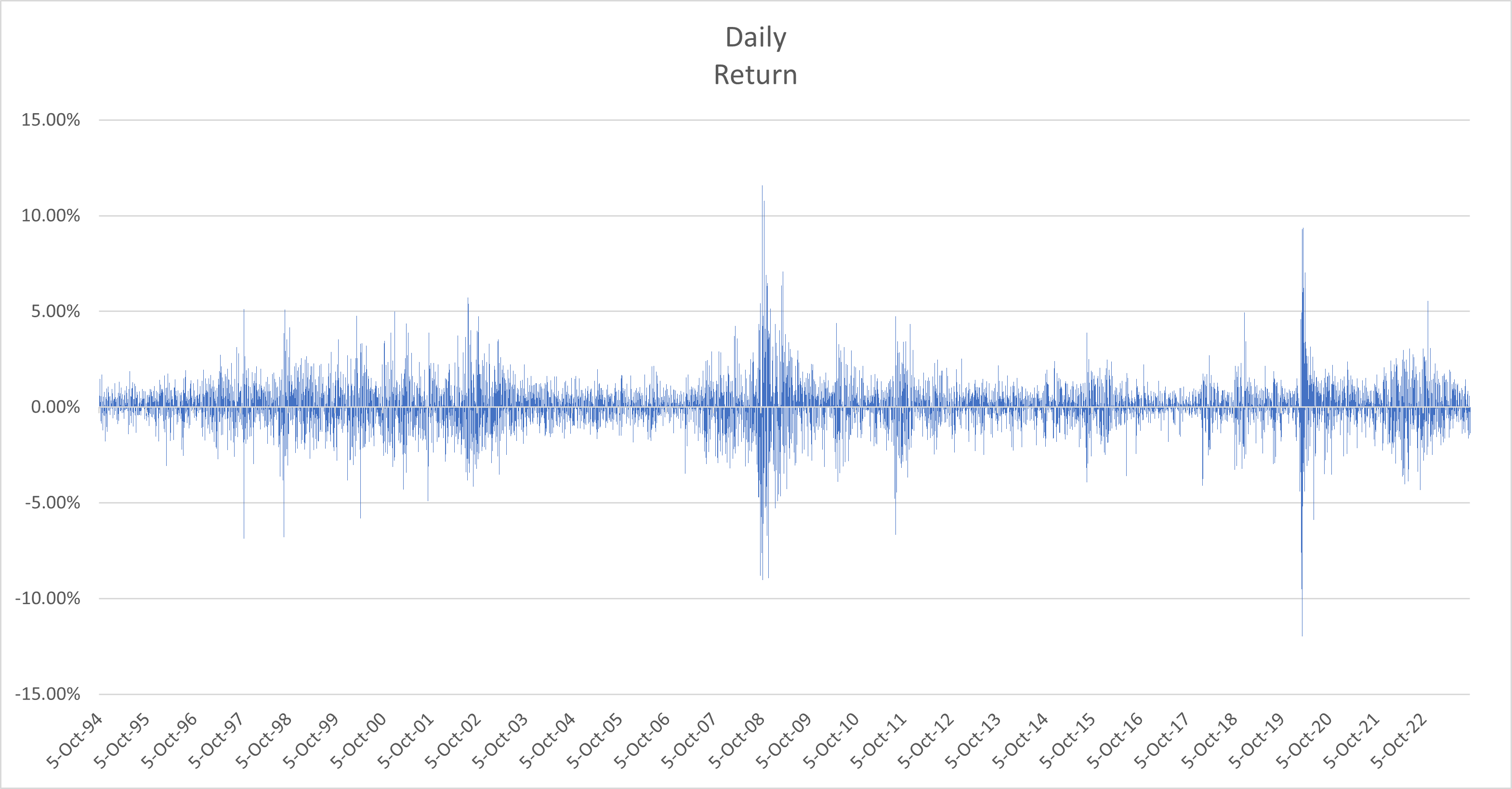

- Random Walk Theory (Fama): Eugene Fama‘s research suggests that stock prices move unpredictably and follow a “random walk”. This means today’s stock prices are not based on yesterday’s prices and predicting the market’s next move is almost impossible. Below is a graph of daily returns of the S&P 500 for 30 years through Oct 3, 2023.

-

- Risk-Reward Relationship (Markowitz and Tobin): Harry Markowitz‘s research on portfolio theory and James Tobin‘s work on the “separation theorem” highlight that higher returns come with higher risks. By trying to time the market, investors might miss out on high-returning days, meaning they could end up with lower overall returns. Tobin suggested managing and lowering the risk of the portfolio by combining Markowitz’s diversified stock portfolio with safe, cash-like investments, such as short term treasuries or safe bonds.

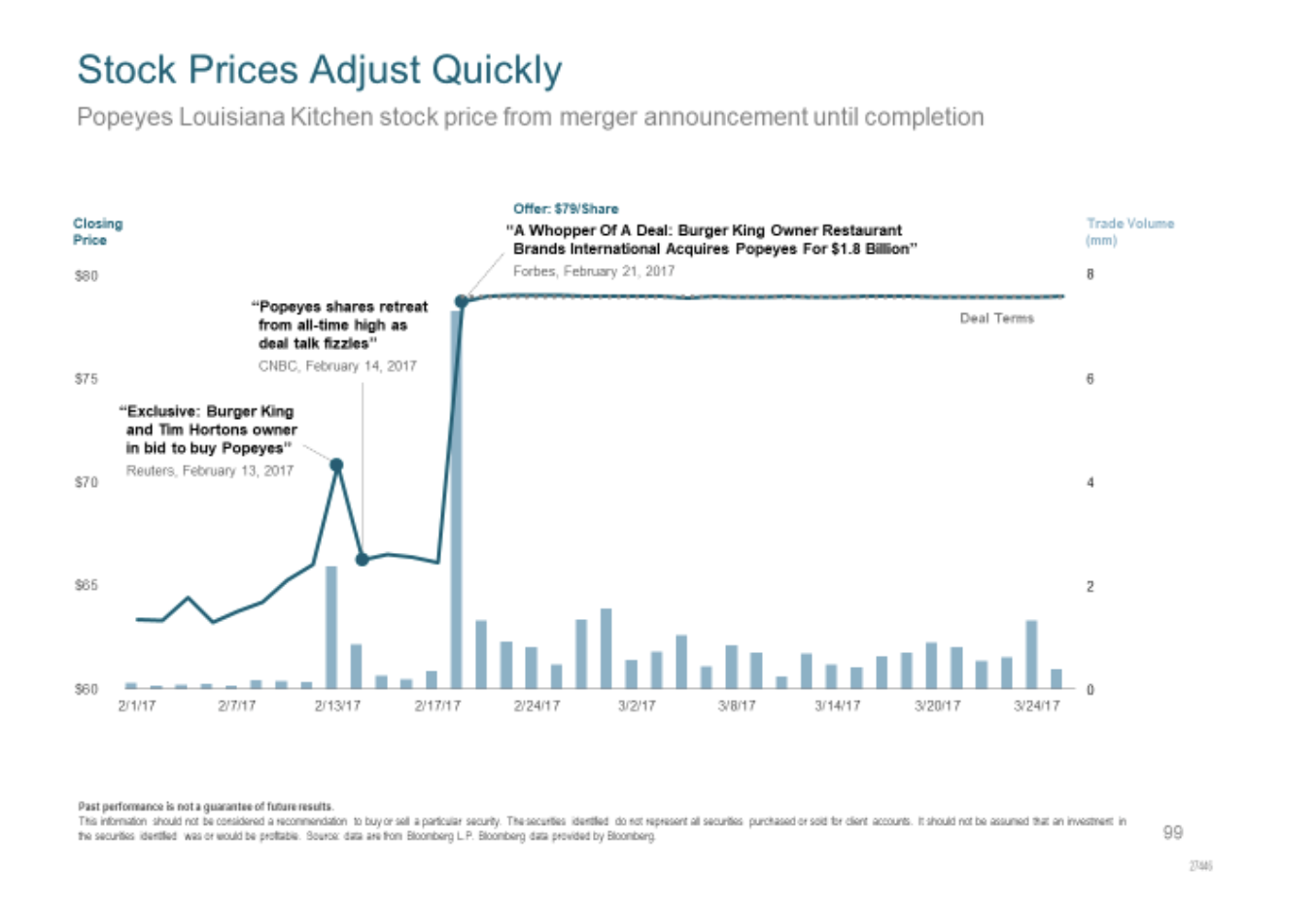

- Efficient Market Hypothesis (Fama): Fama’s theory suggests all known information about a stock is already reflected in its price. If true, this means it’s impossible to buy undervalued stocks or sell overvalued ones consistently because there are no “hidden secrets” in stock prices. Further, prices adjust quickly, as shown below.

-

- Luck versus Skill: Fama and Ken French researched luck versus skill in investing in their paper Luck Versus Skill in the Cross Section of Mutual Fund Returns by comparing the returns of professionally managed funds to returns one would expect by chance or luck. They found that professional money managers do not beat the market once fees and expenses are considered. The paper suggests that it is challenging to find a manager who will consistently outperform the market in the future.

3. Real-world Challenges

-

-

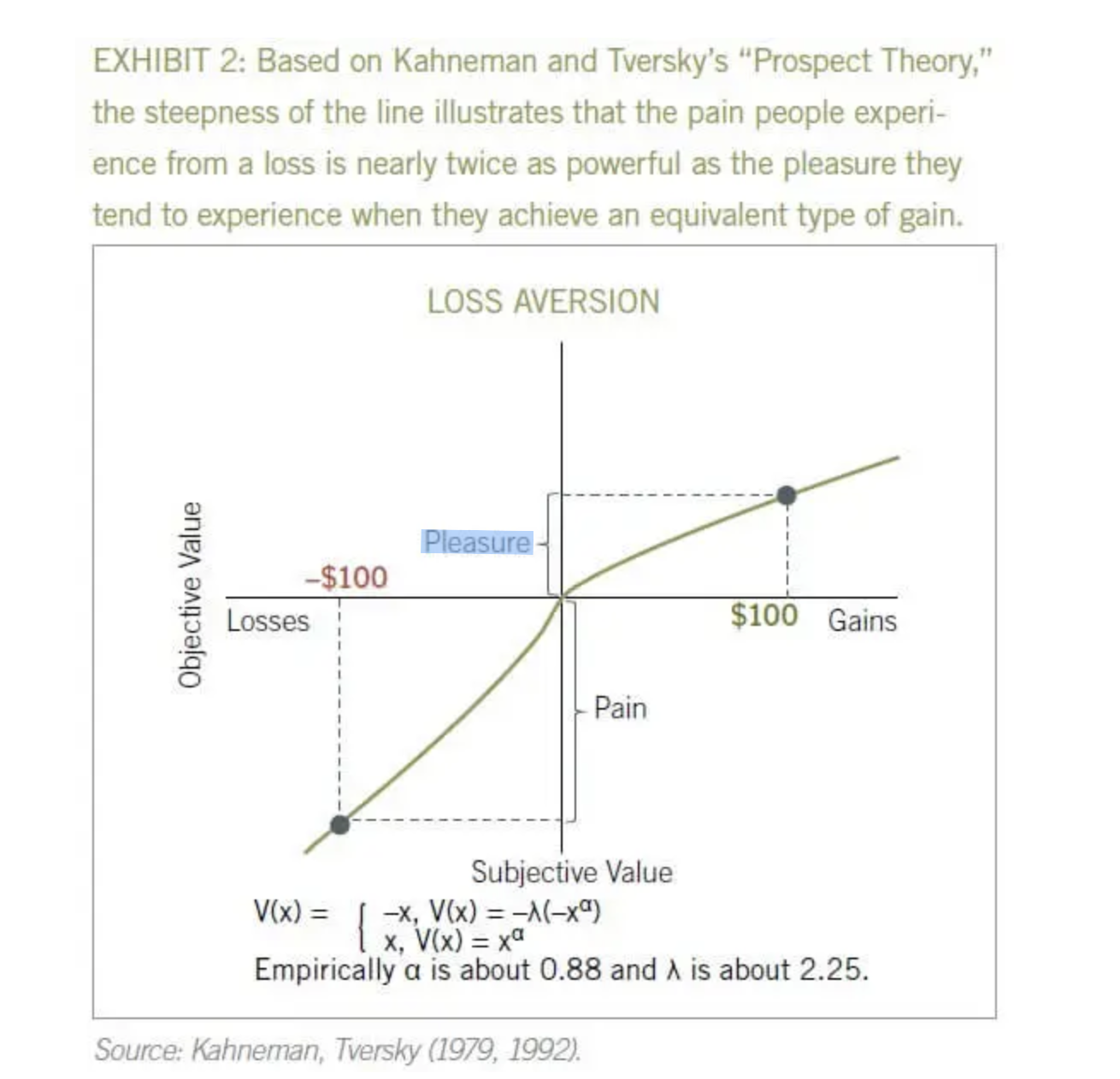

Emotional Decision Making: Fear, loss aversion identified by Danny Kahneman, and greed can influence decisions. When the market drops, fear might make someone sell their stocks. And when it rises, greed might make them buy. This emotional cycle can cause people to buy high and sell low – the opposite of what’s profitable.

-

-

-

Increased Costs: Trying to time the market involves more trading. More trading means more fees and taxes, eating away at potential profits.

-

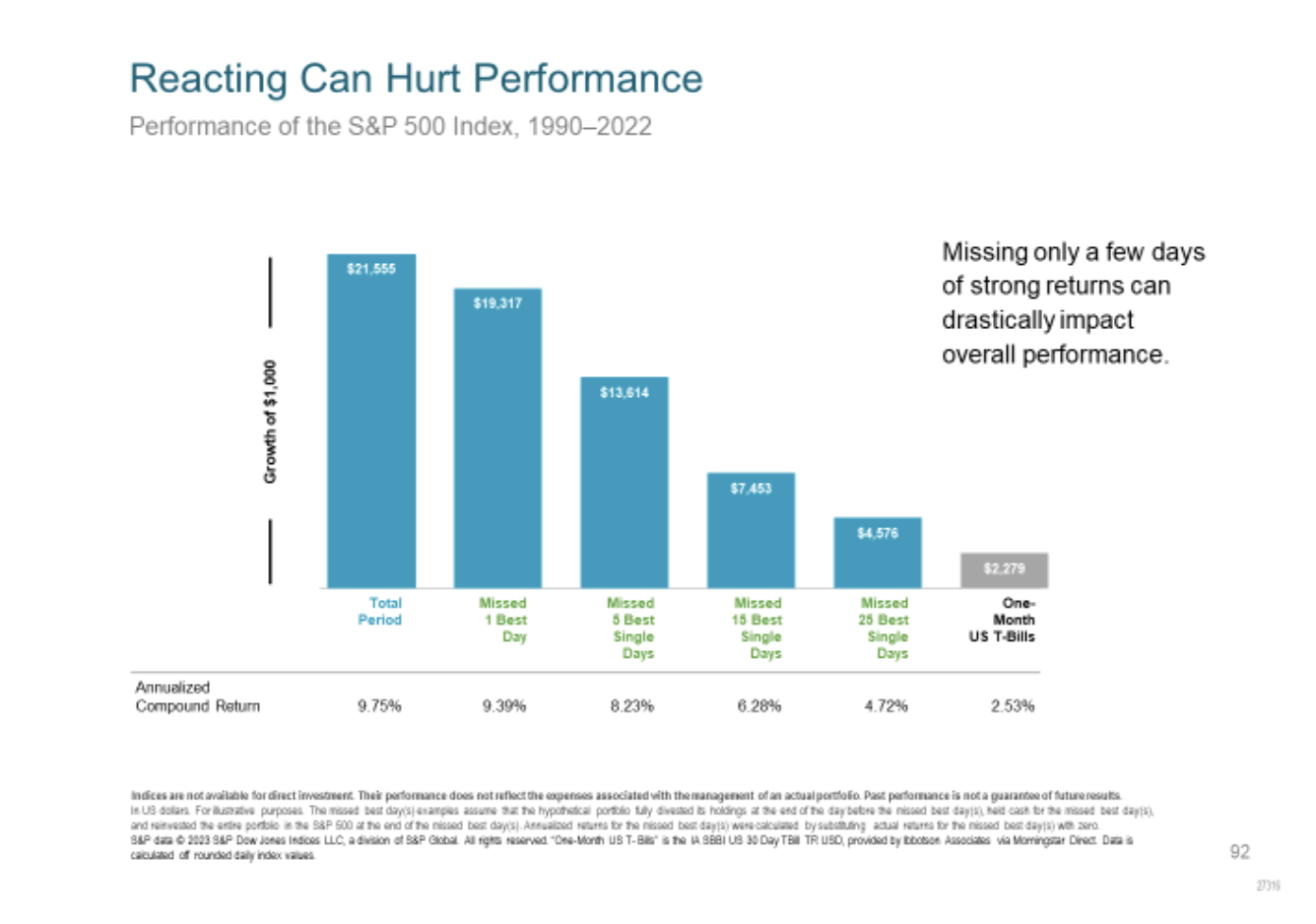

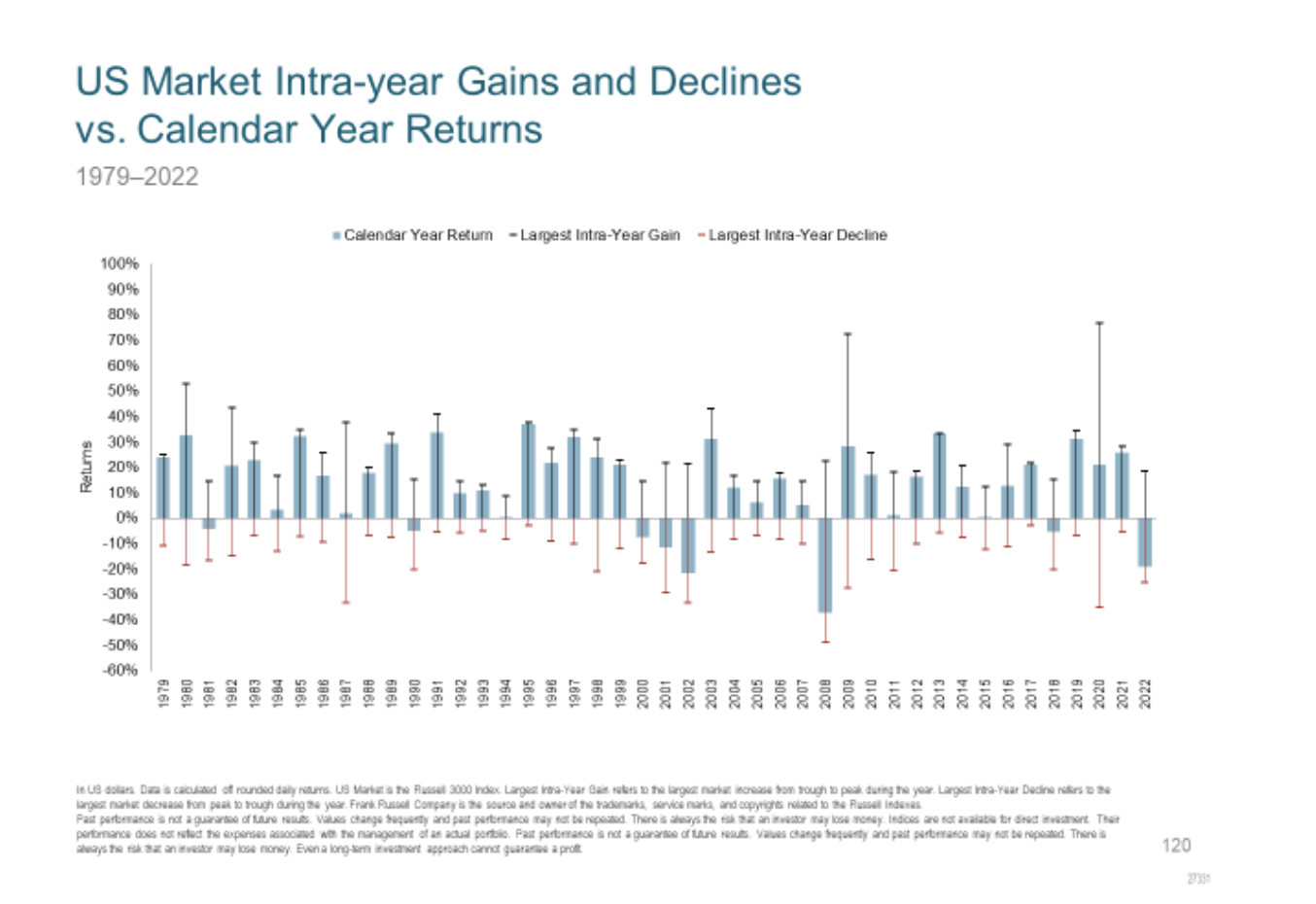

Missing the Best Days: Research by Bill Sharpe and others have shown that a significant portion of stock returns come from just a few of the best trading days. If an investor is out of the market on these days, they might miss out on essential gains.

-

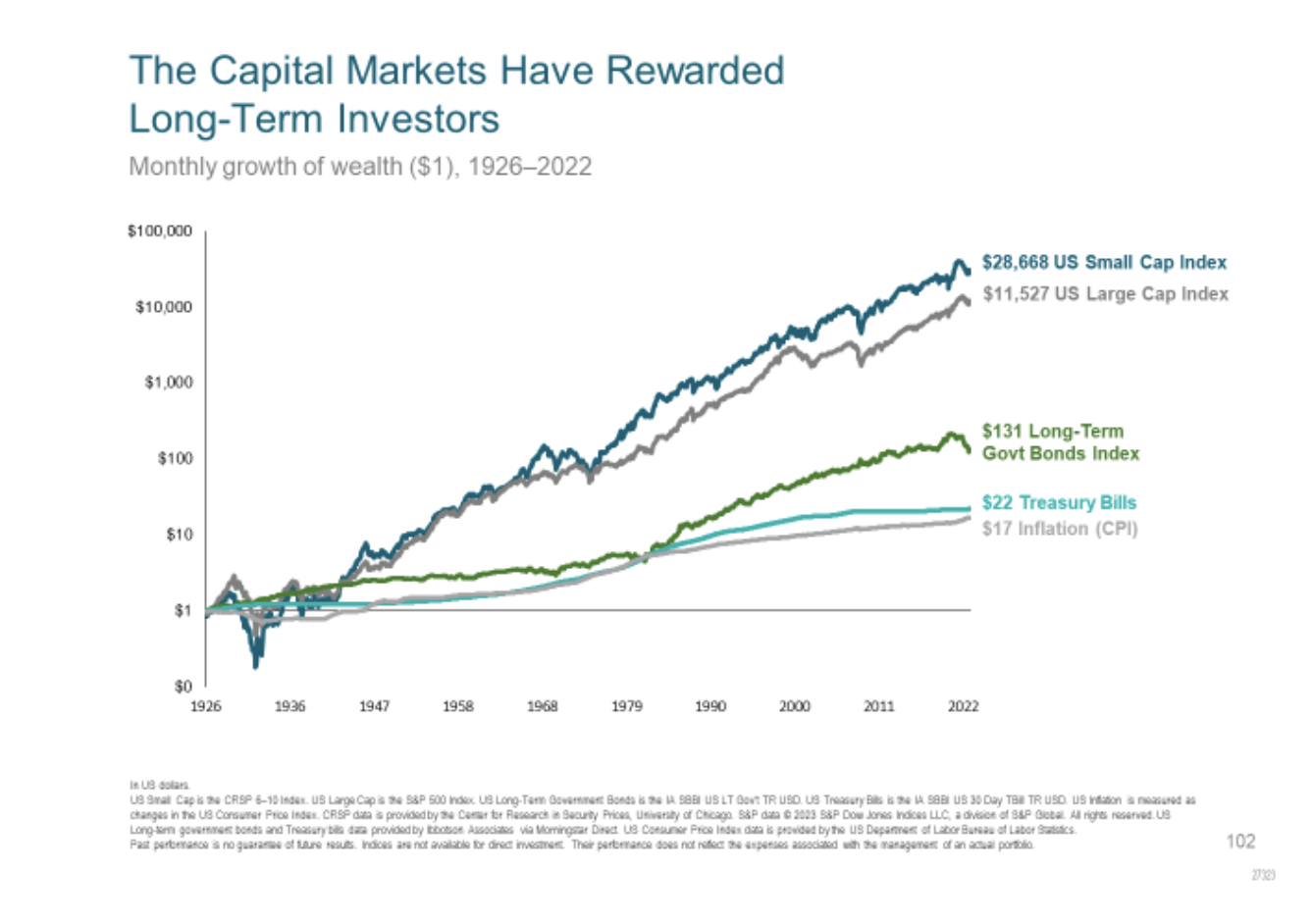

Academic research shows the advantages of holding onto investments for the long term. Instead of trying to time every market move:

-

-

Stay Invested: Over time, historically, the market has trended upwards. By staying invested, one can benefit from this long-term growth.

-

Diversify: Instead of putting all money into one stock or sector, spread it out. This reduces risk and provides a smoother ride.

-

Conclusion

The collective wisdom from these Nobel laureates, and Warren Buffett above, tells us that trying to time the market is more of a gamble than a guaranteed strategy. It’s filled with risks, costs, and challenges. For most people, a more reliable approach is to stay invested, diversify their portfolio, and think long-term. The stock market isn’t a game to be outsmarted; it’s an opportunity to grow wealth over time.

Citations

- Random Walk Theory (Fama)

- Fama, E. F. The Behavior of Stock-Market Prices. The Journal of Business, 38(1), 34-105.

- Risk-Reward Relationship (Markowitz and Tobin)

- Markowitz, H. Portfolio Selection. The Journal of Finance, 7(1), 77-91.

- Tobin, J. Liquidity Preference as Behavior Towards Risk. The Review of Economic Studies, 25(2), 65-86.

- Efficient Market Hypothesis (Fama)

- Fama, E. F. Efficient Capital Markets: A Review of Theory and Empirical Work. The Journal of Finance, 25(2), 383-417.

- CAPM and Return Concepts (Sharpe)

- Sharpe, W. F. Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk. The Journal of Finance, 19(3), 425-442.

- Continuous-time finance (Merton)

- Merton, R. C. Theory of Rational Option Pricing. The Bell Journal of Economics and Management Science, 4(1), 141-183.

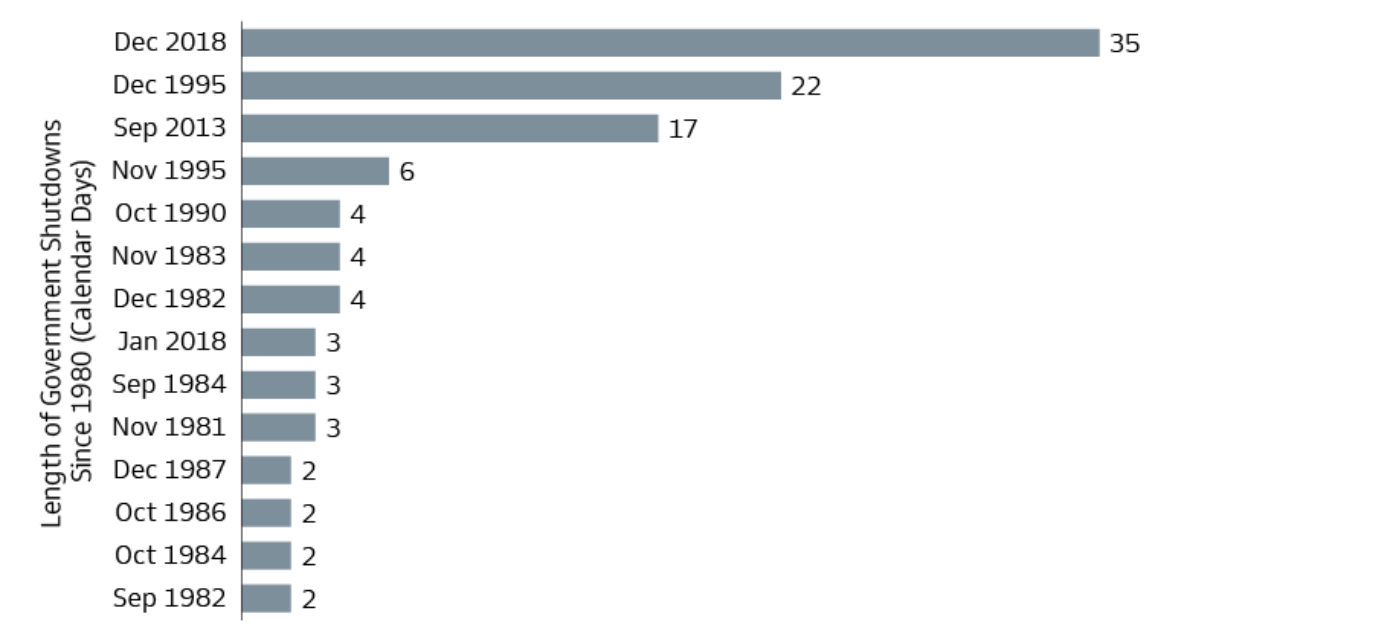

Chart Of The Week: Shutdown Showdown

Goldman Sachs sent an email on Oct 2, 2023, discussing the potential government shutdown. They stated: “Government shutdowns since 1980 have lasted, on median, 4 days, but a shutdown in 2023 may last 2-3 weeks. We expect annualized growth to decline by –0.2pp for each week that a shutdown lasts but believe those losses can be recovered in subsequent months, in part due to back-paying government salaries. Historical market impacts have been relatively muted: since 1980, the S&P 500 has delivered a median return of 0.75% during government shutdowns.”

Some food for thought on the impact on markets.

All the best,

Mike and Emily