“A good process produces good results.”

Nick Saban

“Goals can provide direction and even push you forward in the short-term, but eventually a well-designed system will always win. Having a system is what matters. Committing to the process is what makes the difference.”

James Clear, Author, Atomic Habits

“If you can’t describe what you are doing as a process, you don’t know what you’re doing.”

W. Edwards Deming, Quality Control Expert

Well, the fourth quarter was a good one, despite most economic forecasters’ predictions. Below are the indices we track.

| Data Series | 4th Qtr | 1 Year | 3 Years | 5 Years | 10 Years |

| Russell 3000 | 12.07% | 25.96% | 8.54% | 15.16% | 11.48% |

| S&P 500 | 11.69% | 26.29% | 10.00% | 15.69% | 12.03% |

| Russell 2000 | 14.03% | 16.93% | 2.22% | 9.97% | 7.16% |

| Russell 2000 Value | 15.26% | 14.65% | 7.94% | 10.00% | 6.76% |

| MSCI World ex USA (net div.) | 10.51% | 17.94% | 4.42% | 8.45% | 4.32% |

| MSCI World ex USA Small Cap (net div.) | 10.60% | 12.62% | -0.20% | 7.05% | 4.63% |

| MSCI Emerging Markets (net div.) | 7.86% | 9.83% | -5.08% | 3.68% | 2.66% |

| Bloomberg U.S. Treasury Bond 1-5 Years | 3.21% | 4.37% | -0.85% | 1.18% | 1.12% |

| ICE BofA 1-Year US Treasury Note | 1.79% | 4.74% | 1.18% | 1.66% | 1.18% |

The Nick Saban Way to Investing: Why Process Trumps Results (and How It Can Grow Your Portfolio)

As some of you may know, Emily and her 2 sisters attended the University of Alabama, so we have been somewhat influenced by Nick Saban since 2011. Have you ever wondered what Alabama’s legendary coach and a solid investment strategy have in common? Surprisingly, both hinge on a powerful principle: prioritizing the process over the outcome.

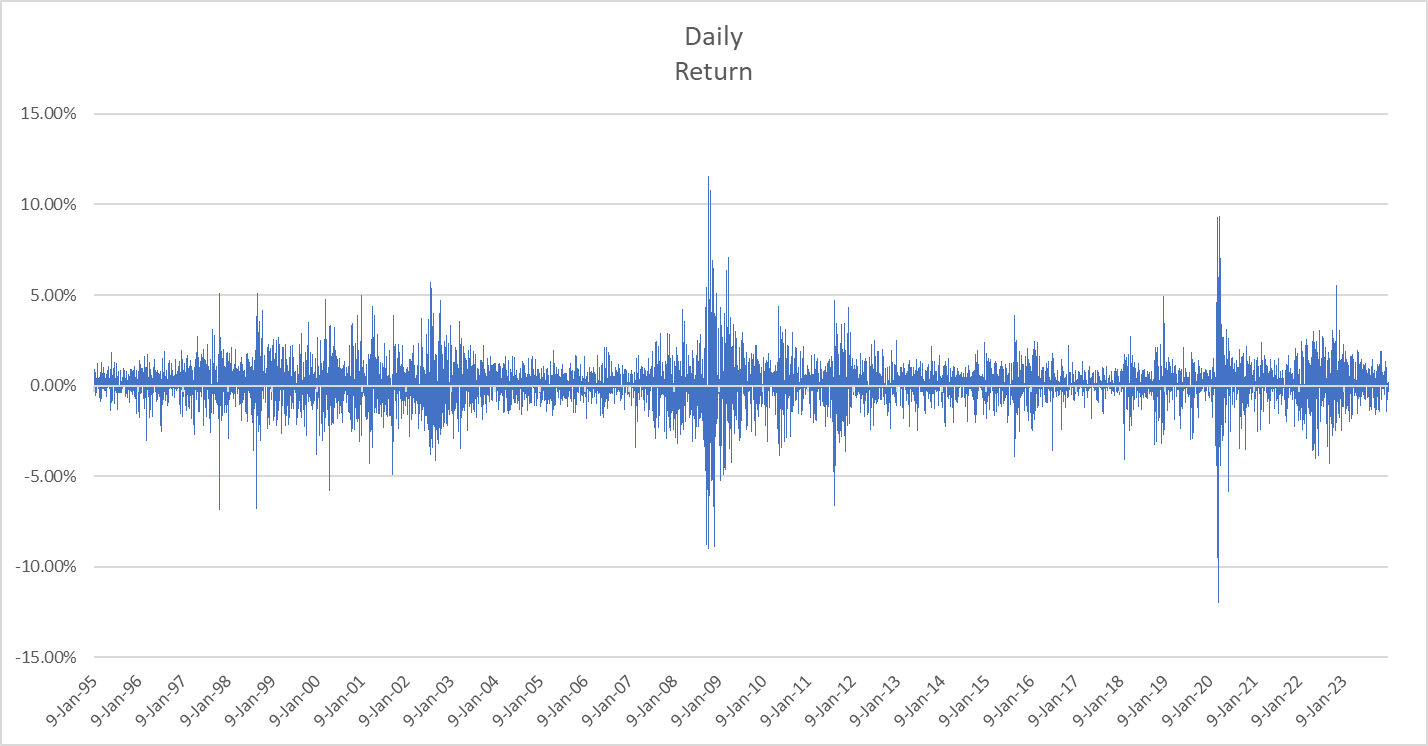

Saban’s relentless focus on meticulous preparation, execution, and constant improvement has propelled Alabama to six national championships. Similarly, in the uncertain world of investing, chasing short-term returns can lead to impulsive decisions and emotional rollercoasters. Imagine trying to make decisions based upon the daily stock moves as shown in the graph below.

Instead, focusing on a well-defined process, grounded in research and evidence, gives an investor a higher probability of achieving their long-term financial goals.

This isn’t just wishful thinking. Nobel laureate Eugene Fama and Professor Kenneth French, whose work on risk factors like size and value underpins Fama-French portfolios, have shown that systematic, process-driven investing outperforms market timing and impulsive decisions. And Harry Markowitz, another Nobel laureate, championed diversification as a cornerstone of risk management, a principle that forms the bedrock of any sound investment process.

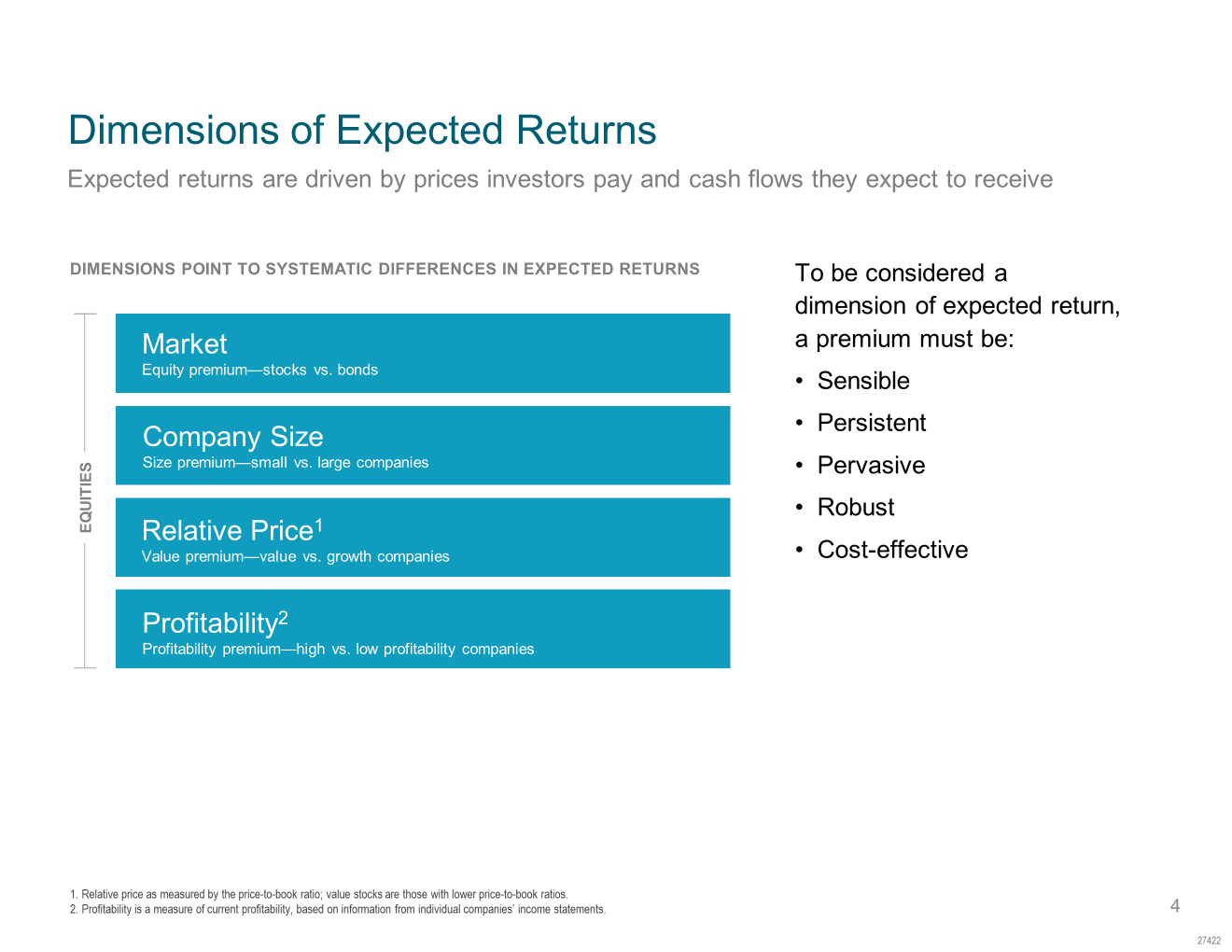

At McCartney Wealth Management, we believe in the power of process. We work with clients to develop personalized investment plans that leverage these proven principles. We employ evidence based research such as Fama-French factor-based strategies to tap into returns that investors get for taking compensated risk.

For example, Fama and French found that systematic factors beyond just market risk significantly influence stock returns and can be harnessed to build more effective portfolios. Let’s dive into these factors and their statistical significance:

1. Size Premium (SMB): Small-cap stocks have historically outperformed large-cap stocks. This may be due to their higher growth potential, lower liquidity, or higher risk, which demands a higher expected return.

2. Value Premium (HML): Stocks with high book-to-market ratios – “value stocks” – tend to outperform “growth stocks” with low book-to-market ratios. This could be due to mean reversion in valuations, where undervalued assets eventually catch up to their intrinsic worth.

3. Profitability Premium (RMW): Companies with high operating profitability, as measured by profitability ratios like operating margin, have historically generated higher returns. This aligns with the idea that better-managed companies deliver superior returns over time.

Statistical Significance: The empirical evidence for these factors is robust. Numerous studies have confirmed their existence and significance using various statistical tests like T-statistics and P-values. For example, the average T-statistics for SMB and HML in Fama and French’s original paper were well above 3, indicating strong statistical separation from random chance (at a P-value < 0.01). Subsequent research has further validated these findings.

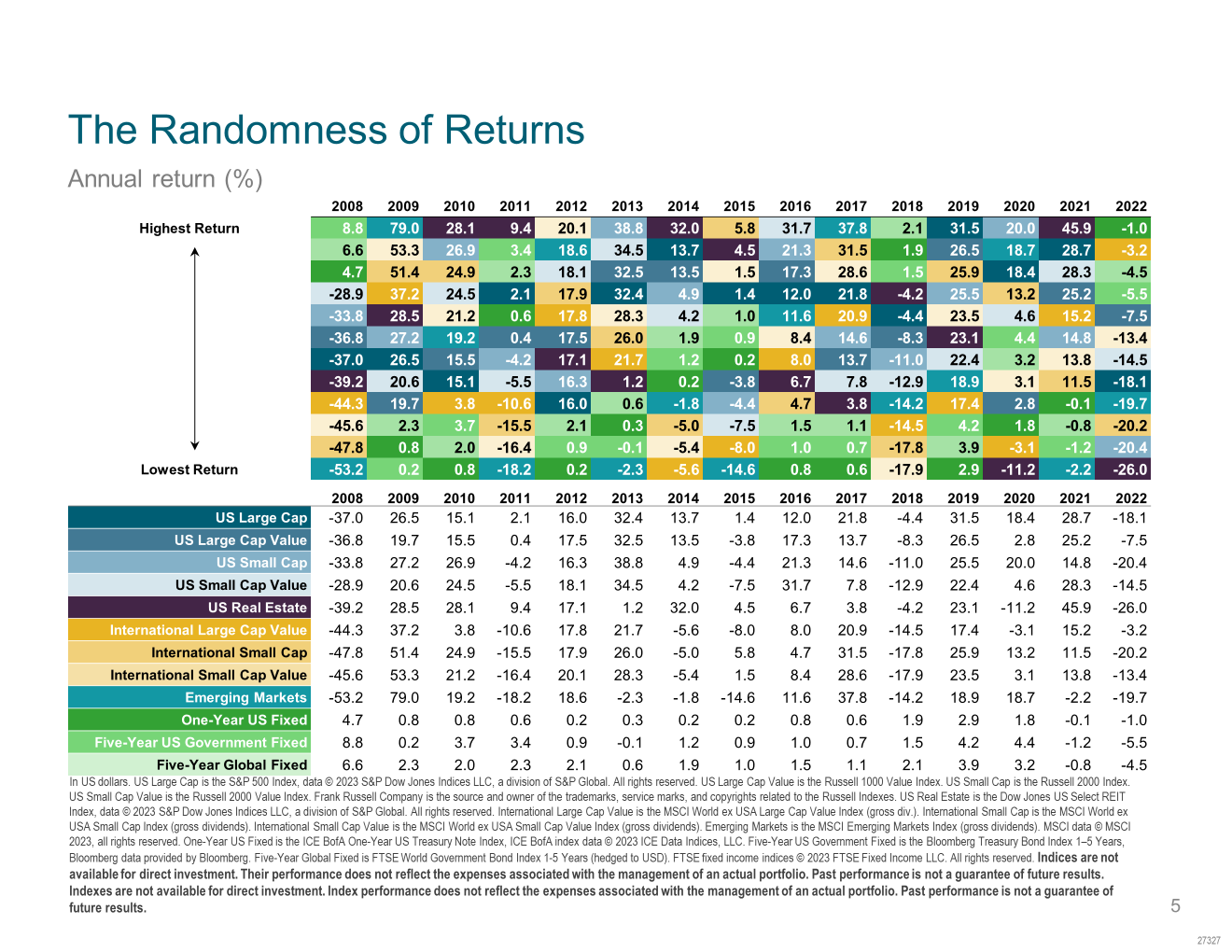

Further, we diligently diversify portfolios across asset classes and geographies, including international and emerging markets, to mitigate risk. This structured approach, based on research and not hunches, aims to navigate market volatility and steer your portfolio towards long-term success. As you can see below, it is impossible to identify in advance which asset class is going to be the best or worst performer in any given calendar year.

But focusing on process doesn’t mean ignoring results entirely. Regular portfolio reviews and performance monitoring are crucial to ensure your strategy stays aligned with your evolving needs, risk tolerance and financial plan. This iterative approach allows you to fine-tune your process, making adjustments as needed while maintaining a steady focus on the long game.

Remember, the market is a marathon, not a sprint. By focusing on the process, on disciplined execution and evidence-based strategies, you’ll be well on your way to achieving your long term financial goals. So, the next time you find yourself tempted to check the scoreboard, take a page from Coach Saban’s playbook, and focus on the process, trust the system, and watch your long-term success unfold.

WE’RE MOVING

We hope you and your families had a Happy New Year! As we look forward to 2024 there are a few changes that are coming to McCartney Wealth management that we want to make you aware of.

We’re Moving! We have loved being in the Webster area since I started MWM in 2010. As we plan to grow and hire a Client Services Representative/Admin this year we are outgrowing our space (and Emily is ready for a door), it is perfect timing that our lease is up on March 31st. Beginning April 1 we will be in offices in the Pierre Laclede building in Clayton, MO. We will be sure to update you when we have our official address and office suite numbers. We look forward to meeting with you in our new offices in the second quarter.

We are also making a technology move and migrating to a different portfolio management software company, Advyzon. You are familiar with our current portfolio management system, Pulse, through your quarterly reports. Pulse (formerly Assetbook) has been a great, trusted provider and was the only cloud based system at the time I started in 2010. Since then, technology has advanced and other competition has moved into the RIA space. We have researched and met with many portfolio management software companies and we are confident that Advyzon will allow us to better serve you as our client. Advyzon has top notch security, more back end functions to optimize our back office and better integrations with the other software we already use, including Schwab. There is no action needed from you at this time. From your point of view the main difference you will notice will be a slight difference visually in the quarterly reports. We will be sure to communicate more details when the migration is complete.

Please reach out with any questions or concerns. We do not make changes light heartedly and believe these will allow us to continue to serve you and your families even better in 2024. We are very grateful to work with you and for your continued business and support.

All the best,

Mike and Emily