“Time horizons are the bases of our decisions – and of our regrets.”

“We can improve our outcomes by understanding the effect of time and variance on our choices.”

“In investing, losing your capital means that you lost both your capital and all future returns that it could have generated…Any form of “game-over” nullifies future gains, bringing the average down.”

Luca Dellanna, Ergodicity (3rd Edition)

“The greatest successes are explained by the establishment of clever arrangements for the reduction of risks rather than by excessive risk taking.”

From Predators to Icons: Exposing the Myth of the Business Hero

Below are the returns for the indices we follow. Overall, it was a good quarter.

| Data Series | 3 Months | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years |

| Russell 3000 | 8.39% | 16.17% | 18.95% | 13.89% | 11.39% | 12.34% |

| Russell 2000 | 5.21% | 8.09% | 12.31% | 10.82% | 4.21% | 8.26% |

| Russell 2000 Value | 3.18% | 2.50% | 6.01% | 15.43% | 3.54% | 7.29% |

| MSCI World ex USA (net div.) | 3.03% | 11.29% | 17.41% | 9.30% | 4.58% | 5.40% |

| MSCI World ex USA Small Cap (net div.) | 0.49% | 5.50% | 10.05% | 6.42% | 1.83% | 5.97% |

| MSCI Emerging Markets (net div.) | 0.90% | 4.89% | 1.75% | 2.32% | 0.93% | 2.95% |

| Bloomberg U.S. Treasury Bond 1-5 Years | -0.90% | 0.95% | -0.40% | -1.90% | 0.87% | 0.82% |

| ICE BofA 1-Year US Treasury Note | 0.42% | 1.67% | 1.93% | 0.23% | 1.30% | 0.89% |

Artificial Intelligence and Investing

There has been a lot of discussion on how AI is going to change many things going forward. One aspect that has been touted is how AI is going to improve investing. Can AI make better investment decisions? Dimensional Fund Advisors recently asked the question and used an existing AI Exchange Traded Fund for an analysis.

“Can AI be used to identify mispriced securities?”

Active investors have long attempted to get an informational edge on markets by using artificial intelligence (AI) processes to retrieve and process data. For example, tools that gauge sentiment from social media or scrape text from company financial reports predate ChatGPT by many years.

Material information gleaned from running AI processes is very likely a subset of the vast information set known by the market in aggregate and reflected in market prices. If new information is obtained, the process of acting on that information incorporates it into market prices.

Another reason to question AI’s role in helping with market timing is limitations with its predictions. AI’s forecasting ability fares well when assessing patterns that are relatively stable. The market is fantastically complex. So much so that no one knows exactly how much a particular piece of information impacts a price, because there are so many other simultaneous inputs. AI trying to predict market prices is like self-piloting cars trying to read stop signs with words, shapes, and colors that differ every day.

As an example, consider the AI-Powered Equity ETF (AIEQ), launched in 2017. It employs IBM Watson’s AI to analyze publicly available information to pick US stocks that will outperform the US market (Exhibit 1).

Exhibit 1: AI Powered Equity ETF vs. Russell 3000 Index and S&P Technology Select Sector Index

Cumulative returns, November 1, 2017–May 26, 2023

Source: FactSet. Sample period begins with the first full month of returns for AI Powered Equity ETF. Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. S&P data © 2023 S&P Down Jones Indices LLC, a division of S&P Global. All rights reserved.

While Watson can outwit an individual, its intelligence pales in comparison to the aggregate wisdom of the millions of individuals trading in stock markets each day. It is perhaps unsurprising then that the Watson-powered ETF has lagged the broad US market and, by a wide margin, the US technology sector since its inception.

Sure, AI can help the execution of trades. But the market is powerful and ensures a price is the most accurate current representation of the value of a stock or bond. There’s no reason to think that AI should fundamentally influence the way people think about stock prices anytime soon.”

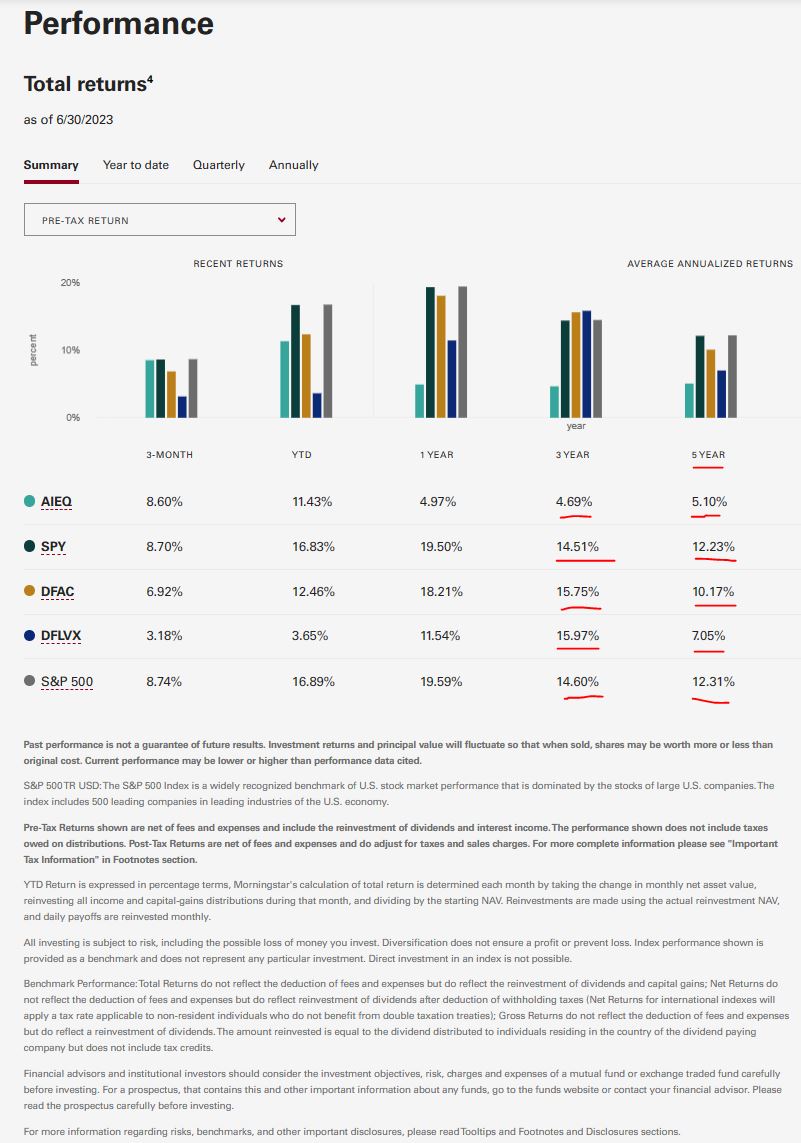

Here is a different comparison I pulled off of Vanguard’s tool using Morningstar data. I compare AIEQ to SPY (an Exchange Traded Fund tracking the S&P 500 Index) and 2 large cap funds we use, DFAC and DFLVX. It seems that artificial intelligence struggles when it comes to long-term investing.

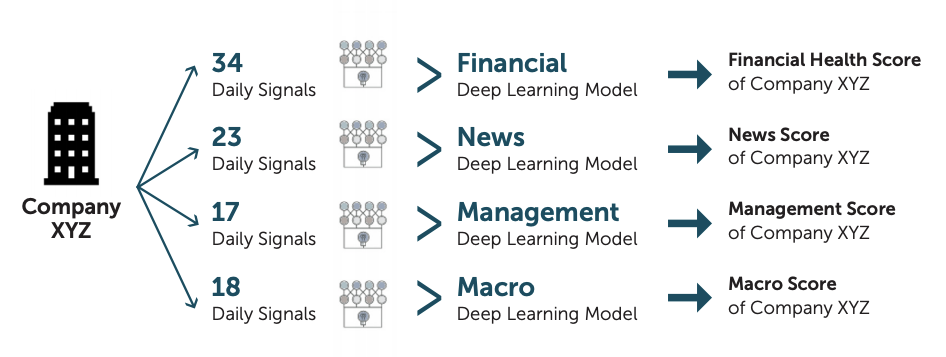

A key point in the piece above is whether AI would be better at predicting the future in a complex system. The future contains unknown surprises. The market prices in all known information according to the Efficient Markets Hypothesis (EMH). When new unknown information occurs, AI will be just as surprised as anyone else. The picture below that AIEQ shows on their website with all of their “signals” appears to be just noise.

Ergodicity

I read the book titled Ergodicity last quarter. Ergodicity is the study of how payoffs scale over time and space. Below is a discussion the author, Luca Dellanna, had with Econ professor and podcaster Russ Roberts on Roberts’ podcast. The points made regarding variance and risk of ruin are highly relevant in our investment approach, as we manage risk as well as return. Irreversible losses are important to avoid, and diversification is one way to minimize the risk of those losses.

“Russ Roberts: How can I reduce the variance? How can I reduce the risk of ruin? How can I push my own returns–not the market’s, but my own–closer to the average? And of course, I said that, as I was saying it, I’m thinking of index mutual funds. Index mutual funds are a way to avoid the kind of ruin that occurs if you pick a handful of stocks, even if you’re a genius, because you could be wiped out.

Luca Dellanna: Exactly. And, I make an example on a use case which I discussed a few times. Someone that works in tech in a startup tells me that they have a lot of stock options in their company, which are worth a lot because the company looks very good and maybe will become the next Google or something like that. And, they say that they know that they should diversify, but they tell me that for them it doesn’t make sense to diversify because any other investment will have a lower expected return. Which on one side is true.

But, the question is, what’s the distribution of the average expected return? Because, if you keep all your money in the stock options of your company–which by the way also provides for your salary–what happens is that you have a certain number of possibilities where you become a millionaire or maybe even a billionaire, and then you have a certain other number of possibilities where you lose almost everything.

Conversely, if you take half of your stock options and you invest them, and you find some way to diversify them with an index fund, you reduce your average expected returns, but the distribution of those returns is such that almost certainly you will end up a millionaire.

And, the question is, what do you really want? And, for most people the answer is, ‘Yeah, actually I want to make sure that I end up very comfortable with almost certainty.’ And, that’s another example why you do not want to look at the average, but you want to look at the distribution of outcomes.”

As Dellanna says in his book, “it is not the best ones who succeed. It is the best ones of those who survive…distinguish between calculated risks whose consequences you can recover from and recklessness whose consequences might permanently debilitate you…Similarly, in investing, losing your capital means that you lost both your capital and all future returns that it could have generated.” “Any form of game-over nullifies future gains, bringing the average down.”

We rigorously try to avoid “game over” scenarios, while trying to follow the financial science on both risk as well as return.

Here are a few other good pieces that we saw this quarter.

Does Higher Inflation Hurt Stock Market Performance? (Video)

Valuing time over money is associated with greater happiness.

If you have any questions, please feel free to reach out.

Best,

Mike and Emily