“I take the market efficiency hypothesis to be the simple statement that security prices reflect all available information.”

Eugene Fama, Nobel Prize 2013, Efficient Capital Markets, Journal of Finance, 1991

“People make better decisions with financial advisers.”

Robert Shiller, Nobel Prize 2013

A choice of investments, portfolio or financial products ideally are the result of a plan—they’re not the plan itself. That’s why the first of Schwab’s 7 Investing Principles is “Establish a financial plan based on your goals.” Investment products—like stocks and bonds—are the tools that are used to potentially realize the goal. They’re part of a larger puzzle. A financial plan can also include retirement, insurance, tax, and estate planning, as well as strategies—such as retiring early, or saving more—that are actions, not products. Effective planners use all these tools, with the financial plan as the playbook.

Charles Schwab & Co., Inc. on Financial Planning

The third quarter was relatively flat, as shown by the returns in the indices we follow below.

| Data Series as of 9/30/2021 | 3 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years |

| Russell 3000 | -0.10% | 14.99% | 31.88% | 16.00% | 16.85% | 16.60% |

| S&P 500 | 0.58% | 15.92% | 30.00% | 15.99% | 16.90% | 16.63% |

| Russell 2000 | -4.36% | 12.41% | 47.68% | 10.54% | 13.45% | 14.63% |

| Russell 2000 Value | -2.98% | 22.92% | 63.92% | 8.58% | 11.03% | 13.22% |

| MSCI World ex USA (net div.) | -0.66% | 9.19% | 26.50% | 7.87% | 8.88% | 7.88% |

| MSCI World ex USA Small Cap (net div.) | 0.72% | 10.71% | 30.14% | 9.50% | 10.33% | 10.03% |

| MSCI Emerging Markets (net div.) | -8.09% | -1.25% | 18.20% | 8.58% | 9.23% | 6.09% |

| Bloomberg U.S. Treasury Bond 1-5 Years | 0.02% | -0.46% | -0.45% | 3.29% | 1.81% | 1.45% |

| ICE BofA 1-Year US Treasury Note | 0.02% | 0.11% | 0.17% | 1.88% | 1.46% | 0.89% |

To sound like a broken record, we are big believers in diversification. The reason is that we are managing not only return, but risk in the portfolios. With proper diversification, we can increase the odds of managing risk for our clients, especially in light of achieving their goals. Large decreases in portfolio values during retirement (known as drawdowns) can negatively impact a financial plan, as one may not have time to make up the losses from a riskier portfolio.

At present, there are numerous risks we see on the horizon. Obviously, we also want to be prepared for the risks we don’t see.

Social Security

As some of you have seen, the Social Security Trustees annual report came out recently, stating the Social Security funds are at risk of not being able to pay full benefits by 2034 or so. We realize that this is a concerning statement and are following the situation closely. It is worth noting that similar reports and headlines have come out through the years.

Social Security is funded right now by the 12.4% payroll tax, paid half by employers and half by employees. Payroll tax income has historically exceeded the amount needed to pay benefits. For example, in 2019, Social Security took in $1.061 trillion in taxes and spent $1.059 trillion in benefits. The concern is that in the future, it is predicted that benefits will exceed the payroll tax, and the difference would have to be paid out of the “trust” fund, which at present has about $2.9 trillion in reserves. If reserves continue to be used over the next 13 or so years, the projection is the reserve fund will be depleted, and only payroll tax receipts will be available to pay benefits. That would amount to about 78% of what current payments are.

We believe between now and 2034, the government will take action to revamp social security to address this issue. The most likely scenario is that payroll taxes will increase (doesn’t make me happy but it would not surprise me) or benefits will get paid out of general funds. Obviously, there is a risk the government does nothing and benefits get reduced.

We model Social Security in all financial plans, and we are evaluating how to continue to model social security in the future. We are actively talking with industry leaders to possibly adjust those models. This is why we believe the financial planning process is very important. If you are concerned about meeting all the goals of your plan, please reach out to set up an appointment to discuss.

Here are a few links to ease some of the angst.

https://www.morningstar.com/articles/1060057/social-security-isnt-going-away

Current Risks

There has been no shortage of headlines (the media loves to create anxiety to increase readers/viewers) regarding risk in the market such as:

1. The Chinese Real Estate/Debt Situation (Evergrande)

2. The US Debt Ceiling issues, including a possible default on US Treasury obligations

3. Inflation, especially in commodities and other inputs to goods

4. Shipping delays and shortages

5. Energy blackouts

In complex systems such as the markets, it is very difficult to isolate any causal relationship, as there are many factors impacting prices. Remember, however, Fama’s concept above. “Security prices reflect all available information” at any given point in time. We use that as a guiding principle in building portfolios for our clients, as well as managing risk. We know the variance for stocks has been historically much higher than shorter term US government bonds, for example, and when we build the entire portfolio, we take such risk into account. We also use Fama’s concept to realize it is impossible to time the market, especially repeatedly, because not only do you have to be right when you get out, but you have to know when to get back in again. Further, the investment function is really just a subset of financial planning.

The Benefits of Financial Planning

According to Charles Schwab’ 2021 Modern Wealth Survey (the “Survey”), only 33% of Americans have a written financial plan. In our view, that is akin to flying blind. Without a financial plan, can one feel confident he or she gets to the end of their life with enough money to support the goals and lifestyle they want? Many do not think a financial plan matters. We, Schwab, and many others think it does.

- A written financial plan increases confidence. According to the Survey, 65% of the people with a written plan feel financially stable versus 40% without a written plan.

- A written financial plan can lead to better financial habits, including having an emergency fund, regularly rebalancing portfolios, managing portfolios in a more tax efficient way, and properly managing debt.

- A financial plan can help you create a risk appropriate investment portfolio for your goals. Establishing a financial plan based upon your goals allows an advisor to use investment products such as stocks and bonds as tools to help realize your goals.

- In addition to the investment portfolio, a financial plan can also include retirement, education, health insurance, life insurance, disability insurance, tax and estate planning, as well as strategies, such as retiring early or saving more, that are actions, not products. We use all of these tools to help clients reach their goals.

Research has shown that households working with a professional planner were more likely to make better financial decisions than those without a planner. In a study published in the Journal of Financial Planning, David Blanchett, Ph.D, used six rounds of the triennial Federal Reserve Board’s Survey of Consumer Finances to examine results achieved by people using 4 information sources for financial planning advice:

- Financial Planners

- Transactional brokers, etc.

- Friends

- Internet.

“Households working with a financial planner were found to be making the best overall financial decisions, followed by those using the internet, while those working with a transactional adviser (broker) were making the worst decisions,” Blanchett wrote.

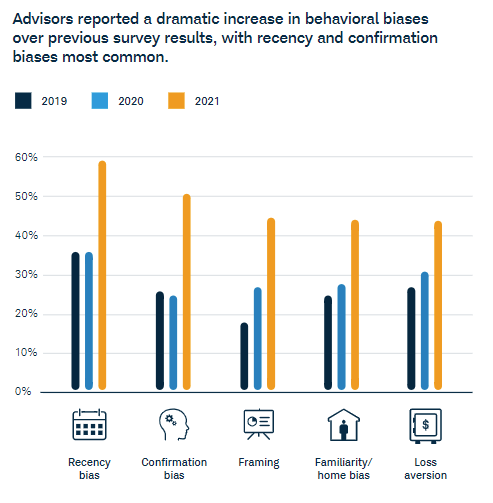

A big factor in why advisors help with health money habits is advisors help investors navigate behavioral biases, which biases are on the increase as shown in a recent 2021 survey by Cerulli Associates, in partnership with Investments and Wealth Institute and Schwab Asset Management. As you can see below, recency bias (being easily influenced by recent news events or experiences) and confirmation bias (seeking information that reinforces existing perceptions) have increased substantially among investors since 2019.

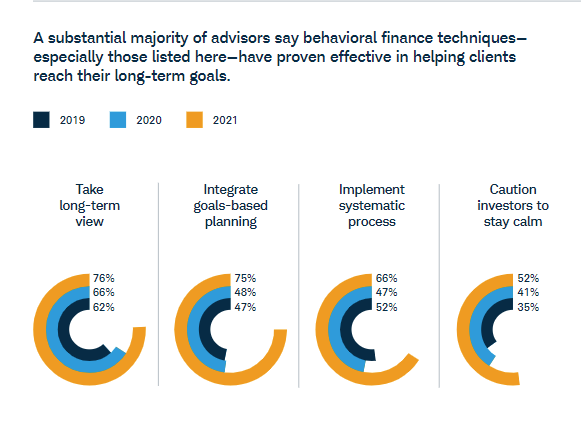

We believe the following techniques that we have consistently used with our clients help manage such biases.

The financial planning services we provide are very important in helping clients achieve their financial goals, thereby avoiding reactive investing.

The financial planning services we provide are very important in helping clients achieve their financial goals, thereby avoiding reactive investing.

If you know anyone we could help, please let us know, and please do not hesitate to reach out with any questions.

Until next time,

Mike and Emily