“Everybody talks as if they know what’s going to happen, and nobody knows what’s going to happen.”

Charlie Munger

“No one can predict the future, even bond buyers. All we have is data from the past and current market prices to make sense of things. Both of these suggest interest rates and yields will stay low. But there are some significant sources of risk ahead and reasons to think this time could be different. Current data should not convince investors to let their guard down.”

Allison Schrager

“Low-probability, high-impact events that are almost impossible to forecast—we call them Black Swan events—are increasingly dominating the environment…Instead of trying to anticipate low-probability, high-impact events, we should reduce our vulnerability to them. Risk management, we believe, should be about lessening the impact of what we don’t understand—not a futile attempt to develop sophisticated techniques and stories that perpetuate our illusions of being able to understand and predict the social and economic environment.”

Nasim Taleb, Daniel Goldstein and Mark Spitznagel

Market Summary

In a world where it is impossible to forecast, markets had a good quarter. Below are the indices we follow.

| Data Series | 3 Mos | 6 Mos | 1 Year | 3 Yrs | 5 Yrs | 10 Yrs | St.Dev |

| S&P 500 | 8.55% | 15.25% | 40.79% | 18.67% | 17.65% | 14.84% | 18.63% |

| Russell 2000 | 4.29% | 17.54% | 62.03% | 13.52% | 16.47% | 12.34% | 19.66% |

| Russell 2000 Value | 4.56% | 26.69% | 73.28% | 10.27% | 13.62% | 10.85% | 17.97% |

| MSCI World ex USA (net div.) | 5.65% | 9.92% | 33.60% | 8.57% | 10.36% | 5.70% | 16.86% |

| MSCI World ex USA Small Cap (net div.) | 4.81% | 9.92% | 42.28% | 8.92% | 11.88% | 7.66% | 17.97% |

| MSCI Emerging Markets (net div.) | 5.05% | 7.45% | 40.90% | 11.27% | 13.03% | 4.28% | 21.51% |

| Bloomberg Barclays U.S. TBond 1-5 Yrs | 0.10% | -0.48% | -0.35% | 3.30% | 1.77% | 1.59% | 3.19% |

| ICE BofA 1-Yr US TNote | 0.02% | 0.09% | 0.22% | 2.01% | 1.47% | 0.90% | 1.74% |

As you know, we do not try to predict in the short or even intermediate term where things are going. We believe in markets for the long-term, but we also know that the swings can at times be large. Combining asset classes based upon risk tolerance and needs is a more prudent long-term strategy. No one likes the low returns on bonds above when things are running hot and up, but they are welcome when stock markets dive and there is a flight to quality. (That low standard deviation in the last column shows those assets are much less volatile). We don’t know when those turns will occur, and we believe prudent risk management includes allocating some money to such investments.

We want to touch on the topic of inflation in this newsletter, as it has gotten a lot of attention lately.

Inflation

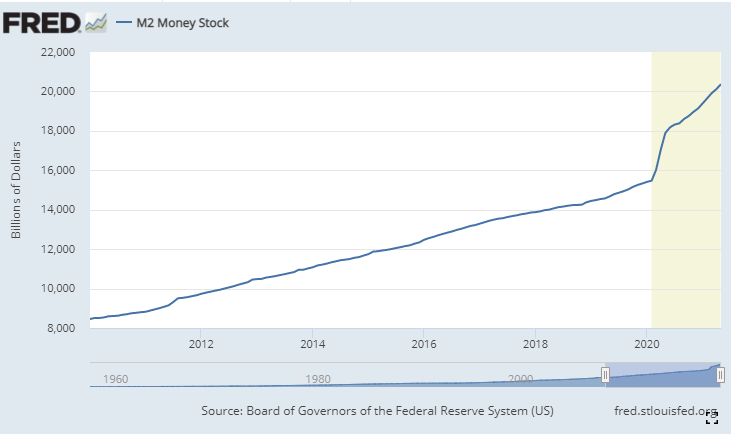

Milton Friedman, the late Professor from the University of Chicago, stated that inflation “is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” Below is a picture of the increase in the quantity of money in the past year or so.

As you can see, that increase in the money supply has been very large. The important question that is practically impossible to answer is can that increase be absorbed so it is not significantly more than an increase in output? Since that is difficult to answer, we will address what an investor should do to minimize the risk.

Why does inflation matter? As our friends at Avantis Investors have recently written:

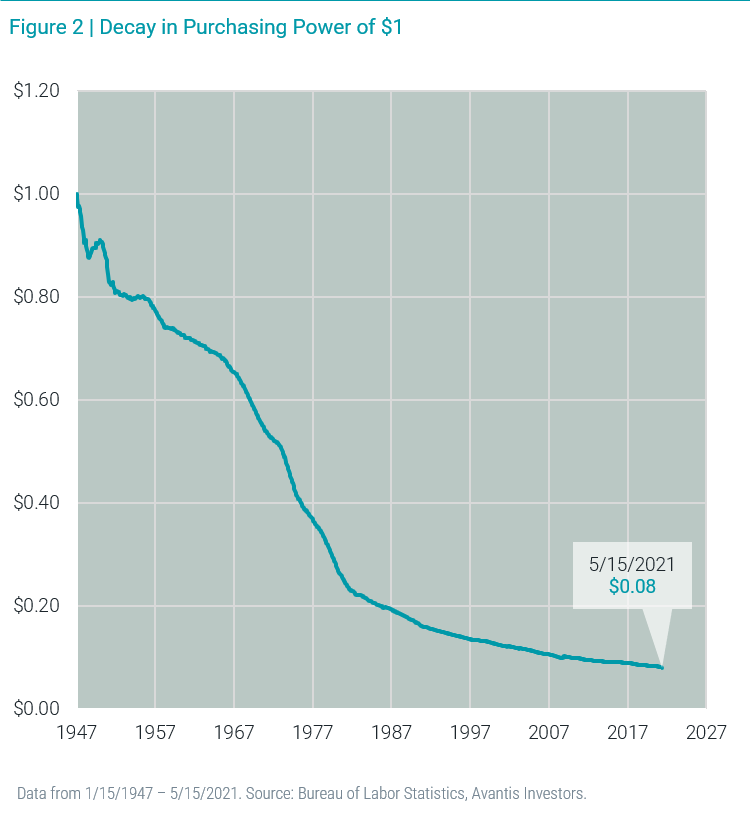

“Economist Milton Friedman was quoted as saying “inflation is taxation without legislation.” Thinking of inflation as a tax is useful because the reality is that inflation erodes your purchasing power. Said differently, $1 was able to buy more things in 1947 than it can buy today. Figure 2 shows how the purchasing power of $1 in 1947—the longest history available at the BLS website—has declined through time. Today, that same dollar buys about 8 cents’ worth of goods.”

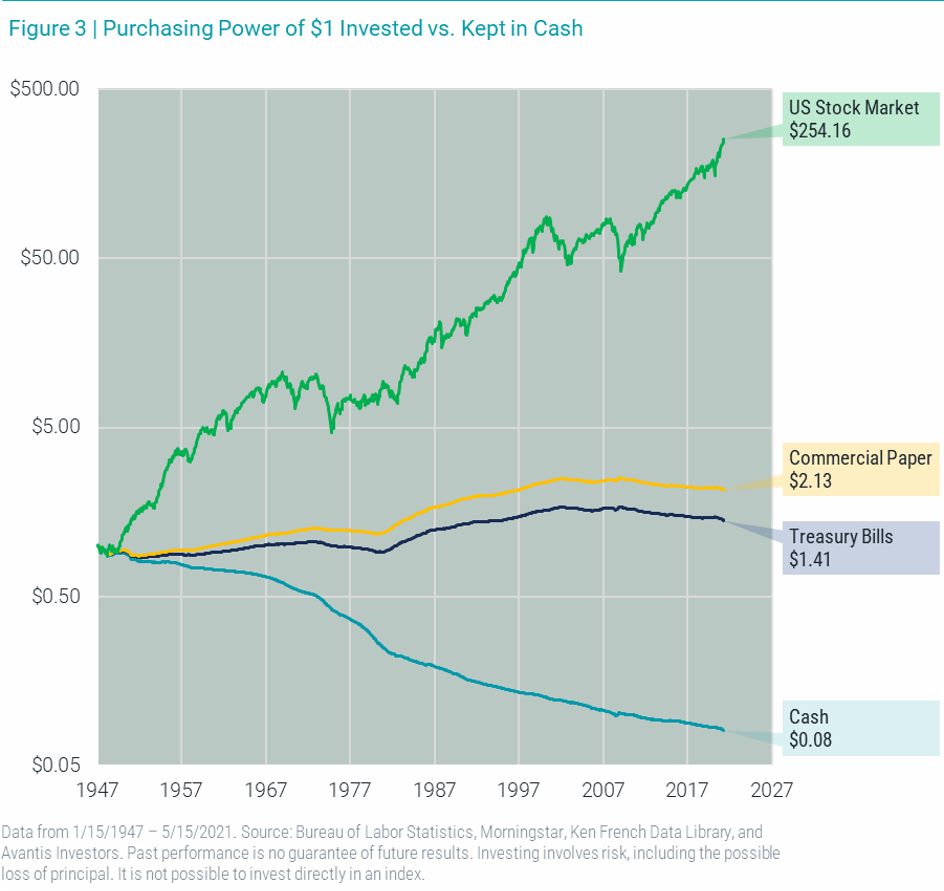

How should one deal with this in the long-term? We believe being diversified and with some exposure to stocks and bonds is a prudent way to deal with inflation in the long-term. Below is a chart showing cash compared to T Bills and the entire US stock market (CRSP Total Stock Market Index) since 1947. Although treasury bills essentially kept pace with inflation, stocks increased purchasing power significantly greater than treasury bills over the long-term.

As our friends at Dimensional Fund Advisors have stated:

“Investors should know that over the long haul stocks have historically outpaced inflation, but there have also been short-term stretches where this has not been the case.”

“While stocks are more volatile than T-bills, they have also been more likely to outpace inflation over long periods. The lesson here is that volatility is not the only type of risk that should concern investors. Ultimately, many investors may need to have some of their allocation in growth investments that outpace inflation to maintain their standard of living and grow their wealth.”

“By combining the right mix of growth and risk management assets, investors may be able to blunt the effects of inflation and grow their wealth over time.”

Nobel Prize winning professor Gene Fama and Ken French wrote in their blog:

“Short-term high grade bonds are a good hedge against inflation. If hedging inflation is your overriding goal, short-term high grade bonds are the route for you. (Gene has been saying this for about 40 years.) But don’t expect much in the way of a real return. Short-term bonds maintain purchasing power, but they don’t enhance it, since the real returns they produce are quite low (for example, less than 1% per year on T-bills). In other words, if you don’t take much real risk, you can’t expect much real return.”

Treasury inflation protected securities (“TIPS”) are also a good diversifier. They essentially compensate you for “unexpected” inflation. As inflation (measured by the consumer price index) rises, so does the par value of TIPS, while the interest rate remains fixed. This means that if inflation unexpectedly rises, the purchasing power of any principal invested in TIPS should also increase, although again, without much real return. Again, it is stocks over the long-haul that have provided the “real” return that has increased wealth.

What about commodities? Inmoo Lee and Marlena Lee of Dimensional did some research on that. “Commodities, gold, and oil are unlikely to deliver the high returns and substantial diversification benefits that some proponents have claimed. Economic theory does not provide a compelling argument that says these alternative assets should have high expected returns. Additionally, because these assets have such large return variances, adding them to a typical stock and bond portfolio is likely to increase, rather than decrease, the real-return volatility of the overall portfolio.”

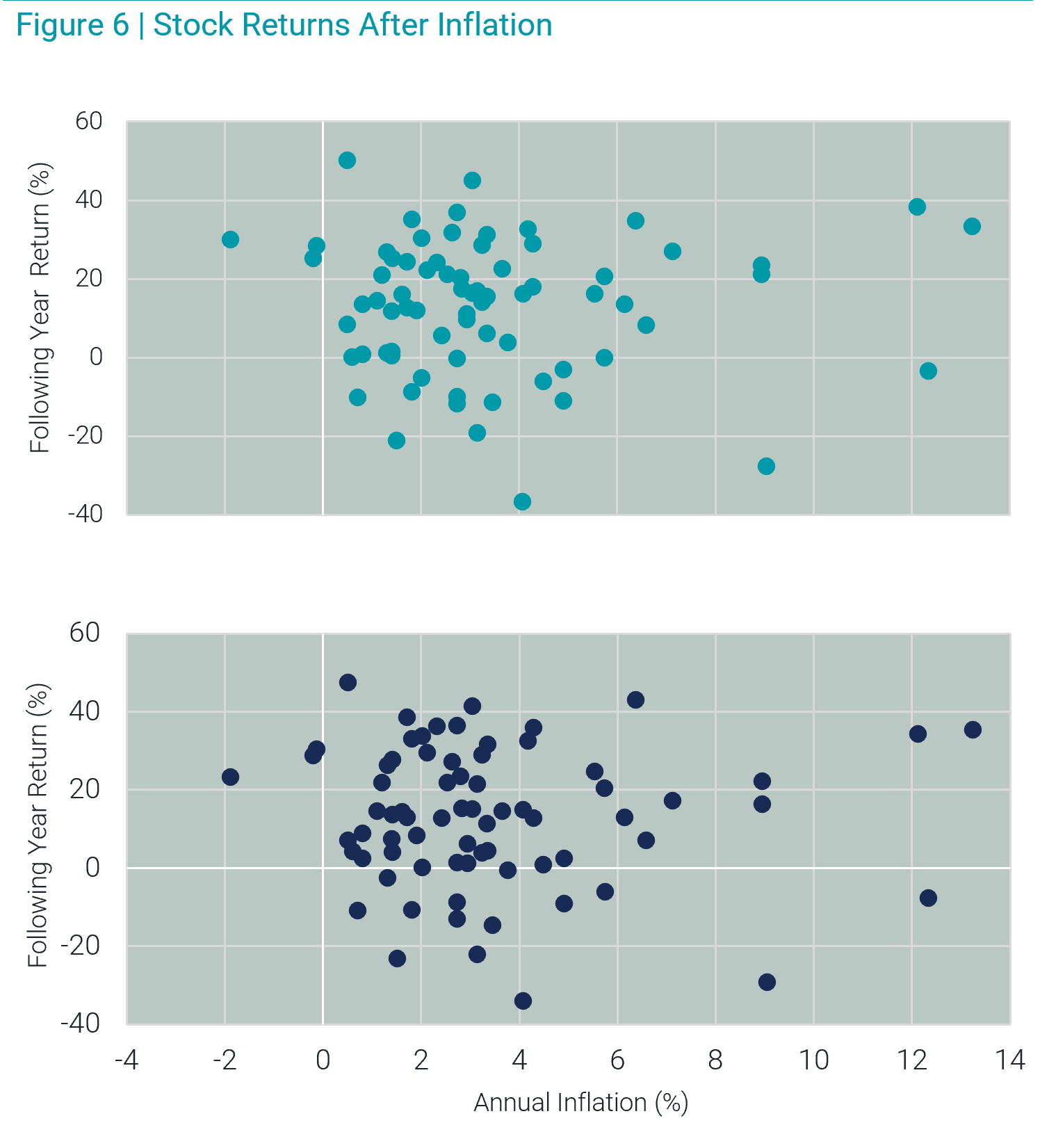

Does a rise in inflation predict poorer stock returns? Avantis Investors ran a simple experiment comparing a previous year’s inflation data’s impact on the next year’s stock returns. The top chart shows the US Stock Market, and the bottom shows small cap value. The relation was very weak, meaning if you “were trying to use this year’s inflation level to predict next year’s stock market return, you’d probably be relying on luck more than anything else.” There is not much predictive ability of current inflation rates on future stock returns.

Our goal at McCartney Wealth Management on behalf of our clients is to combine the right mix of assets to blunt the effects of inflation for our clients while growing their wealth over time. We also want to practice prudent risk management in case the equity markets suffer a setback similar to the Great Financial Crisis. By being properly diversified, including in the right asset allocations for the long-term, we believe we increase our odds of achieving that goal.

Our goal at McCartney Wealth Management on behalf of our clients is to combine the right mix of assets to blunt the effects of inflation for our clients while growing their wealth over time. We also want to practice prudent risk management in case the equity markets suffer a setback similar to the Great Financial Crisis. By being properly diversified, including in the right asset allocations for the long-term, we believe we increase our odds of achieving that goal.

As Dimensional points out, “inflation is only one consideration among many that investors must contend with when building a portfolio for the future. The right mix of assets for any investor will depend upon that investor’s unique goals and needs. A financial advisor can help investors weigh the impact of inflation and other important considerations when preparing and investing for the future.”

Investing is actually very complicated, as we have witnessed in 2007-2009, 2018 and 2020. Not only does one have to deal with uncertainty, expected returns, inflation, and interest rates, but one also has to wrestle with the emotional side of investing, especially when markets plummet from time to time due to some economic or world crisis that develops. We have no idea whether inflation, and especially unintended inflation, is going to occur. We are here to help you prepare and invest for the future, balancing inflation, growth, risk management, and behavioral finance for a better long-term outcome and experience.

Until next time,

Mike and Emily