“The median forecast of policy committee members calls for 3 quarter-point rate hikes in 2022, followed by 3 more in 2023. The bond market is pricing in a targeted federal-funds rate of 0.75%-1.00% by the end of next year, up from 0%-0.25% now.”

Barrons.com December 17, 2021

(The actual rate hikes in 2022 by the Federal Reserve amounted to 4.25% and they hiked 7 times).

“Your 2022 S&P 500 forecasts: Oppenheimer 5330, BMO 5300, DB 5250, GS 5100, JPM 5050, RBC 5050, Citi 4900, UBS 4850, Cantor 4800, Barclays 4800, Wells 4715, Bofa 4600, MS 4400.”

Jonathan Ferro, Bloomberg TV, January 3, 2022

(The actual close was 3839)

“For a number of years, professors at Duke University conducted a survey in which the chief financial officers of large corporations estimated the returns of the Standard & Poor’s index over the following year. The Duke scholars collected 11,600 such forecasts and examined their accuracy. The conclusion was straightforward: financial officers of large corporations had no clue about the short-term future of the stock market.”

Daniel Kahneman, World Renowned Psychologist and Nobel Prize Winner in Economics

It was a tough year for both stocks and bonds, as indicated by the indices we track below.

| Data Series | 3 Months | 1 Year | 3 Years | 5 Years | 10 Years |

| Russell 3000 | 7.18% | -19.21% | 7.07% | 8.79% | 12.13% |

| Russell 2000 | 6.23% | -20.44% | 3.10% | 4.13% | 9.01% |

| Russell 2000 Value | 8.42% | -14.48% | 4.70% | 4.13% | 8.48% |

| MSCI World ex USA (net div.) | 16.18% | -14.29% | 1.27% | 1.79% | 4.59% |

| MSCI World ex USA Small Cap (net div.) | 15.21% | -20.59% | -0.15% | 0.45% | 5.77% |

| MSCI Emerging Markets (net div.) | 9.70% | -20.09% | -2.69% | -1.40% | 1.44% |

| Bloomberg U.S. Treasury Bond 1-5 Years | 0.94% | -5.47% | -0.85% | 0.62% | 0.68% |

| ICE BofA 1-Year US Treasury Note | 0.76% | -1.02% | 0.23% | 1.09% | 0.74% |

The Failure of Forecasts and Predictions

As you can see by the predictions in December 2021 of both the Federal Reserve and the big investment houses such as Goldman Sachs, Morgan Stanley, JP Morgan and Citi, none of them were even close in predicting where both interest rates and the S&P 500 would be at the end of 2022. Given that it is the Federal Reserve’s job to manage and change the Federal Funds rate, the fact that they were so wrong on where the Federal Funds rate would be at the end of 2022 is somewhat scary.

J. Scott Armstrong wrote a paper titled The Seer-Sucker Theory: The Value of Experts in Forecasting. “One would expect experts to have reliable information for predicting change and to be able to utilize information effectively. However, expertise beyond a minimal level is of little value in forecasting change.” As economist John Kenneth Galbraith stated years ago, “There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.”

Why are forecasts and predictions so hard? Because no one can predict the future. There is a tremendous amount of uncertainty in the world. Daniel Kahneman has stated, “Inadequate appreciation of the uncertainty of the environment inevitably leads economic agents to take risks they should avoid…An unbiased appreciation of uncertainty is a cornerstone of rationality – but it is not what people and organizations want.” As Benoit Mandelbrot stated, “there is something in the human condition that abhors uncertainty, unevenness, unpredictability. People like an average to hold onto, a target to aim at – even if it is a moving target.” Nassim Taleb adds, “in fact, we saw that the world is too random and unpredictable to base a policy on visibility of the future.”

Further, humans are in general overconfident. As Kahneman has found, “we are often confident even when we are wrong…Many people are overconfident, prone to place too much faith in their intuitions. They apparently find cognitive effort at least mildly unpleasant and avoid it as much as possible. It suggests that when people believe a conclusion is true, they are also very likely to believe arguments that appear to support it, even when these arguments are unsound.”

If Forecasting is Virtually Impossible, How Should We Invest?

Fortunately, there is a better way to invest for the long-term instead of listening to the likes of Jim Cramer or some market pundit. Below are a few pieces of advice from Dimensional Fund Advisors on how to think about investing for the long-term, focusing on the value premium and investing in a rising rate environment.

Value Bounces Back

After more than a decade of underperforming growth stocks, value stocks bounced back over the past couple of years. While “Value’s Rebound Rewarded Investors Who Stayed in Their Seats,” the rally led some to question how much longer its run can last.

“Just like data shows that bull markets often last longer than bear markets, and have higher peaks, value runs are much longer and reach higher peaks than the downturns,” Wes Crill said. “But it is important for investors to balance their enthusiasm for higher expected returns with their tolerance for underperformance.”

Value investing is based on the premise that paying less for a set of future cash flows is associated with a higher expected return. That’s one of the most fundamental tenets of investing. Combined with lengthy historical data on the value premium, our research shows that value investing continues to be a reliable way for investors to increase expected returns.

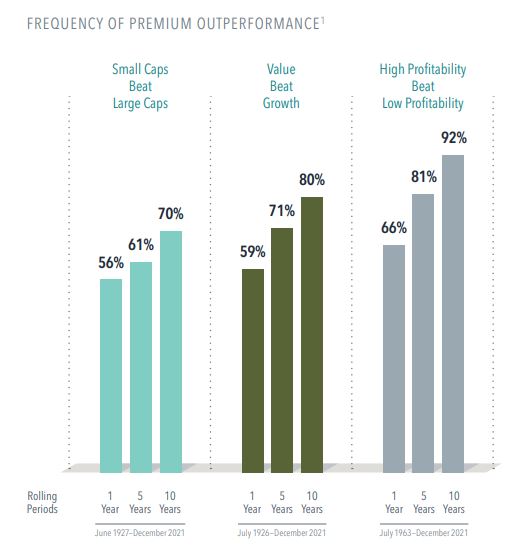

When It’s Value vs. Growth, History Is on Value’s Side

There is pervasive historical evidence of value stocks outperforming growth stocks. Data covering nearly a century in the US, and nearly five decades of market data outside the US, support the notion that value stocks—those with lower relative prices—have higher expected returns.

Recently, growth stocks have enjoyed a run of outperformance vs. their value counterparts. But while disappointing periods emerge from time to time, the principle that lower relative prices lead to higher expected returns remains the same. On average, value stocks have outperformed growth stocks by 4.1% annually in the US since 1927, as Exhibit 1 shows.

EXHIBIT 1

Value Add

Yearly observations of premiums: value minus growth in US markets, 1927–2021

Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. The Fama/French Indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.

Some historical context is helpful in providing perspective for growth stocks’ recent outperformance. As Exhibit 1 demonstrates, realized premiums are highly volatile. While periods of underperformance are disappointing, they are also within the range of possible outcomes.

We believe investors are best served by making decisions based on sound economic principles supported by a preponderance of evidence. Value investing is based on the premise that paying less for a set of future cash flows is associated with a higher expected return. That’s one of the most fundamental tenets of investing. Combined with the long series of empirical data on the value premium, our research shows that value investing continues to be a reliable way for investors to increase expected returns going forward.

How Stocks Respond to Hikes in Fed Funds Rate

Some investors may worry that rising interest rates will decrease equity valuations and therefore lead to relatively poor equity market performance. However, history offers good news: Equity returns in the US have been positive on average following hikes in the fed funds rate.1

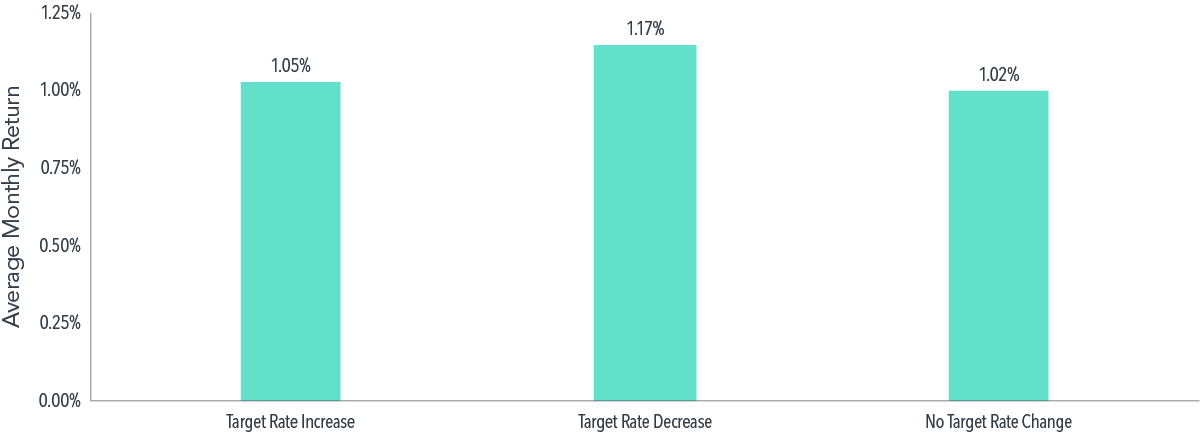

We study the relation between US equity returns, measured by the Fama/French Total US Market Research Index, and changes in the federal funds target rate from 1983 to 2021. Over this period of 468 months, rates increased in 70 months and decreased in 67 months. Exhibit 1 presents the average monthly returns of US equities in months when there is an increase, decrease, or no change in the target rate. On average, US equity market returns are reliably positive in months with increases in target rates.2 Moreover, the average stock market return in those months is similar to the average return in months with decreases or no changes in target rates.

EXHIBIT 1

Reliably Rewarding

US equity market returns and fed funds target rate change, January 1983–December 2021

Past performance is not a guarantee of future results.

What about the months after rate hikes? This question may be of particular interest when the Fed is expected to increase the federal funds target rate multiple times. Exhibit 2 presents annualized US equity market returns over the one-, three-, and five-year periods following one or two consecutive monthly increases in the fed funds target rate, as well as following months with no increase. In reassuring news for investors concerned with the current environment of increasing rates, the US equity market has delivered strong longer-term performance on average regardless of activity at the Fed.

EXHIBIT 2

Keep On Keeping On

US equity market returns following consecutive fed funds rate hikes, January 1983–December 2021

Past performance is not a guarantee of future results.

The Fed’s signals and actions will continue to be closely watched by the market. As the Fed often signals its agenda in advance, we believe market participants are already incorporating this information into market prices. While it’s natural to wonder what the Fed’s actions mean for equity performance, our research indicates that US equity markets offer positive returns on average following rate hikes. Thus, reducing equity allocations in anticipation of, or in reaction to, fed funds rate increases is unlikely to lead to better investment outcomes. Instead, investors who maintain a broadly diversified portfolio and use information in market prices to systematically focus on higher expected returns may be better positioned for long-term investment success.

The Importance of Diversification and Focusing on Factors and Dimensions of Return

Hendrik Bessembinder published a paper in 2017 discussing whether stocks outperform treasury bills and diversification. In his paper, he found:

“Four out of every seven common stocks that have appeared in the CRSP database since 1926 have lifetime buy-and-hold returns less than one-month Treasuries. When stated in terms of lifetime dollar wealth creation, the best-performing four percent of listed companies explain the net gain for the entire U.S. stock market since 1926, as other stocks collectively matched Treasury bills.”

The key is that broad diversification is necessary to have that four percent in your portfolio, as it is virtually impossible to pick those stocks consistently in advance, and those stocks change over time.

In addition to broad diversification, we put a bit more into the following asset classes because they have had consistent return premiums over the long-term.

If you have any questions, feel free to reach out.

Best,

Mike and Emily