The one thing you have to avoid is the risk of ruin.

Naval Ravikant

T-bills are a good inflation hedge, producing three- to five-year (simple and robust) correlations with inflation close to 0.5 because short-term interest rates directly reflect expected inflation. However, a good inflation hedge does not necessarily mean an overall high nominal or real return.

Andrew Ang, Asset Management: A Systematic Approach to Factor Investing

Inflation destroys savings and people’s ability to make long-term plans and turns the entire economy into an attempt to spend money as fast as possible before it loses its value.

Socialism Sucks: Two Economists Drink Their Way Through the Unfree World (Lawson, Robert)

Market Summary

Below are some of the indices we track. I don’t think many would have predicted the returns, especially in the US, with where things were in January of 2021.

| Data Series | 3 Months | 1 Year | 3 Years | 5 Years | 10 Years |

| Russell 3000 (US Broad Market) | 9.28% | 25.66% | 25.79% | 17.97% | 16.30% |

| S&P 500 (Large Co.) | 11.03% | 28.71% | 26.07% | 18.47% | 16.55% |

| Russell 2000 (Small Co.) | 2.14% | 14.82% | 20.02% | 12.02% | 13.23% |

| Russell 2000 Value (Small Value) | 4.36% | 28.27% | 17.99% | 9.07% | 12.03% |

| MSCI World ex USA (Int’l Dev) | 3.14% | 12.62% | 14.07% | 9.63% | 7.84% |

| MSCI World ex USA Small Cap (Int’l Small) | 0.39% | 11.14% | 16.27% | 11.03% | 9.99% |

| MSCI Emerging Markets | -1.31% | -2.54% | 10.94% | 9.87% | 5.49% |

| Bloomberg U.S. Treasury Bond 1-5 Years | –0.74% | -1.19% | 2.44% | 1.90% | 1.33% |

| ICE BofA 1-Year US Treasury Note | -0.18% | -0.07% | 1.55% | 1.42% | 0.86% |

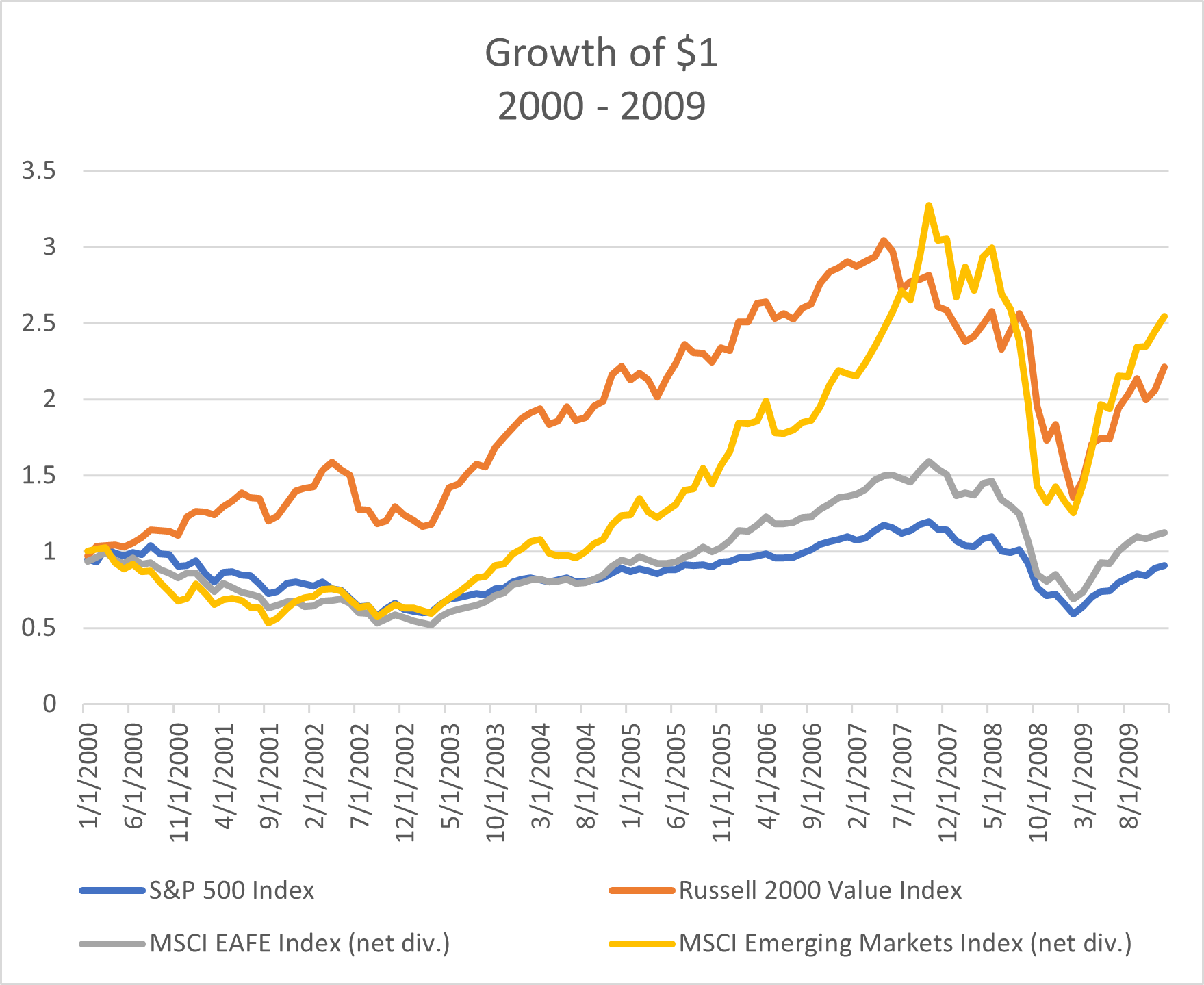

As one can see, the U.S. markets performed much better than international and emerging markets. However, since it is not possible to consistently market time, we believe it is still important to maintain a long-term diversified portfolio, including international and emerging markets stocks. As people forget, the S&P 500 was negative for an entire decade (2000-2009), and it was emerging markets and small value (Russell 2000 Index below) stocks that carried portfolios then. If you invested $1 in the S&P 500 on January 1, 2000, you would have had 90.9 cents on 12/31/2009.

| Data Series 2000 – 2009 | Annualized Return | Total Return | Growth of Wealth |

| S&P 500 Index | -0.95% | -9.10% | 90.90% |

| Russell 2000 Value Index | 8.27% | 121.38% | 221.38% |

| MSCI EAFE Index (net div.) | 1.17% | 12.38% | 112.38% |

| MSCI Emerging Markets Index (net div.) | 9.78% | 154.28% | 254.28% |

Inflation

Inflation is on everyone’s mind lately, as cost increases as measured by both the consumer price index and producer price index have soared to levels not seen since the early 1980’s. Inflation, if not brought under control, is worrisome as it can erode the value of people’s savings very quickly. We do believe a well diversified portfolio can protect investors against the ravages of inflation. Gerard O’Reilly, co-CEO of Dimensional Fund Advisors stated: “The collective best guess of investors as aggregated by market prices is hard to beat as a guide to what the future may hold. Investors may therefore be best off tuning out the pundits and figuring out how to either outpace or hedge against the inflation that’s already anticipated in market prices.” It is hard to argue with that.

Financial advice is a long game. At its core, it’s about ensuring clients have enough money to fund their needs, wants and dreams through the end of their lives. That involves not only focusing on returns, but also risk. Inflation is one aspect of that.

Weston Wellington, who has been involved with Dimensional for years, wrote a piece on inflation a few months back that we would like to share with you. We feel it does a great job of addressing the concerns around inflation and what an investor should do about it.

PERSPECTIVES

July 29. 2021

‘Everything Screams Inflation.’ How to Interpret the Headlines.

By Weston Wellington Vice President Dimensional Fund Advisors

KEY TAKEAWAYS

- After last year’s economic shocks, we shouldn’t be surprised to see prices rebounding.

- But the potential for inflation is one among many factors investors take into account when agreeing on a price at which to trade.

- A look at headlines from the past 50 years shows the difficulty of timing markets around inflation expectations. Investors may be better served sticking to a long-term plan.

How quickly things change.

Two years ago, the New York Times reported, “Federal Reserve officials are increasingly worried that inflation is too low and could leave the central bank with less room to maneuver in an economic downturn.”1 More recently, a Wall Street Journal article presented a sharply different view, with a headline that likely touched a raw nerve among investors: “Everything Screams Inflation.” The author, a veteran financial columnist, observed, “We could be at a generational turning point for finance. Politics, economics, international relations, demography and labor are all shifting to supporting inflation.”2

Is inflation headed higher? In the short term, it has already moved that way. With many firms now reporting strong demand for goods and services following the swift collapse in business activity last year, prices are rising—sometimes substantially. Is this a negative? It depends on where one sits in the economic food chain. Airlines are once again enjoying fully booked flights, and many restaurants are struggling to hire cooks and waiters. We should not be surprised that airfares and steak dinners cost more than they did a year ago. Or that stock prices for JetBlue Airways and The Cheesecake Factory surged over 150% from their lows in the spring of 2020.3

Do such price increases signal a coming wave of broad and persistent inflation or just a temporary snapback following the unusually sharp economic downturn in 2020? We simply don’t know. But future inflation is just one of many factors that investors take into account. The market’s job is to take positive information, such as exciting new products, substantial sales gains, and dividend increases, and balance it against negative information, like falling profits, wars, and natural disasters, to arrive at a price every day that both buyers and sellers deem fair.

The future is always uncertain. But willingness to bear uncertainty is the key reason investors have the opportunity for profit.

Let us assume for the moment that rising inflation persists into the future. Some investors might want to hedge against higher inflation, while others might see it as a market-timing signal and make changes to their investment portfolios. But for the market timers to do so successfully, they would need a trading rule that directs exactly when and how to revise the portfolio—“I’ll know it when I see it” is not a strategy. A trading rule based on inflation estimates, however, is just a market-timing strategy dressed in different clothes. A successful effort requires two correct predictions: when to revise the portfolio and when to change it back.

It’s not enough to be negative on the outlook for stocks or bonds in the face of disconcerting information regarding inflation (or anything else). Current prices already reflect such concerns. To justify switching a portfolio, one needs to be even more negative than the average investor. And then outsmart the crowd once again when the time appears right to switch back. Rinse and repeat.

The evidence of success in pursuing such timing strategies—by individuals and professionals alike—is conspicuous by its absence.

To illustrate the problem, imagine it’s New Year’s Day 1979. The broad US stock market4 produced a positive return in 1978 but failed to keep pace with inflation for the second year in a row. Your crystal ball informs you that the next two years will see back-to-back double-digit inflation for the first time since World War I.

What would you do? You have painful memories of 1974, when the inflation-adjusted total return for US stocks was –35.05%, among the five worst returns in data going back to 1926.

We suspect many investors would sell stocks in anticipation of significantly lower security prices over the subsequent two years. The result? Most likely a failure to capture above-average returns from both the equity and size dimensions, as shown in Exhibit 1.

EXHIBIT 1

Looking Up

Cumulative return, January 1979–December 1980

Past performance is no guarantee of future results. Indices are not available for direct investment.

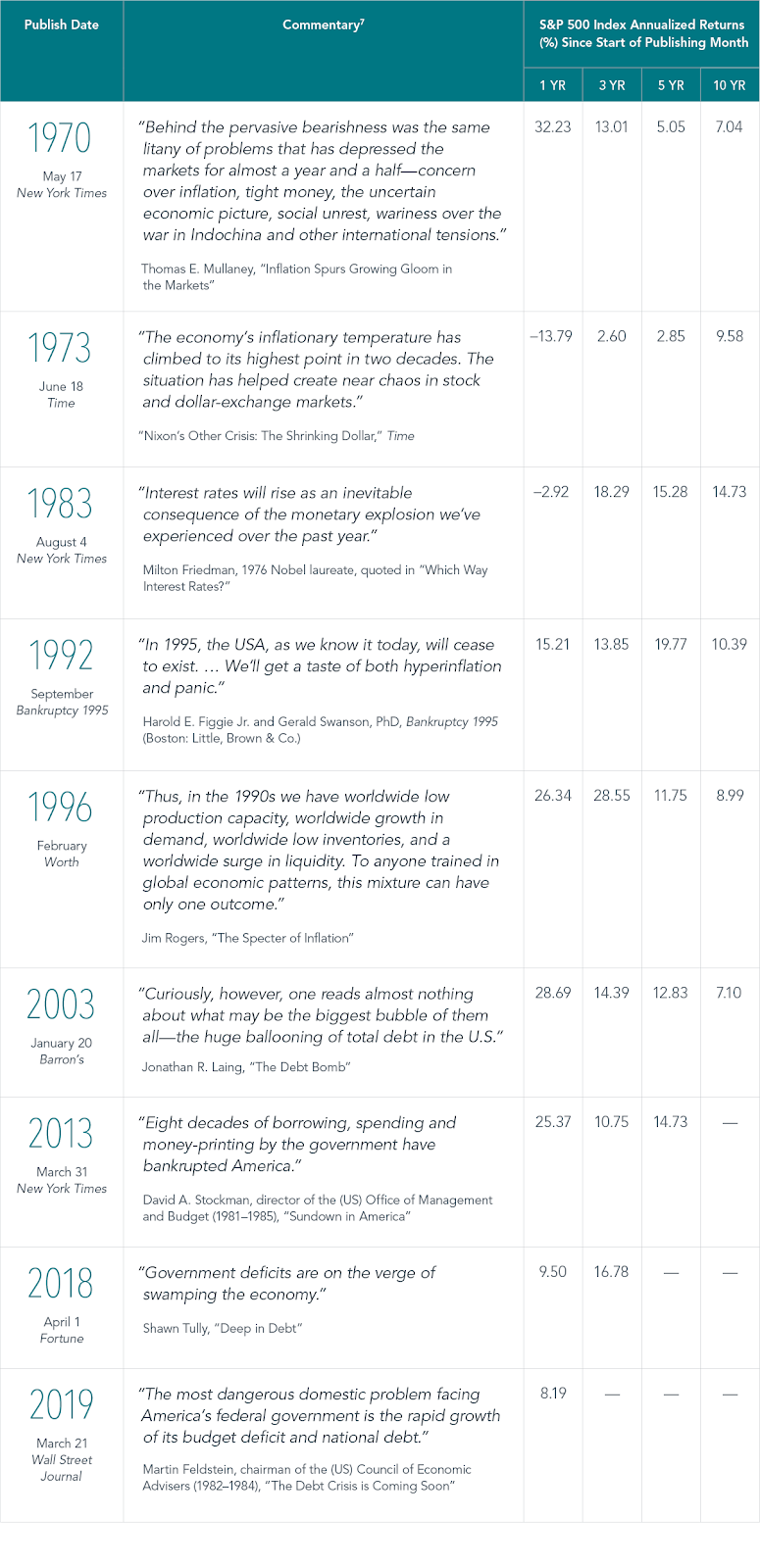

Some of the recent concern regarding inflation appears linked to substantial increases in government spending and the US debt load. Determining the appropriate level of each is a contentious public policy issue, and we don’t wish to minimize its importance. But the news items in Exhibit 2 suggest these concerns are not new, and the expected consequences of these issues are likely already reflected in current prices.

The future is always uncertain. But as economist Frank Knight observed 100 years ago, willingness to bear uncertainty is the key reason investors have the opportunity for profit. Investors will always have something to worry about, and the possibility of unwelcome or unexpected events should be addressed by the portfolio’s initial design rather than by a hasty response to stressful headlines in the future. As recent research from Dimensional highlights, simply staying invested can help investors outpace inflation over the long term.

EXHIBIT 2

Fears Through the Years

We do not know where asset prices will go in the short term. We would not be surprised if volatility in the market picks up over the next 6 months if inflation persists and the Federal Reserve sticks to its plan of raising interest rates and quantitative tightening. However, we believe a well-diversified portfolio designed for your financial plan and risk tolerance is the best long-term solution to a good investment experience.

Until next time,

Mike and Emily

FOOTNOTES

- 1Jeanna Smialek, “Fed Officials Sound Alarm Over Stubbornly Weak Inflation,” New York Times, May 17, 2019.

- 2James Mackintosh, “Everything Screams Inflation,” Wall Street Journal, May 5, 2021.

- 3Sourced using Bloomberg security returns. Low for Cheesecake Factory was April 2, 2020, and low for JetBlue was March 23, 2020.

- 4As measured by the CRSP 1-10 index.

- 5S&P data © S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

- 6Frank H. Knight, Risk, Uncertainty and Profit (Boston and New York: Houghton Mifflin Co., 1921).

- 7Headlines are sourced from various publicly available news outlets and are provided for context, not to explain the market’s behavior. This material is in relation to the US market and contains analysis specific to the US.

- 1Jeanna Smialek, “Fed Officials Sound Alarm Over Stubbornly Weak Inflation,” New York Times, May 17, 2019.

- 2James Mackintosh, “Everything Screams Inflation,” Wall Street Journal, May 5, 2021.

- 3Sourced using Bloomberg security returns. Low for Cheesecake Factory was April 2, 2020, and low for JetBlue was March 23, 2020.

- 4As measured by the CRSP 1-10 index.

- 5S&P data © S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

- 6Frank H. Knight, Risk, Uncertainty and Profit (Boston and New York: Houghton Mifflin Co., 1921).

- 7Headlines are sourced from various publicly available news outlets and are provided for context, not to explain the market’s behavior. This material is in relation to the US market and contains analysis specific to the US.

DISCLOSURES

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.