And with the impact of sustainability on investment returns increasing, we believe that sustainable investing is the strongest foundation for client portfolios going forward.

Larry Fink, CEO, BlackRock, January 14, 2020

We find that firms with good performance on material sustainability issues significantly outperform firms with poor performance on these issues, suggesting that investments in sustainability issues are shareholder-value enhancing.

Mozaffar Khan, George Serafeim and Aaron Yoon

Corporate Sustainability: First Evidence on Materiality

The more concentrated a portfolio is, the greater the risk of missing out on the market’s biggest winners and underperforming. This risk is greater among mid- and small-cap stocks than it is among large ones.

Alex Bryan, Morningstar, “Why Diversification Beats Conviction”

Quick Year in Review

2019 was a really good year, as evidenced by the indices we follow below.

|

Data Series USD % |

4th Qtr |

1 Year |

3 Years |

5 Years |

10 Years |

|

S&P 500 |

9.07% |

31.49% |

15.27% |

11.70% |

13.56% |

|

Russell 2000 |

9.94% |

25.52% |

8.59% |

8.23% |

11.83% |

|

Russell 2000 Value |

8.49% |

22.39% |

4.77% |

6.99% |

10.56% |

|

MSCI World ex USA (net div.) |

7.86% |

22.49% |

9.34% |

5.42% |

5.32% |

|

MSCI World ex USA Small Cap (net div.) |

11.40% |

25.41% |

10.42% |

8.17% |

8.04% |

|

MSCI Emerging Markets (net div.) |

11.84% |

18.42% |

11.57% |

5.61% |

3.68% |

|

Bloomberg Barclays U.S. Treasury Bond 1-5 Years |

0.33% |

4.25% |

2.13% |

1.67% |

1.73% |

|

ICE BofA 1-Year US Treasury Note |

0.59% |

2.93% |

1.78% |

1.25% |

0.83% |

Coming off a dreadful 4th quarter of 2018, there was not a lot of optimism. The Wall Street Journal Online ran the following headline on January 1, 2019.

“U.S. Stocks Face Rocky Path Ahead in 2019; Many fund managers say they expect more volatility with the bull market in doubt”

In the Wall Street Journal’s Year End Review on January 2, 2019, the headline was:

“Year-End Review & Outlook (A Special Report): Markets & Finance — Weak 2018 Finish Testing Investors’ Faith in Stocks”

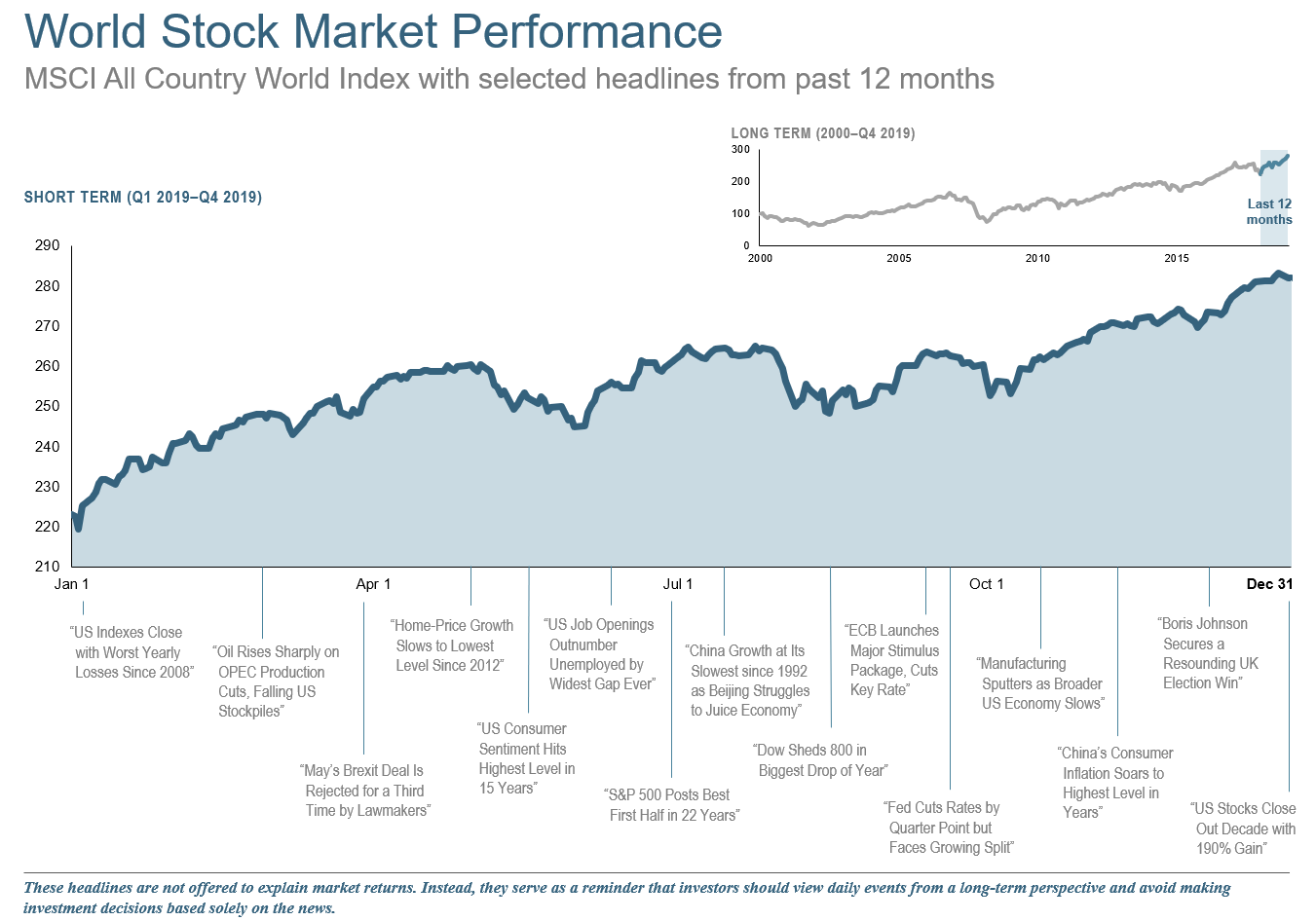

It is a good thing we did not bail from the markets in 2019 based upon those headlines!!! The results show that predicting short-term returns is a fools game, and it is important to be broadly diversified and have the appropriate risk allocation for your financial plan and risk appetite.

Fast forward to the 4th quarter of 2019, equity markets around the globe posted positive returns. Looking at broad market indices, US equities outperformed non-US developed markets but underperformed emerging markets.

Value stocks underperformed growth stocks in all regions. Small caps outperformed large caps in the US and non-US developed markets but underperformed in emerging markets.

REIT indices underperformed equity market indices in both the US and non-US developed markets.

Here is a graphical look at the MSCI All Country World Index for the year, plus an inset showing performance of the Index since 2000.

Diversification

We continue to beat the drums on diversification. Recent data from Societe Generale’s Andrew Lapthrone noted that just 1 in 5 of 16,000 global stocks outperformed the S&P 500 over the past 2 years. It is virtually impossible to know what those 1 in 5 will be in advance. Consequently, it is much better to be broadly diversified. Not only are your returns likely to be better, but because your investments are spread among many companies around the world, your return to risk ratio will also be better.

Larry Fink of BlackRock on Sustainable Investing

The world of investing is starting to change. Larry Fink, the CEO of the largest asset manager BlackRock, made the national news last Tuesday, and not just the business news. He issued a letter on January 14 to CEOs regarding how BlackRock is going to invest its $7 trillion in money going forward (see full letter here https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter). BlackRock will no longer invest in thermal coal producers in BlackRock’s actively managed portfolios, and it will be increasingly disposed to vote against management and boards of publicly traded companies if the companies do not disclose climate change risks and plans in line with key industry standards. As Fink stated in his letter:

“In a letter to our clients today, BlackRock announced a number of initiatives to place sustainability at the center of our investment approach, including: making sustainability integral to portfolio construction and risk management; exiting investments that present a high sustainability-related risk, such as thermal coal producers; launching new investment products that screen fossil fuels; and strengthening our commitment to sustainability and transparency in our investment stewardship activities.”

“Given the groundwork we have already laid engaging on disclosure, and the growing investment risks surrounding sustainability, we will be increasingly disposed to vote against management and board directors when companies are not making sufficient progress on sustainability-related disclosures and the business practices and plans underlying them.”

Jeremy Grantham, founder of Grantham, Mayo, & van Otterloo and one of the foremost capitalists of the last 50 years, has made a marked push to more sustainable investing. In an interview last week, referring to the oil industry, he stated “the last 10 years it’s up 5% and the S&P has tripled. Coal has been even worse, and it is going out of business. It has been put on notice.”

The numbers are worse than Grantham indicates. While the S&P 500 was up 13.56% annualized over the past 10 years ended 12/31/2019, according to Morningstar, the returns for the Oil and Gas and Coal sectors over the same period were dismal:

Oil and Gas Integrated Sector 1.59% annualized

Thermal Coal Sector -7.24% annualized.

Does it make sense to invest this way? According to recent research published in the Journal of Portfolio Management (The Journal of Portfolio Management July 2019, 45 (5) 69-83), it appears that improvement in ESG scores results in improved valuation as mediated by declines in systematic (lower costs of capital) and specific risk (reduced incidence of tail risk events) profiles. This is consistent with George Serafeim’s research at Harvard that “good performance on material sustainability issues are shareholder-value enhancing.”

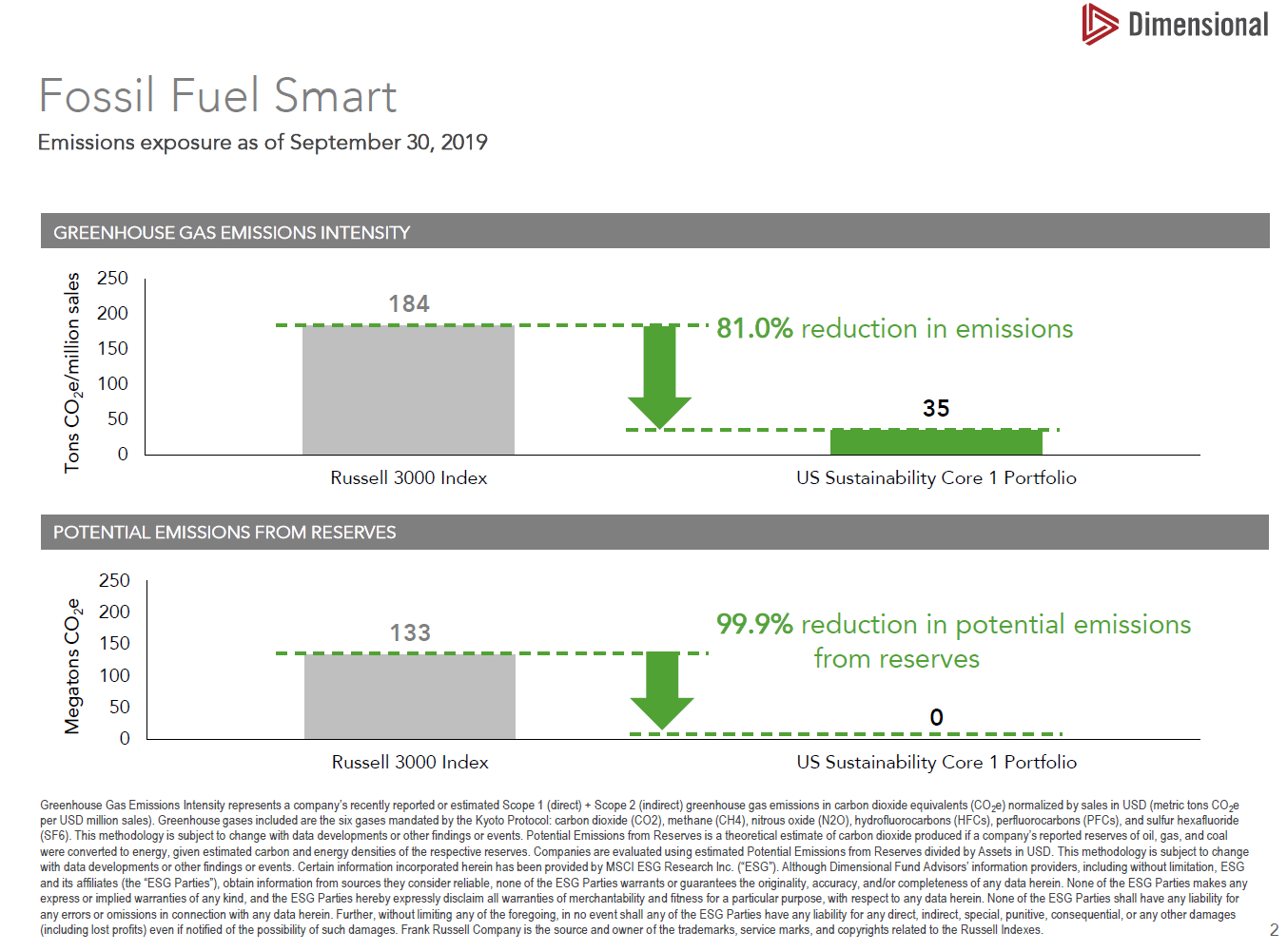

Our friends at Dimensional have been investing sustainably since 2008. Comparing Dimensional Fund Advisor’s US Sustainability Core 1 Portfolio versus its similar Core Equity 1 Portfolio, as you can see, performance over the past 10 years in their actual mutual funds has not been materially different, and has actually been slightly better for Dimensional’s Sustainability Portfolio. However, the reduction in emissions from greenhouse gases and reserves is dramatically lower as shown in the slide below.

| Data Series as of 12/31/2019 | 1 Year | 3 Years | 5 Years | 10 Years |

| DFA US Sustainability Core 1 Portfolio | 32.52% | 14.47% | 11.03% | 13.39% |

| DFA US Core Equity 1 Portfolio Class I | 30.18% | 13.22% | 10.45% | 13.22% |

One does not have to give up returns in real life to invest pursuant to Larry Fink’s direction. If you are interested, we have taken our evidence based portfolios and added a sustainable, ESG layer to them. Visit our website here for more info. https://mccwm.com/investing-for-a-better-tomorrow/ We are happy to answer any questions you may have regarding the approach.

Until next time,

Mike and Emily