“Active managers think the market is inefficient when they buy but efficient when they sell. How do they know they won’t go to their grave being the only one who knew the right price of Cisco?”

The late Dan Wheeler, Dimensional Fund Advisors

“An extreme return on a portfolio of many stocks is much less likely than an extreme return on an individual stock.”

Fischer Black and the Revolutionary Idea of Finance (Mehrling, Perry)

“I have come to understand that few things are harder to predict accurately than the timing and magnitude of financial crises, because the financial system is so genuinely complex and so many of the relationships within it are non-linear, even chaotic.”

Niall Ferguson

If you would have told me we would have had 3 bank failures in the first quarter and the US stock market performed as well as it did, I would have fallen over laughing. However, here is how the market indices we follow did in the first quarter. Not bad at all.

| Data Series | 3 Months | 1 Year | 3 Years | 5 Years | 10 Years |

| Russell 3000 | 7.18% | -8.58% | 18.48% | 10.45% | 11.73% |

| S&P 500 | 7.50% | -7.73% | 18.60% | 11.19% | 12.24% |

| Russell 2000 | 2.74% | -11.61% | 17.51% | 4.71% | 8.04% |

| Russell 2000 Value | -0.66% | -12.96% | 21.01% | 4.55% | 7.22% |

| MSCI World ex USA (net div.) | 8.02% | -2.74% | 13.49% | 3.80% | 4.91% |

| MSCI World ex USA Small Cap (net div.) | 4.99% | -10.13% | 13.43% | 1.54% | 5.54% |

| MSCI Emerging Markets (net div.) | 3.96% | -10.70% | 7.83% | -0.91% | 2.00% |

| Bloomberg U.S. Treasury Bond 1-5 Years | 1.87% | -0.35% | -1.47% | 1.08% | 0.85% |

| ICE BofA 1-Year US Treasury Note | 1.25% | 1.02% | 0.08% | 1.29% | 0.85% |

Normally, I draft most of the newsletter. However, whenever I get a piece that I believe is very good and worth sharing, I share! Below is a question and answer that Michael Perry of Dimensional Fund Advisors sent out. I thought it was particularly interesting and enlightening, especially with everything going on in the financial markets and banking world in the first quarter.

Should I be worried by the recent banking turmoil’s impact on the stock market?

“March 2023 has been a significant month for banks in the US and globally. On March 10th, Silicon Valley Bank (SIVB) succumbed to a phenomenon called a “bank run” resulting in the largest failure of a US bank since the 2008 global financial crisis. Two days later, a second regional US bank, Signature Bank, was shut down. The developments don’t stop just in the US. Switzerland’s largest bank, UBS, agreed to buy its rival, Credit Suisse, in a rescue deal to help ease concerns in the global financial markets stemming from the turmoil facing some American banks.

All this to say: investors might be worried and eyeing their exposure to these regional and global banks. While it is natural to worry about the sensational news headlines being published these days, it is important to also step back and look at the bigger picture. Regardless of if a bank, or any other company for that matter, falters or not, your investment plan shouldn’t.

An easy but often underestimated tool to help avoid concerns about individual companies is to diversify globally and across sectors. Thanks to financial innovations in the form of mutual funds and ETFs, investors can now access thousands of securities diversified across countries and sectors at low costs. While not all risks can be diversified away, such as the risk of an economic recession, diversification is still a powerful tool to reduce the risk that any one company, industry, or country might face. For instance, as of February 28, SIVB was just one of more than 9,000 companies in the MSCI All Country World IMI Index (MSCI ACWI IMI) and represented a mere 0.03% of the index. As of the same date, regional banks in total represented only 1.15% of the index, with the largest at 0.10%. Incorporating diversification in your investment plan might help you avoid some of the pitfalls that concentrated portfolios face.

It is also important to remember that uncertainty is nothing new and that investing inherently comes with risks. When we consider what events have taken place in the last three years alone – a global pandemic, the Russian invasion of Ukraine, spiking inflation, and the fear of a recession – there’s been plenty of causes for concern regarding the state of the world and the markets. Despite these events, for the three-year period ending on February 28, 2023, the Russell 3000 Index (a broad market-cap weighted index of public US companies) returned 11.79% annualized, outperforming its average annualized return of 11.65% since inception in January 1979.

Having a sound financial plan can help investors weather through periods of uncertainty. Also important to the experience is having the discipline to stick with that plan through uncertain periods, rather than trying to predict or make sudden movements as a reaction to them. Investors that do are generally able to reap long-term benefits while also maintaining their peace of mind through the inevitable ups and downs that come with investing in the markets.”

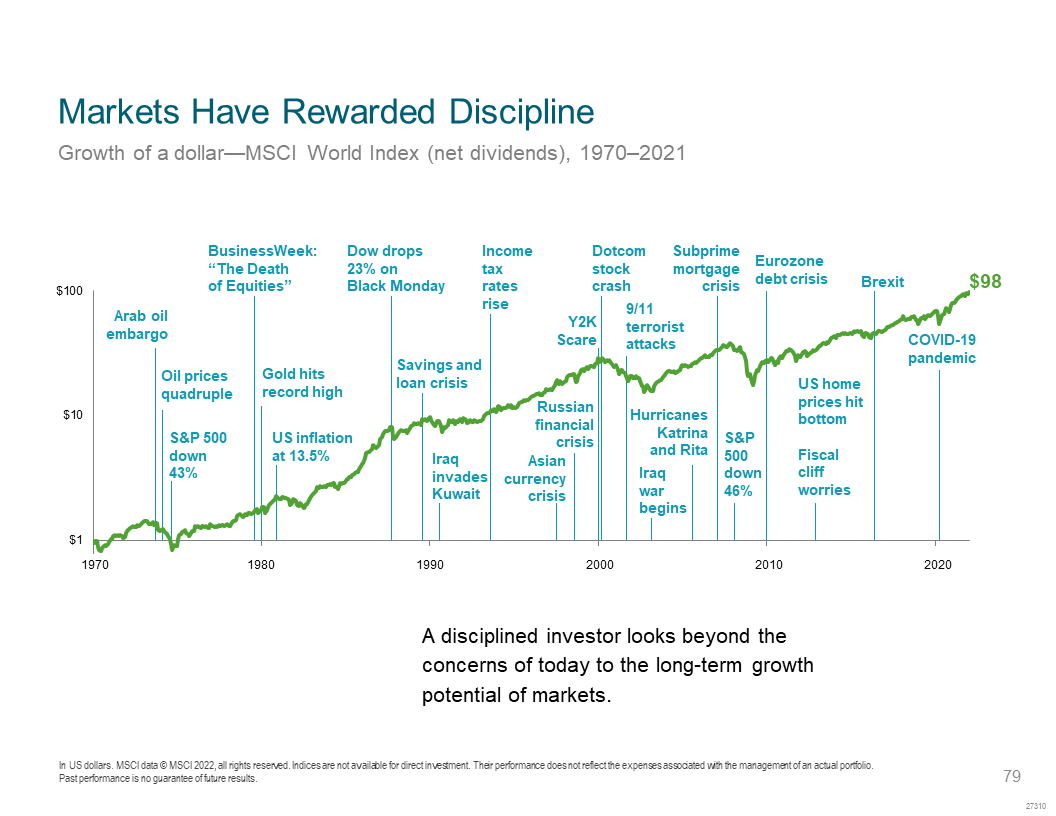

Echoing Michael’s thoughts above, below are several charts showing the long term trend of the stock market. As Dimensional has pointed out in the past, “markets around the world have often rewarded investors even when economic activity has slowed. This is an important lesson on the forward-looking nature of markets, highlighting how current market prices reflect market participants’ collective expectations for the future.”

Additional Thoughts

It is important to remember that there are many influences on market prices, including:

- Supply and Demand

- Economic Indicators

- Government Policies

- Political Instability

- Natural Disasters

- Consumer Behavior

- Market Sentiment

- Corporate Performance

The stock market is a complex system. As Nassim Taleb has written, “the main idea behind complex systems is that the ensemble behaves in ways not predicted by its components.” All of the above influences are dynamic and are constantly changing. To believe that our individual information is better than the markets takes some hubris. Robert Merton was recently interviewed on the Rational Reminder podcast, and he stated:

“I want to point out very clearly that the market has information, very important information that no one has. No sovereign wealth fund, no central bank. We all have pieces of it…The market encapsulates that aggregate information from all of us that none of us have. The first point to make is the market is a very important source of information. It has information that no one has, okay? Now, the question is, how good is that information? That has to be measured relative to the information you have…Whenever you’re assessing an investment decision, you have to always ask, if the market is disagreeing with me, or if the market doesn’t seem to be aligned with me, that could be that I know things the market doesn’t. It also could be, the market knows things that you don’t [my emphasis]…Market efficiency, and we’ve been testing that formally for more than a half century, by and large, it’s pretty darn hard to beat the market.”

As Friedrich Hayek wrote in 1945, “Fundamentally, in a system in which the knowledge of the relevant facts is dispersed among many people, prices can act to coordinate the separate actions of different people in the same way as subjective values help the individual to coördinate the parts of his plan.”

Fischer Black’s biography by Perry Mehrling contributes to the thoughts above. Black became a big fan of the Capital Asset Pricing Model (CAPM), which is a model that describes the relationship between the expected return and the risk of investing in a security, including stocks. Once he understood and believed in CAPM, Black “chose more carefully what specific risks to bear” both in life and in investing. “Risk and time, he said, are the problems that define the modern field of finance…All this was about avoiding risks that do not pay…What about risks that do pay? After learning CAPM, Fischer switched from individual stock holding to mutual funds, and he never switched back.” Why? “[B]ecause the risk in the market portfolio comes with a commensurate expected payoff, whereas the risk in an individual stock may not.” As stated above, “an extreme return on a portfolio of many stocks is much less likely than an extreme return on an individual stock…Modern finance tells us how to reduce risk by diversifying over time.”

Because the timing and magnitude of a financial crisis is so hard to predict, it is better to take a broadly diversified approach to investing based upon the risk that you can bear and consistent with a financial plan that is reasonably related to your goals. Because time in the market, not timing the market, is important to achieving long-term goals, it is best to avoid the noise and stick to a long-term plan because as with all complex systems, the results of the interactions are not always predictable.

As Ken French has written, “there is a large academic literature on whether market returns are predictable. The general conclusion is that it is impossible to predict the market return with any confidence… “A Comprehensive Look at the Empirical Performance of Equity Premium Prediction,” by Amit Goyal and Ivo Welch (Review of Financial Studies, 2008), is a good summary of the evidence.”

Until next time,

Mike and Emily