“I know that history is going to be dominated by an improbable event, I just don’t know what that event will be.”

Nassim Nicholas Taleb, The Black Swan

“We are effectively not skilled at intuitively gauging the impact of the improbable.”

Nassim Nicholas Taleb, The Black Swan

“These are models. And the reason we call them models is that they’re not 100 percent true. If they were, we would call them reality, not models. They’re simplifications. But the acid test is, How good are the simplifications for your purposes? And for almost all purposes, market efficiency is a very good approximation. There is very little evidence that money managers can beat the market.”

Gene Fama

“Staying rich requires an entirely different approach from getting rich. It might be said that one gets rich by working hard and taking big risks, and that one stays rich by limiting risk and not spending too much.”

Aswath Damodaran and Peter Bernstein

“The greatest shortcoming of the human race is our inability to understand the exponential function.”

Albert Allen Bartlett

I want to reach out in regard to the coronavirus and markets. I want to first emphasize that this is not a panic laden newsletter. However, I continuously emphasize that we manage both return and risk. One way we measure risk is by variance or standard deviation. Another way we can think about risk is one of minimizing losses and preservation of capital.

In my entire career in the investment adviser space, I’ve not recommended market timing. I’ve been following the coronavirus situation closely. I have not really been following what the market participants have been saying, but I’ve been following the leading epidemiologists in the world and their perspective.

Their consistent view is that the virus can no longer be contained. Marc Lipsitch, the Harvard epidemiology professor said yesterday: “I think the likely outcome is that it will ultimately not be containable.” Neil Ferguson and colleagues at Imperial College London estimate that about two thirds of coronavirus cases exported from mainland China have gone undetected worldwide.

This is not a reason to panic, but it is good to plan. There is definitely some downside risk that supply chains and business will slow down for a while. There is also the possibility that a vaccine is found or that central banks are able to manage the situation. Because markets are a complex system with no one cause for movement, it is virtually impossible to predict what will happen, especially in the short-term.

Valuations of stocks are nothing more than the discounted cash future cash flows of a company (and for the market, discounted future cash flows in the aggregate), and those are discounted by an appropriate discount rate.

If those cash flows decrease, holding the discount rate constant, you will have a reduction in the value of both individual stocks and markets as a whole. The discount rate is important, as central banks will most likely try to reduce that, and we do not know if the central bank function will offset the lessening of discounted future cash flows, if that should occur.

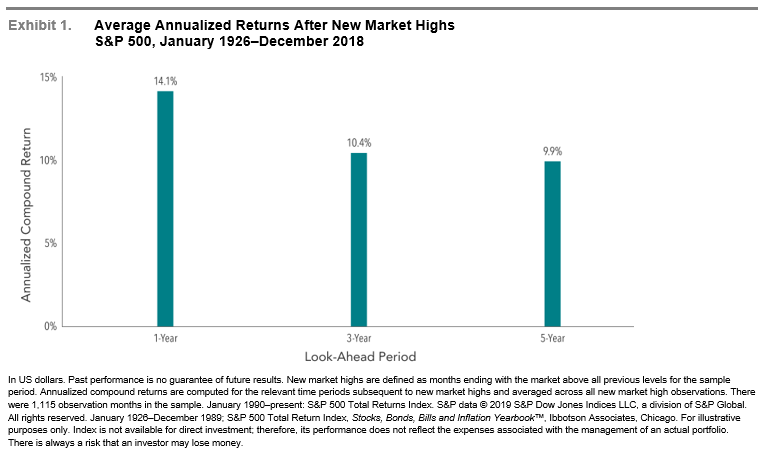

The market does a good job pricing in those changes in expectations. As Gene Fama and Ken French say in their July 14, 2009, post:

“During the financial crisis, some investors discovered that their tolerance for risk is lower than they thought, so it might make sense for them to permanently reduce their exposure to equities. Investors who wish to avoid the price impact of the recession, however, are probably too late. Today’s stock prices already reflect the anticipated effects of the slowdown, as well as any effects the recession has on expected future returns.”

We still believe in a long term view and approach to investing in the stock market. However, if you have a large amount of stock risk and your tolerance for risk may be lower than you originally thought, you could suffer relatively large losses in the short to intermediate term. If you have significant cash needs in the next year, or you were concerned about a significant reduction in the value of your portfolio, and you have greater than 60% of your portfolio in stocks, we think it is worthwhile to discuss the situation. Many of our clients actually hold 60% or less of their portfolio in stocks. We’re comfortable with this long-term approach as long as you don’t have any significant cash needs in the next year.

Historically, when volatility kicks up, it remains around for some time. As Benoit Mandelbrot wrote in The Misbehavior of Markets, “volatility clusters.”

Our good friend Eduardo Repetto and his former colleague, L. Jacobo Rodriguez, wrote a very good paper entitled “Market Anxiety” in 2008. In it, they found:

- It was not unusual to find that periods of extreme negative performance have “historically been periods of higher than average volatility and higher than average cross sectional dispersion.”

- Volatility and cross-sectional dispersion are likely to continue in the short run (because they are autocorrelated, which we will not elaborate on).

- However, neither volatility nor dispersion predicts future returns, positive or negative. This is a very important point!

- Returns in the semesters and years following semesters and years of extreme negative performance have been on average positive.

- Realized risk premiums are not reliably negative during economic recessions.

- Attempts to time allocations to risky assets at different stages of the business cycles are likely to be futile and only bring about an increase in transaction costs.

Repetto concludes with the following:

“Volatility and cross-sectional dispersion bring uncertainty, which in turn brings anxiety. The best way to mitigate that uncertainty is to be broadly diversified within and across asset classes at all times, so that investors need not worry about whether they own the stocks that earn the returns of those asset classes or whether they are fully invested in the markets when they turn.” For all of our clients, we use very broadly diversified portfolios.

McCartney Wealth Management does believe in a passive approach to investing. We do not know where the markets are going in the short to intermediate term due to market volatility, but we have a strong belief that markets will be positive in the long term.

We do think it makes sense to alert investors and clients when the health experts are concerned about a global pandemic and manage the expectations of clients with the possible downside risks in the market.

Below are a few links to some of the people we’re following to assist us in our analysis.(Twitter handles).

Professor Marc Lipsitch – Harvard – @mlipsitch

Professor Neil Ferguson – Imperial College London – @neil_ferguson

Professor Ian Mackay – @MackayIM

Please reach out with any questions.