“But to say the record of their transactions, the price chart, can be described by random processes is not to say the chart is irrational or haphazard; rather, it is to say it is unpredictable.”

Benoit Mandelbrot

“The scientist has a lot of experience with ignorance and doubt and uncertainty… we take it for granted that it is perfectly consistent to be unsure—that it is possible to live and not know. But I don’t know whether everyone realizes that this is true.”

Richard Feynman

“There’s so much uncertainty involved in the outcomes from investing that it’s difficult to extract the signal from the noise.”

Eugene Fama

“Unfortunately, skill in evaluating the business prospects of a firm is not sufficient for successful stock trading, where the key question is whether the information about the firm is already incorporated in the price of its stock. Traders apparently lack the skill to answer this crucial question, but they appear to be ignorant of their ignorance.”

Daniel Kahneman

“We are far too willing to reject the belief that much of what we see in life is random.”

Daniel Kahneman

1st Quarter 2024

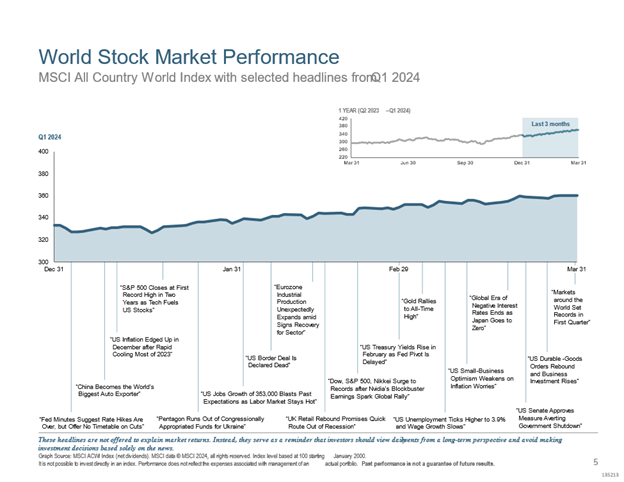

The first quarter was a good one, as shown by the indices we follow below.

| Data Series | YTD | 1 Year | 3 Years | 5 Years | 10 Years |

| Russell 3000 | 10.02% | 29.29% | 9.78% | 14.34% | 12.33% |

| S&P 500 | 10.56% | 29.88% | 11.49% | 15.05% | 12.96% |

| Russell 2000 | 5.18% | 19.71% | -0.10% | 8.10% | 7.58% |

| Russell 2000 Value | 2.90% | 18.75% | 2.22% | 8.17% | 6.87% |

| MSCI World ex USA (net div.) | 5.59% | 15.29% | 4.93% | 7.48% | 4.81% |

| MSCI World ex USA Small Cap (net div.) | 2.58% | 10.04% | -0.93% | 5.39% | 4.54% |

| MSCI Emerging Markets (net div.) | 2.37% | 8.15% | -5.05% | 2.22% | 2.95% |

| Bloomberg U.S. Treasury Bond 1-5 Years | -0.05% | 2.40% | -0.67% | 0.93% | 1.09% |

| ICE BofA 1-Year US Treasury Note | 0.83% | 4.30% | 1.44% | 1.66% | 1.25% |

The US equity market posted positive returns for the quarter and outperformed both non-US developed and emerging markets. Developed markets outside of the US also posted positive returns for the quarter and underperformed the US market, but outperformed emerging markets. Emerging markets posted positive returns for the quarter and underperformed both US and non-US developed markets.

Understanding Knightian Uncertainty and Risk in the Stock Market – The Importance of Uncertainty, Risk, Elections and War

In the world of finance and economics, two concepts often come up when discussing investment decisions: risk and uncertainty. These terms were formally distinguished over a century ago by economist Frank Knight in his 1921 book, “Risk, Uncertainty, and Profit“. According to Knight, risk applies to situations where we do not know the outcome of a given situation but can accurately measure the odds. For instance, if a coin is flipped, we don’t know whether it will land on heads or tails, but we know the probability for each outcome is 50%.

On the other hand, Knightian uncertainty, or “true uncertainty,” applies to situations where we cannot know all the information to set accurate odds in the first place. This is a situation where the possible outcomes are not known, or where it’s impossible to assign probabilities to them. An example of Knightian uncertainty is the potential impact of a completely new and unknown technology or market disruption. Understanding uncertainty reminds us the world is complex and helps us set realistic expectations about what data can and cannot tell us.

When investing, we encounter both risk and uncertainty. The risk in an investment can be quantified using historical data and statistical models. For instance, we can calculate the average return and volatility of a stock based on its past performance. However, the future performance of the stock market also involves Knightian uncertainty. Factors such as changes in market sentiment, unforeseen events like pandemics, war, or sudden regulatory changes can drive unforeseeable changes in stock returns. It is a reason why we (or anyone else) cannot answer definitively the question “where is the market going” for any given period.

So, how can an investor navigate through this landscape of risk and uncertainty? This is where the research of Harry Markowitz and others come into play. Markowitz introduced Modern Portfolio Theory (MPT), which revolutionized the way we think about investments. Instead of focusing on individual stocks, MPT emphasizes the importance of portfolio diversification by eliminating single stock (bankruptcy) risk as well as holding domestic and international stocks and bonds. By holding a diversified portfolio, investors can try to optimize their returns for a given level of risk.

Markowitz’s theory was later built upon by other researchers such as Bill Sharpe, leading to the development of the Capital Asset Pricing Model (CAPM). This model provides a method to determine the expected return of an asset based on its systematic (market) risk. It suggests that by investing in a mix of a risk-free asset and a market portfolio, investors can achieve an optimal balance between risk and return.

Eugene Fama and Kenneth French then expanded upon the Capital Asset Pricing Model (CAPM) by adding two more factors to the “market” factor: size and value in the Fama-French Three-Factor Model. The size factor, referred to as “Small Minus Big” (SMB), is the return spread between small- and large-cap stocks. The value factor, known as “High Minus Low” (HML), measures the return spread between high book-to-market (cheaper) and low book-to-market (more expensive) stocks. This model acknowledges that small-cap and value stocks tend to outperform the market, and it adjusts for this tendency, making it a more effective tool for evaluating manager performance. More recent research has added two more factors, investment (the return spread between companies that invest conservatively and those that invest aggressively) and profitability (the return spread between companies with high versus low operating profitability), to their factor model.

Robert Merton also advanced the CAPM by introducing the Intertemporal Capital Asset Pricing Model (ICAPM). This model extends the traditional CAPM by considering that most investors participate in markets over multiple years and are interested in developing a strategy that shifts as market conditions and risks change over time. ICAPM assumes that investors hedge risky positions and construct dynamic portfolios over time. It considers how investment opportunities might shift as expectations of risk change, resulting in situations in which investors may wish to hedge, especially as they may have to live off their portfolio after retiring and no longer having a salary.

While the stock market presents both risk and Knightian uncertainty, theories and models developed by economists like Frank Knight, Harry Markowitz, Bill Sharpe, Gene Fama and Bob Merton provide valuable tools for investors to navigate such risk and uncertainty. By understanding the difference between risk and uncertainty, and by using strategies such as portfolio diversification and asset pricing models, investors can make more informed decisions and better manage the inherent risk of the market.

Elections, Markets and Uncertainty

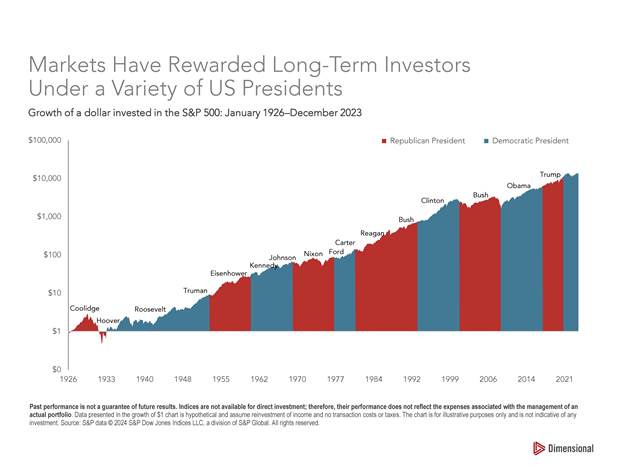

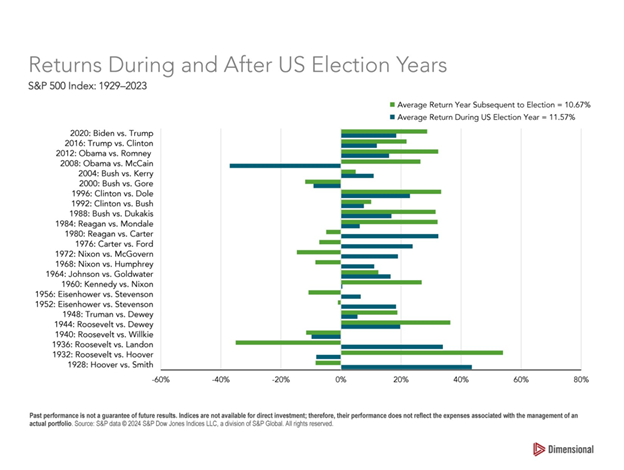

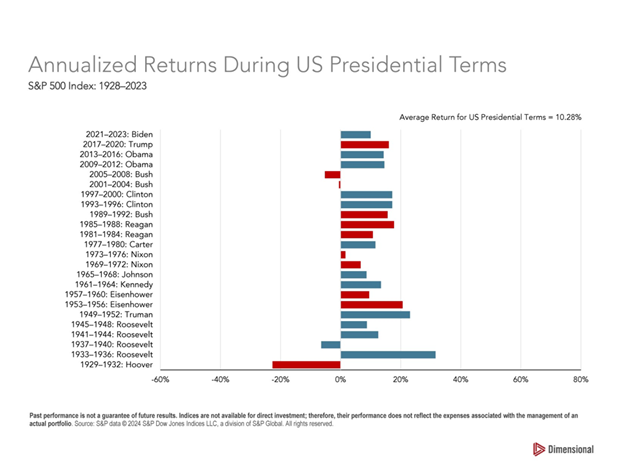

Speaking of uncertainty, elections can create great uncertainty in both the political world and markets. The impact of elections and the governing parties on stock market returns in the United States is a topic of significant interest to investors. Research shows that while elections do influence the stock market, the specific political party in control most likely does not significantly affect the market’s long-term performance.

Below are several other graphics depicting S&P 500 returns under different regimes.

It’s important to note that market returns are influenced by many factors, including political, economic and inflation trends such as actions of foreign leaders, interest rate changes, changing oil prices and technological advances; rather than strictly election results. While elections may introduce short-term volatility due to policy uncertainty, their impact on medium-to-long-term stock market performance appears to be minimal.

For long-term investors, the best course of action during an election year is to stick with a sound long-term investment plan based on individual investment goals. This means staying fully invested throughout the year per your plan or investing consistently per your plan. Investors should avoid market timing around politics. While it can be tempting to make investment decisions based on the potential impact of election outcomes, as shown above historical data suggests that the party running the country makes no clear difference for the stock markets in the long-term.

Shareholders invest in companies that focus on serving their customers and growing their businesses and profits, regardless of who is in the White House. Long-term investors are typically better off sticking to their investment plan and not making drastic changes based on election outcomes.

Until next time,

Mike and Emily

PS. The last 2 quotes at the beginning of the newsletter are a nod to one of the deepest thinkers ever, Danny Kahneman, who passed away on March 27. He had a profound impact upon understanding how humans behave, including investors. As a psychologist, he won a Nobel Prize in Economics, and by some accounts, is one of the most cited academic psychologists ever. Good obit here. The Nobel citation commended Kahneman “for having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty.”