The efficient markets hypothesis is “a very simple statement: prices reflect all available information…It’s a model, so it’s not completely true. No models are completely true…I don’t know any investors who shouldn’t act as if markets are efficient.”

Eugene Fama, Nobel Prize Economics 2013, Robert R. McCormick Distinguished Service Professor of Finance – University of Chicago

The effects of noise on the world, and on our views of the world, are profound. Noise in the sense of a large number of small events is often a causal factor much more powerful than a small number of large events can be. Noise makes trading in financial markets possible, and thus allows us to observe prices for financial assets. Noise causes markets to be somewhat inefficient, but often prevents us from taking advantage of inefficiencies. Noise in the form of uncertainty about future tastes and technology by sector causes business cycles, and makes them highly resistant to improvement through government intervention. Noise in the form of expectations that need not follow rational rules causes inflation to be what it is, at least in the absence of a gold standard or fixed exchange rates. Noise in the form of uncertainty about what relative prices would be with other exchange rates makes us think incorrectly that changes in exchange rates or inflation rates cause changes in trade or investment flows or economic activity. Most generally, noise makes it very difficult to test either practical or academic theories about the way that financial or economic markets work. We are forced to act largely in the dark.

Fischer Black, Mathematician and Originator of Black Scholes Option Pricing Model

I think being educated about both the empirical evidence and theoretical rationales for anything, they can help sustain patience in bad times. And I suggest some practical tips, such as viewing your portfolio broadly and rarely.

Antti Ilmanen, Principal at AQR and PhD from University of Chicago

“The most important, and rarest, trait of all: The ability to live through volatility without changing your investment process. This is almost impossible for most people to do; when the chips are down they have a terrible time not selling their stocks at a loss. They have a really hard time getting themselves to average down or to put any money into stocks at all when the market is going down. People don’t like short-term pain even if it results in better long term results. Very few investors can handle the volatility required for high returns.”

Mark Sellers, Hedge Fund Manager

Author of Article “So You Want to Be the Next Warren Buffett?”

Below are returns from indices we track. It has been a rough 6 months. In fact, it has been the steepest first-half decline for the S&P 500 since 1970.

Market Summary

Stocks fell for another straight quarter, with the MSCI All Country World IMI Index dropping nearly 16% and major indices entering bear market territory in June. Inflation fears dominated headlines even as it seemed investors eased back their expectations for inflation with the 1-year breakeven rate ending the quarter at 4.3%, after peaking at over 6% in late March. US stocks were particularly hard hit, with international markets, especially emerging markets, faring a bit better. Aside from China, which was up 3.3% for the quarter, all developed and emerging markets posted negative returns. Value exposure cushioned the blow with the MSCI All Country World IMI Value Index outperforming the growth index by over 8%.

Although the drop in the markets has been significant, it is actually not uncommon. Since 1987, there have been 9 years where there have been intra-year declines greater than 20% for the S&P 500, as shown in the figure below.

Thoughts on Volatile Times

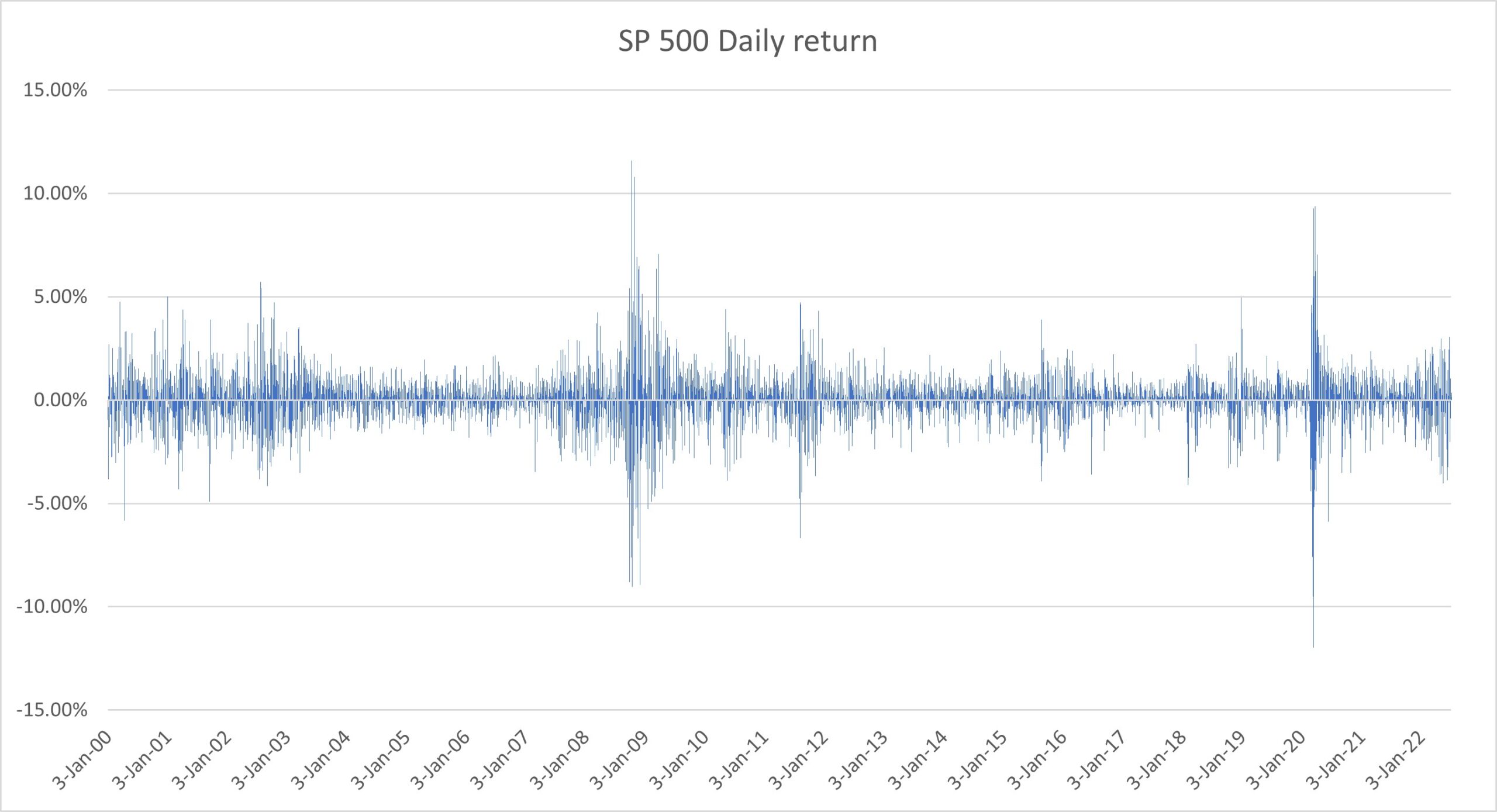

As the late Fischer Black says above, there is a lot of noise in markets (and in the world in general). Below is a graph showing the daily movements of the S&P 500 since January 1, 2000. This is evidence of a lot of noise. It is very hard to determine a discernible pattern in the graph below. This is why I have a hard time telling you where the market is going in the short term.

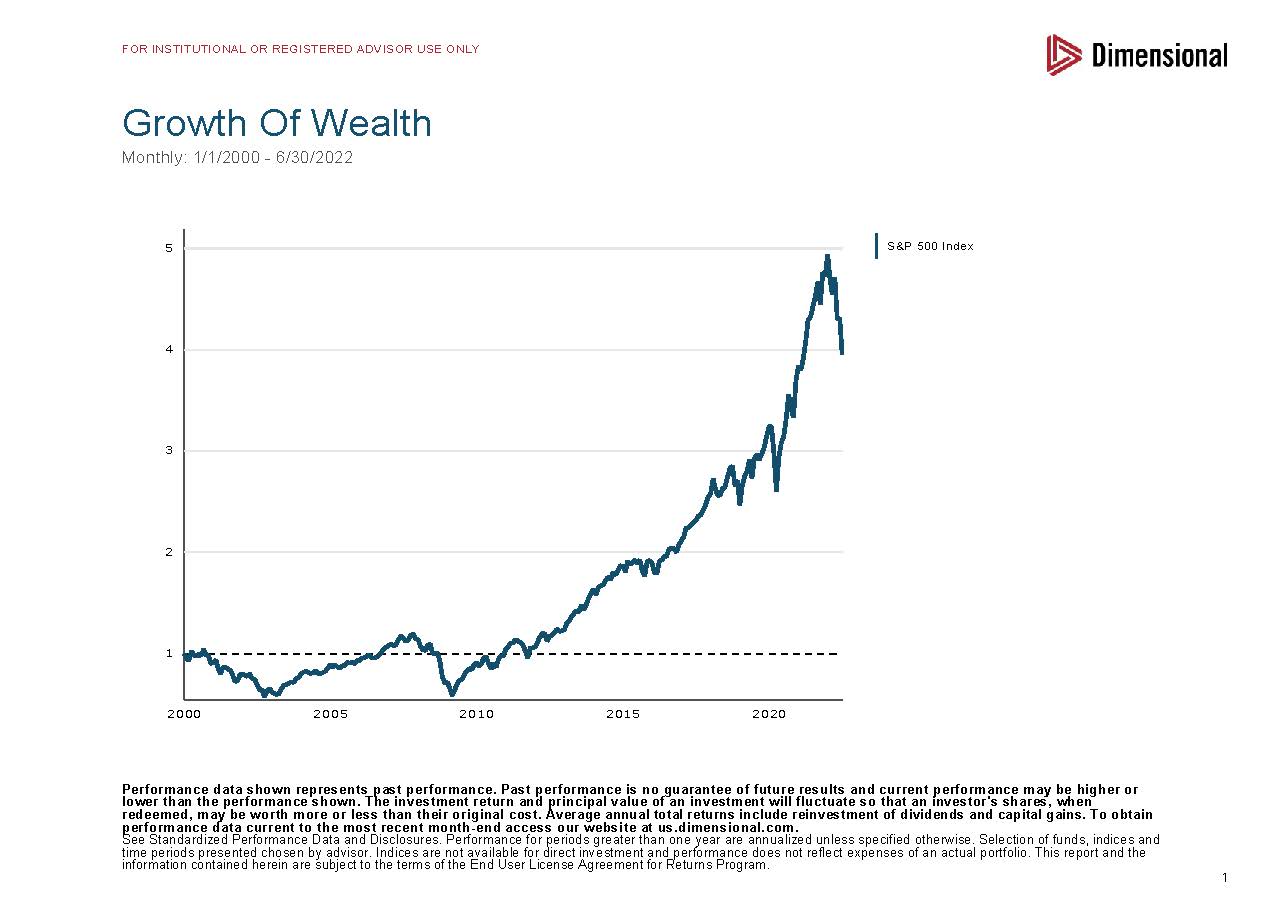

However, when we look at the return of the S&P 500 Index from January 1, 2000 – June 30, 2022, here is what the graph looks like.

The S&P 500 has returned 6.3% annualized from January 1, 2020, through June 30, 2022. In other words, $1,000,000 has turned into approximately $3,950,000 in that Index. We are playing a long-term game. As Antti Ilmanen recommends above, to have a better investment experience, one should view their “portfolio broadly and rarely.” Why is that? Terry Odean and Brad Baerber found in their paper Boys Will Be Boys: Gender, Overconfidence and Common Stock Investment “that men trade 45% more than women, and such trading reduces men’s returns by 2.65 percentage points a year as opposed to 1.72 percentage points for women.” Trading less and looking less is better for long-term returns.

In addition, Odean and Baerber found in The Behavior of Individual Investors “that individual investors (1) underperform standard benchmarks (e.g., a low cost index fund), (2) sell winning investments while holding losing investments (the “disposition effect”), (3) are heavily influenced by limited attention and past return performance in their purchase decisions, (4) engage in naïve reinforcement learning by repeating past behaviors that coincided with pleasure while avoiding past behaviors that generated pain, and (5) tend to hold undiversified stock portfolios.” Advisors can help investors stick to the long-term during times of market volatility and stress. And as both Gene Fama says above and as his colleague Ken French also says, “almost all of us should act as if prices are right” and that markets are efficient.

Marlena Lee at Dimensional has provided some guidance recently on how to think about investing. Below are her thoughts.

Three Crucial Lessons for Weathering the Stock Market’s Storm

By Marlena Lee, PhD Global Head of Investment Solutions

Investors can always expect uncertainty. While volatile periods like the one we’re experiencing now can be intense, investors who learn to embrace uncertainty may often triumph in the long run. Reacting to down markets is a good way to derail progress made toward reaching your financial goals.

Here are three lessons to keep in mind during periods of volatility that can help you stick to your well-built plan. And if you don’t have a plan, there’s a suggestion for that too.

1. A recession is not a reason to sell

Are we headed into a recession? A century of economic cycles teaches us we may well be in one before economists make that call.

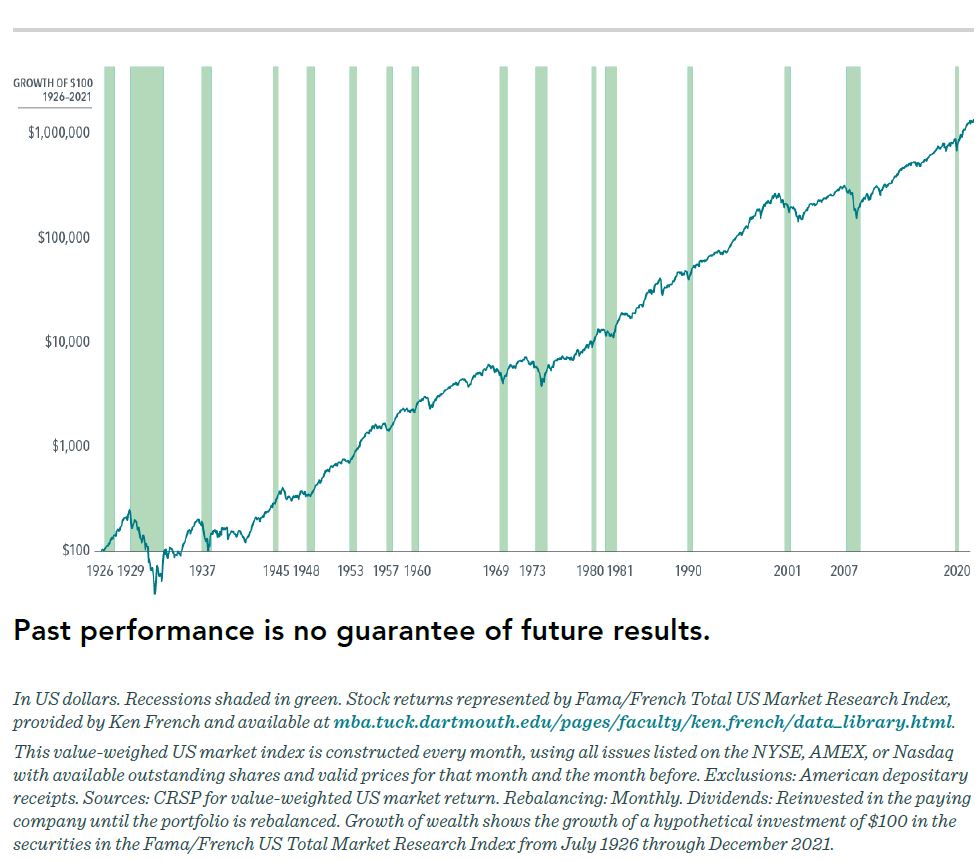

But one of the best predictors of the economy is the stock market itself. Markets tend to fall in advance of recessions and start climbing earlier than the economy does. As the chart below shows, returns have often been positive while in a recession.

All the dots in the upper left quadrant in the chart below are years where the US economy contracted but US stocks still outperformed less-risky Treasury bills. It’s a great illustration of the forward-looking nature of markets. If you’re worried, other investors are too, and that uncertainty is reflected in stock prices.

Whether accompanied by recessions or not, market downturns can be unsettling. But over the past century, US stocks have averaged positive returns over one-year, three-year, and five-year periods following a steep decline.

Whether accompanied by recessions or not, market downturns can be unsettling. But over the past century, US stocks have averaged positive returns over one-year, three-year, and five-year periods following a steep decline.

A year after the S&P 500 crossed into bear market territory (a 20% fall from the market’s previous peak), it rebounded by about 20% on average. And after five years, the S&P 500 averaged returns over 70%.1

2. Time the market at your peril

When stocks have declined, it might be tempting to sell to stem further losses. You might think, “I’ll sit out until things get a bit better.” But by the time markets are less volatile, you’ll have often missed part of the recovery. Yes, it stings to watch your portfolio shrink, but imagine how you’ll feel when it’s stuck while the market rebounds.

Big return days are hard to predict, and you really don’t want to miss them. If you invested $1,000 in the S&P 500 continuously from the beginning of 1990 through the end of 2020, you would have $20,451. If you missed the single best day, you’d only have $18,329—and only $12,917 if you missed the best five days.2

History shows the stock market tends to rebound quickly. The same can’t be said for individual stocks or even entire sectors. (How many railroad stocks do you own?) So, while investing means taking on some risk for expected reward, investors should mitigate risks where they can. Diversification is a top risk mitigation tool, along with investing in fixed income and having a financial plan.

3. It may be a good time to reassess your portfolio and your plan

We saw many fads crop up through the pandemic, from baking to puppy adoption. Did you experiment with one of the pandemic investment fads—FAANGs or meme stocks or dogecoin? If so, it may be time to put those fads in the rearview.

Do you know the names of all the stocks you own? Then you probably own too few. How much of your portfolio sits outside the US? Because about half the global market is comprised of foreign stocks. If you only invest in the S&P 500, you’re missing half of the investment opportunity set. A market-cap-weighted global portfolio is a better starting point than chasing segments of the market that have outperformed in the past few years.

And if you want to outperform the market, allow decades of academic research to light the way. Portfolios focused on small caps, value stocks, and more profitable companies have had higher returns over the long run. The portfolio I use is invested across more than 10,000 global equities in over 40 countries.

Beyond a well-designed portfolio, one of the best ways to deal with volatile markets and disappointing returns is to have planned for them. A financial advisor can help you develop a plan that bakes in the chances you’ll experience some market lows. And they can help you find the confidence to weather the current storm and get to the other side.

A sound approach to investing—through a plan, a well-designed portfolio, and an advisor—is the ultimate self-care during these rough markets. Your future self will thank you.

This piece first appeared in MarketWatch with the title “Follow these 3 crucial lessons for weathering the stock market’s storm.”

David Booth, Founder of Dimensional, constantly preaches that it is important to have a plan. “Different people are comfortable with different levels of risk. This is one of the reasons I encourage everyone to talk to a financial advisor before investing. Investing is inherently complex. Dealing with that complexity is the job of a professional advisor. They figure out a long-term strategy that considers both your goals and your risk tolerance. If you’re comfortable, it’s easier to stay the course through both good and bad times.” This is consistent with Mark Sellers’ quote above that “the ability to live through volatility without changing your investment thought process” is the rarest trait of all of great investors. Hopefully, during these volatile times, we can stay true to your plan to increase the odds of your long-term investing success.

Until next time,

Mike and Emily