“A man who carries a cat by the tail learns something he can learn in no other way.”

Mark Twain

“I remind myself of Einstein’s remark that common sense is nothing but a collection of misconceptions acquired by age eighteen.”

Nassim Taleb, from book Fooled by Randomness

“Success breeds a disregard of the possibility of failure.”

Hyman Minsky, Former professor of economics at Washington University in St. Louis

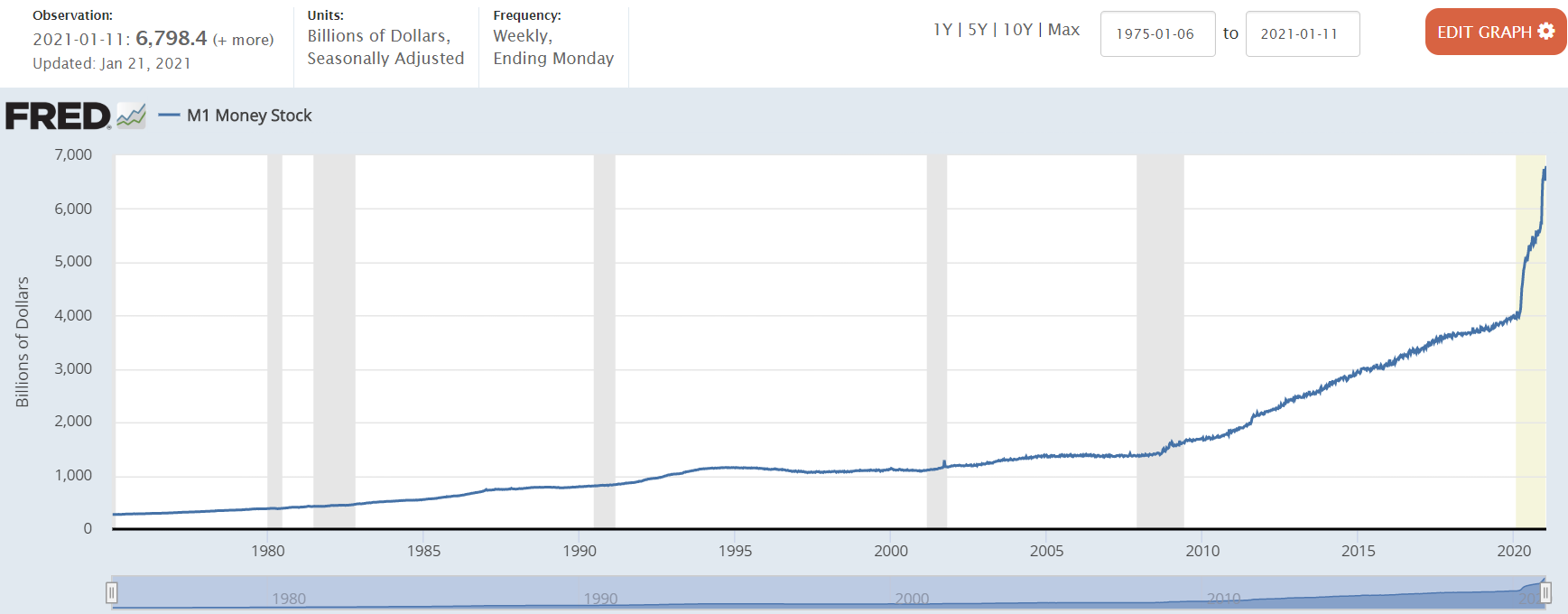

2020 was unique in so many ways. We had a once in a one-hundred-year pandemic, which is still not over. We had a stock market that started to crash in a rapid fashion starting in February, and then rebounded strongly starting in April after both the Federal Reserve and Congress flooded the economy with liquidity from March onward (see graph below on M1 Money Stock), with the Federal Reserve buying all sorts of risk assets except stocks, but including high yield junk bonds, which act a LOT like stocks. The Treasury department delivered significant stimulus checks to both individuals and businesses as COVID-19 lockdowns occurred. And the nation went through a difficult election and post-election process, which is also not completely over.

Even though the stock market ended up having a good year on a calendar year basis, risk and uncertainty existed throughout 2020 and still exists. Although some people think that risk has been eliminated by the Federal Reserve and the Treasury Department, other experts would disagree. In complex systems such as financial markets, risk is always there, and markets can change very quickly as evidenced in February. Prices are information, and when prices or interest rates arguably get distorted, that means information is also distorted. Distorted information can lead to a misallocation of resources in a market-based economy, such as inflated stock and home prices. Or as Hyman Minsky stated, “stability leads to instability.”

As mathematician Benoit Mandelbrot has said, “there is something in the human condition that abhors uncertainty, unevenness, unpredictability. People like an average to hold onto, a target to aim at—even if it is a moving target.” As Mandelbrot’s friend Nassim Taleb wrote in Fooled by Randomness, “Probability is not a mere computation of odds on the dice or more complicated variants; it is the acceptance of the lack of certainty in our knowledge and the development of methods for dealing with our ignorance.” From a market perspective, one of those methods for dealing with ignorance of where markets will go is diversification, or not having all our eggs in one basket. From a true “investing” standpoint, it is better to have assets spread over different asset classes versus picking only one asset class. Picking one is a bet – or speculation – not investing.

Multiple studies have shown that humans are generally risk averse. On the flip side, investors also suffer regret if they miss out on a move higher. As Taleb points out “past events will always look less random than they were…Psychologists call this overestimation of what one knew at the time of the event due to subsequent information the hindsight bias, the “I knew it all along” effect.” Danny Kahneman stated, “you should also know that regret and hindsight bias will come together, so anything you can do to preclude hindsight is likely to be helpful.” Unfortunately, in the investment space, that is a difficult task.

Taleb takes a hardline approach.

“Say you engage in a business of protecting investors from rare events by constructing packages that shield them from their sting (something I have done on occasion). Say that nothing happens during the period. Some investors will complain about your spending their money; some will even try to make you feel sorry: “You wasted my money on insurance last year; the factory did not burn, it was a stupid expense. You should only insure for events that happen.” One investor came to see me fully expecting me to be apologetic (it did not work). But the world is not that homogeneous: There are some (though very few) who will call you to express their gratitude and thank you for having protected them from the events that did not take place.”

When we protect capital, we still feel somewhat badly if the market went the other way. However, we do not feel badly about protecting the portfolio from massive uncertainty when a once in one-hundred-year event occurs.

Last year, especially with some of our investors getting closer to retirement and with the massive uncertainty regarding the pandemic and the economy, preserving capital for that demographic was very important. Normally it takes a relatively long time to make money, and much less time to lose it. We do not believe one can persistently and consistently time markets. However, we do believe that we can protect capital in times of great uncertainty; and we also believe that doing so makes more sense than taking extraordinary risk and possibly blowing up a financial plan. As Taleb states, “considering that alternative outcomes could have taken place, that the world could have been different, is the core of probabilistic thinking,” a belief we share. Just because an alternative did not occur does not mean it was not in the probability of outcomes that could have occurred.

Our planning software, MoneyGuidePro, estimates returns and standard deviations for different portfolios going forward based upon a stock/bond allocation. Below are the current projections. That is all they are, and disclosures are here.

| Name | Cash | Bond | Stock | Projected Return | Standard Deviation | 2 Std Dev Down from Avg | 2 Std Dev Up from Avg |

| Capital Preservation I | 5% | 67% | 28% | 4.05% | 4.85% | -5.65% | 13.75% |

| Capital Preservation II | 5% | 57% | 38% | 4.43% | 6.43% | -8.43% | 17.29% |

| Balanced I | 4% | 51% | 45% | 4.69% | 7.51% | -10.33% | 19.71% |

| Balanced II | 4% | 42% | 54% | 5.03% | 8.96% | -12.89% | 22.95% |

| Total Return I | 4% | 35% | 61% | 5.36% | 10.25% | -15.14% | 25.86% |

| Total Return II | 3% | 25% | 72% | 5.79% | 12.07% | -18.35% | 29.93% |

| Capital Growth I | 2% | 16% | 82% | 6.20% | 13.79% | -21.38% | 33.78% |

| Capital Growth II | 0% | 9% | 91% | 6.57% | 15.31% | -24.05% | 37.19% |

| Equity Growth | 0% | 0% | 100% | 6.93% | 16.83% | -26.73% | 40.59% |

The most important thing to understand is that a normal return (95% of the time) in any given year is the range of 2 standard deviations from the average, down or up. The riskier (greater the percentage of stock) the portfolio, the greater the portfolio strays from the average in any given year. For a diversified 100% stock portfolio according to MoneyGuidePro’s planning models, if you had a -26.73% return in a calendar year, that would be considered normal based upon the standard deviation.

That range of returns shows the randomness of returns. Because returns are “fat tailed,” meaning there are more outliers than we would expect by the statistics above, the range of returns for each of the portfolios is even greater in real life than shown in the model above. Remember, models help us understand real world phenomena, but they are solely models, and not reality.

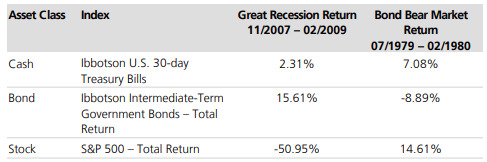

Below is another chart that shows how short-term treasuries, intermediate term treasuries and the S&P 500 did in 2 different difficult market scenarios, including the financial crisis of 2007-2009.

In the great recession of 2007-2009, the S&P 500 declined 51% in 16 months, which was extremely painful for investors solely concentrated in that index. As you can see, there was a flight to quality to Treasury Bills and Bonds during that period and diversifying and holding some of those assets in the portfolio would have cushioned the fall.

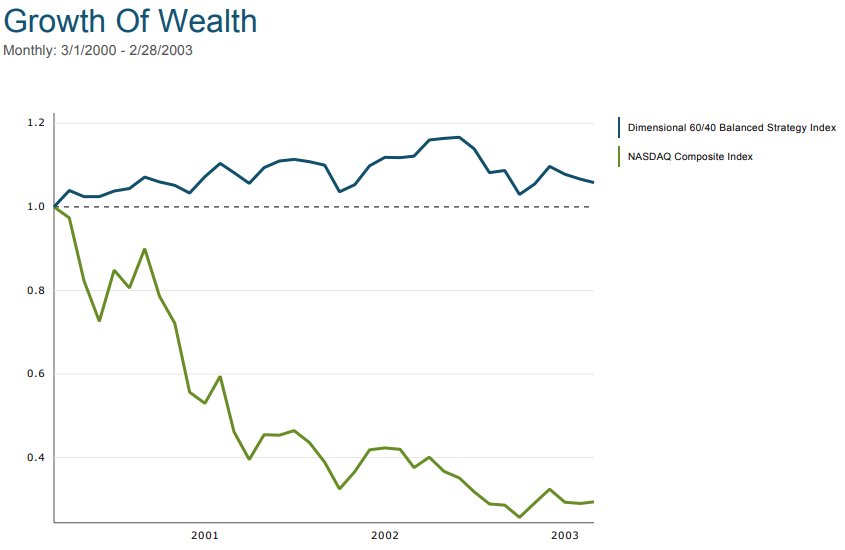

From March 1, 2000 – February 28, 2003, the Nasdaq Composite Index* (one cannot buy an index, but one can buy a low cost fund tracking the index), which tracks many tech stocks, fell 71%. $1,000,000 turned into $290,000.

Assume you had a financial plan based upon “betting” on the Nasdaq Index, and that -71% randomness occurred while you needed to pull $100,000 out of the portfolio. The financial plan could have been ruined. Instead, compare that to the Dimensional 60/40 Balanced Strategy Index*, a much more diversified index, which was up 5.82% cumulatively in the same period. Although only a 1.9% annualized return over 3 years, it would have been much better to have $1,060,000 than $290,000.

Return is important, but so is risk, especially as one gets closer to retirement and has to “eat” their portfolio.

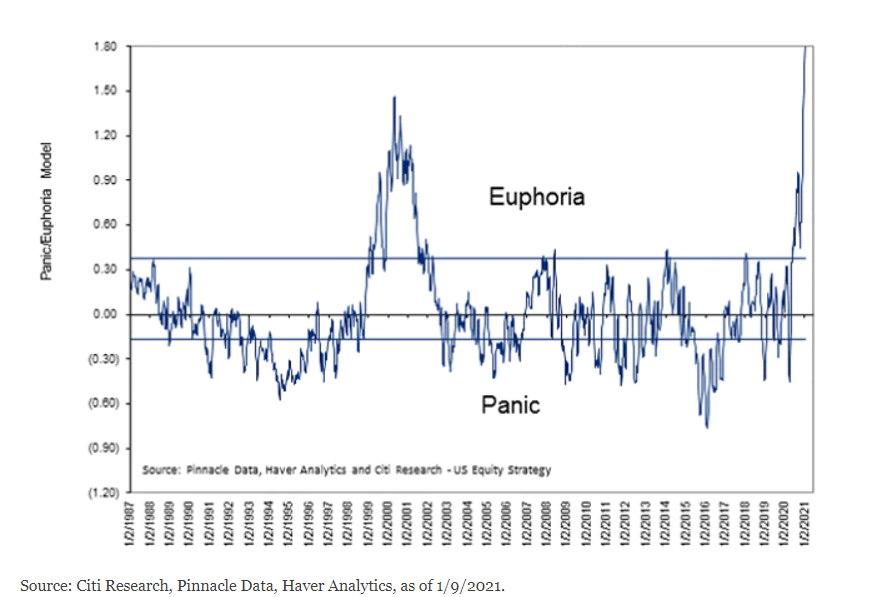

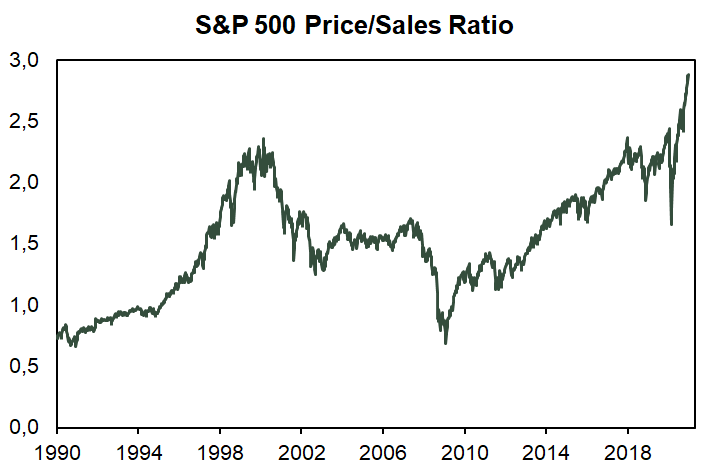

Valuations and investor euphoria are at present elevated, with euphoria at an all time high as well as the price to sales ratio.

Counter that with massive Federal Reserve liquidity shown in the above graph and additional stimulus from Congress and Treasury, and it is anyone’s guess where markets go in the short to intermediate term. Hence, diversify. As Gene Fama has said, “During the financial crisis, some investors discovered that their tolerance for risk is lower than they thought, so it might make sense for them to permanently reduce their exposure to equities (stocks)….If the current high volatility makes you permanently averse to stock market volatility, and the inevitable variation in market volatility, you should get out. But you shouldn’t have been in the stock market in the first place since fluctuations in volatility are the norm.”

We are not brokers, and we do not speculate for our clients. We are investment advisers that take a long-term approach to wealth management and preservation. We are not averse to clients speculating with a small amounts of money; we just advise against doing so with “stay independent” money. As the late Nobel Prize winner Merton Miller said, “I choose a few stocks myself. But I do it strictly for entertainment.”

We are here to evaluate the probabilities, preserve capital for retirement, and grow portfolios prudently based upon the time horizon, needs and risk tolerance of our investors. We will always take risk and uncertainty into our decision making for our clients, and try to align those considerations with financial plans. Risk of ruin is always real, and it is something we contemplate for our clients. As Peter Bernstein and Aswath Damodaran wrote in their book Investment Management, “Staying rich requires an entirely different approach from getting rich. It might be said that one gets rich by working hard and taking big risks, and that one stays rich by limiting risk and not spending too much.” We prefer not to grab the cat by the tail.

All the best,

Mike and Emily

PS. For additional reading regarding both upside and downside risk, please see the following links. Again, no one knows.

Goldman Sachs says the S&P 500 will rise 14% in 2021

Baupost’s Seth Klarman compares investors to ‘frogs in boiling water’

Grantham Warns of Biden Stimulus Further Inflating Epic Bubble

*The Global 60/40 Fund Custom Benchmark is an unmanaged hypothetical index composed of 60% MSCI World Index (net dividends) and 40% FTSE World Government Bond Index 1-3 Years (hedged). MSCI data copyright MSCI 2021, all rights reserved. FTSE fixed income indices © 2021 FTSE Fixed Income LLC. All rights reserved. The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange. All rights reserved.