“There is general agreement among researchers that nearly all stock pickers, whether they know it or not—and few of them do—are playing a game of chance. The subjective experience of traders is that they are making sensible educated guesses in a situation of great uncertainty. In highly efficient markets, however, educated guesses are no more accurate than blind guesses.”

Daniel Kahneman, Nobel Prize Winner in Economics

“As Nassim Taleb has argued, inadequate appreciation of the uncertainty of the environment inevitably leads economic agents to take risks they should avoid.”

Daniel Kahneman, Nobel Prize Winner in Economics

“An unbiased appreciation of uncertainty is a cornerstone of rationality—but it is not what people and organizations want.”

Daniel Kahneman, Nobel Prize Winner in Economics

“There is something in the human condition that abhors uncertainty, unevenness, unpredictability. People like an average to hold onto, a target to aim at—even if it is a moving target.”

Benoit Mandelbrot, Mathematician

The current market environment has been one of the most difficult I have encountered since taking Portfolio Management and Options and Futures Theory while a graduate student at Indiana University in the 1980’s.

The combination of the worst global pandemic since 1918, a complete shutdown of the economy as a result, the massive flooding of liquidity from the Federal Reserve in historic proportions, and the social unrest arising from the murder of George Floyd in Minnesota, has resulted in great uncertainty and volatility in the markets and the economy.

In the past 2 months, we have either spoken with or participated in webinars with the following:

Gene Fama – https://www.chicagobooth.edu/faculty/directory/f/eugene-f-fama

Robert Shiller – http://www.econ.yale.edu/~shiller/

Ken French – https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/

Ed Lazear – https://www.gsb.stanford.edu/faculty-research/faculty/edward-lazear

Aswath Damodaran – http://pages.stern.nyu.edu/~adamodar/

Jeremy Stein – https://scholar.harvard.edu/stein/home

Sunil Wahal – https://isearch.asu.edu/profile/825492

Meir Statman – https://www.scu.edu/business/finance/faculty/statman/

Rober Novy-Marx – http://rnm.simon.rochester.edu/

In addition, we have had numerous discussions with the fund companies we use.

- Dimensional Fund Advisors

- Vanguard

- BlackRock

- Avantis

- Goldman Sachs.

After all these discussions, no one truly knows where the economy and the markets are headed. The common theme has been the tremendous uncertainty that persists in the economy, markets, and life in general at the present time.

That is why we believe diversification is more important than ever, as having exposure to different asset classes (stocks and bonds) can spread the risk, and hopefully offer a better investment experience over both the short and long-term. In addition, we believe structuring portfolios to capture long-term expected returns makes the most sense in increasing the odds of a favorable investment experience. When we talk long-term, we are usually talking about 10-year investment horizons and longer.

There are no guarantees over any investment time horizon, but the more patient one is, the better the odds of having a good experience.

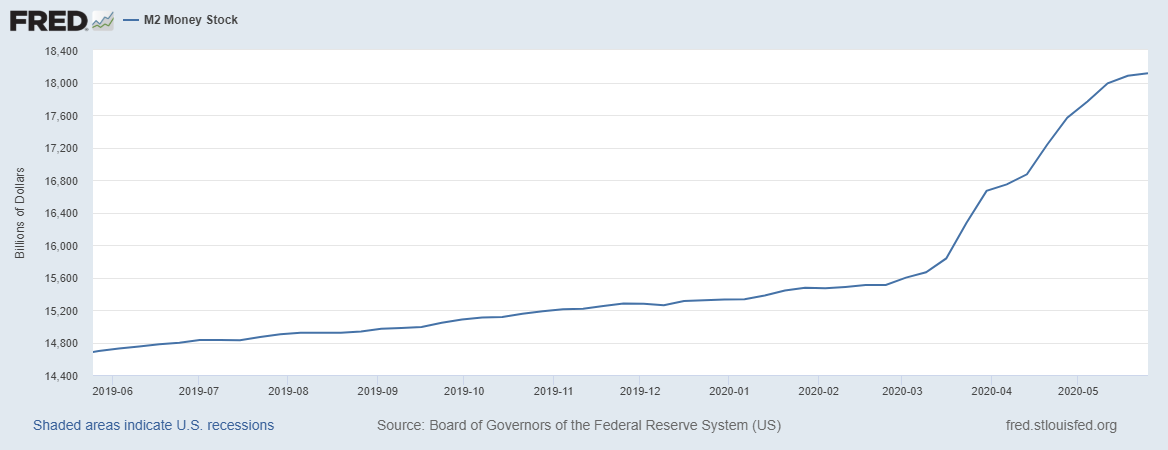

With regard to the current crisis, I want to share with you the latest graph from the Federal Reserve in St. Louis showing the massive increase in the money supply this year.

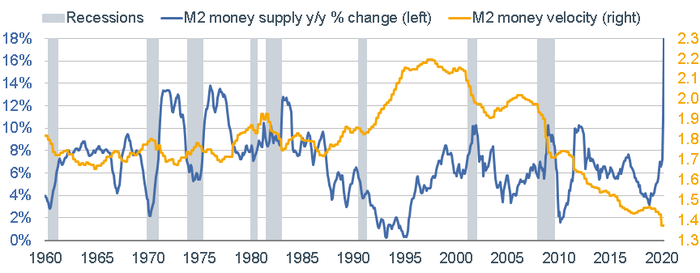

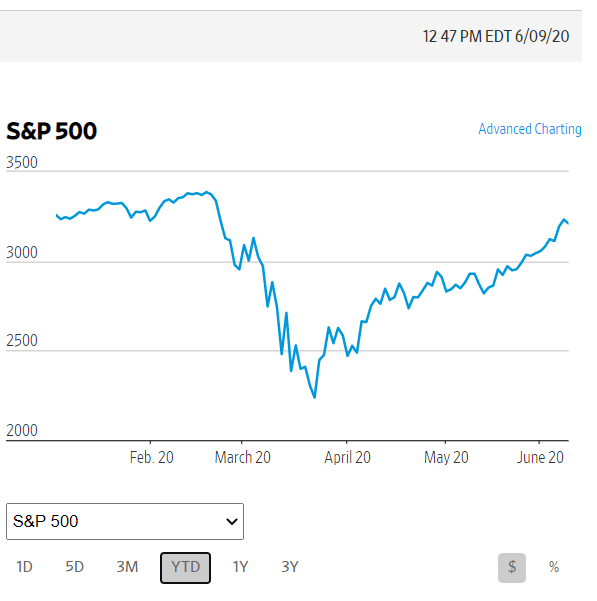

Here is another view from Schwab.

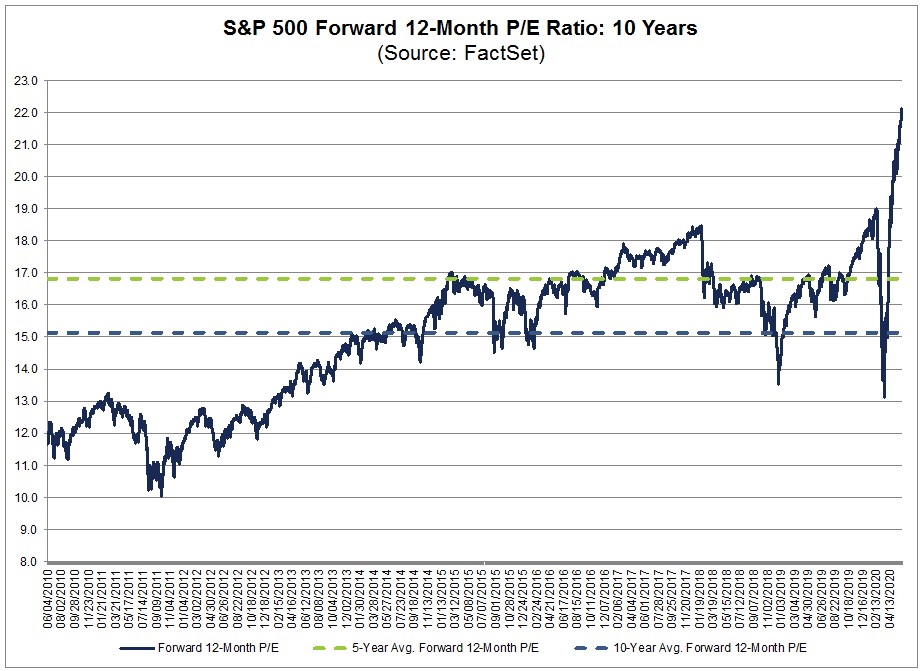

$3 trillion in M2 money stock has been created in just over 2 months, and it is expected that the Federal Reserve will create even more going forward. I spoke with my law school classmate and very good friend, who is a distressed debt trader and former bankruptcy lawyer. His view is that the vast amount of liquidity created by the Federal Reserve has poured into the equity markets, increasing asset prices. His view may or may not be correct, but due to the massive uncertainty in general, I do not believe his view can be ignored. The following graph shows that the price to earnings ratio as of June 5 was very high on a historical basis.

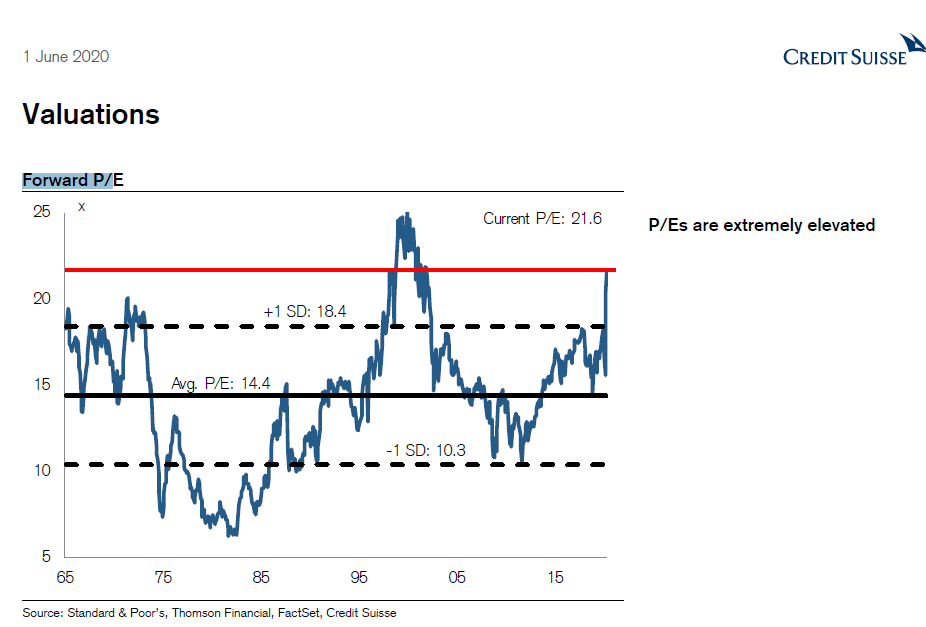

Here is a Credit Suisse analysis from June 1, showing the highest forward Price Earnings ratio since the tech bubble of 1999. Those PEs have come down a bit because of the retracement on June 11, but they are still elevated.

In addition to the Federal Reserve’s increase in the money supply, the Federal Reserve announced on March 23 that they would purchase corporate bonds and corporate bond ETFs such as LQD, and they further announced on April 9 that they would buy “junk” bond ETFs, such as HYG and JNK. Both actions are unprecedented in the history of the Federal Reserve.

Below is how the S&P 500 responded to those announcements, with a low this year on the date of the Fed’s first announcement of March 23, and a further run-up after the April 9 support of “junk” bonds.

Although the Fed has alleviated some of the liquidity crisis that occurred, there is a question whether such a “bailout”, especially of high-yield “junk” bonds, will encourage even more aggressive risk taking by corporations taking on even more debt, with the bad incentive that such risk taking will be bailed out by the Federal Government in the future if things get worse. Further, will the Federal Reserve continue to be market participants to a much greater level than they have historically been, and what impact will that have on markets, risk taking, and asset pricing?

We always must keep in mind Gene Fama’s Efficient Markets Hypothesis, which states that “current prices incorporate all available information and expectations.” That information includes the Federal Reserves’ stimulus mentioned above. Fama’s hypothesis acknowledges that “mispricings” can occur, but not in predictable patterns that lead to consistent outperformance. Obviously, by acknowledging mispricings, it is acknowledged that prices are not always “right.” What it does mean is that prices do give us meaningful information, and that it is extremely difficult, if not impossible, for active strategies to consistently add value through security selection and market timing. Hence, another reason why a more passive, diversified approach makes a lot of sense.

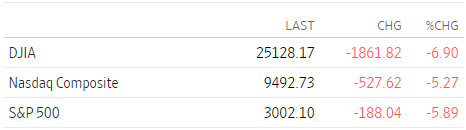

An example of Fama’s hypothesis at work was Jay Powell’s Fed meeting and press conference on June 10, and the market’s reaction on June 11 to the “new” news. After digesting details of the meeting, market participants adjusted their valuations of individual companies and the market as a whole. Powell’s press conference suggested that recovery of employment in the labor market may take longer than was priced in, and in addition to that, it appears that some outbreaks of COVID are occurring or recurring in certain locales in the United States, some at a worrying pace. The Dow finished down almost 7%, and the S&P 500 down almost 6%.

When volatility spikes, it tends to stay elevated for extended periods of time, sometimes as long as six months. If a second wave comes in the fall, I would fully expect volatility to climb again, as that would create additional uncertainty, which the market does not like.

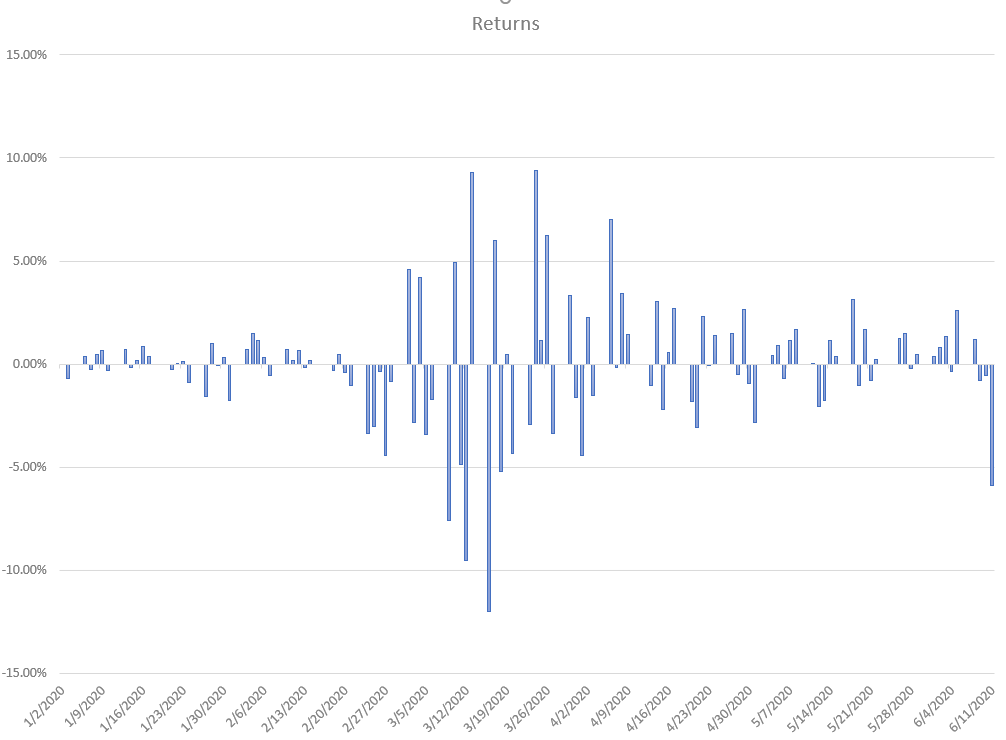

No one knows where things are going in the short-term. If volatility stays elevated as we suspect, there will continue to be large valuation swings, both positive and negative. Here is a chart showing S&P 500 daily returns for 2020 through the end of the day June 11. As shown, it is hard to pick any daily pattern.

We believe we have positioned our clients’ portfolios for the long-term. However, if you believe you have more risk than you can stomach, please do not hesitate to call us. We are happy to discuss with you and develop a portfolio that is appropriate for both your financial plan and your peace of mind.

All the best,

Mike and Emily