“The high volatility of stock returns is common knowledge, but many professional investors seem unaware of its implications. Negative [stock] equity premiums and negative premiums of value and small stock returns relative to market are commonplace for three- to five-year periods, and they are far from rare for ten-year periods. Given this uncertainty, investors who will abandon equities or tilts toward value or small stocks in the face of three, five, or even ten years of disappointing returns may be wise to avoid these strategies in the first place.”

Eugene Fama and Kenneth French

Volatility Lessons

“For many years, scholars and investment professionals have argued that value strategies outperform the market. These value strategies call for buying stocks that have low prices relative to earnings, dividends, book assets, or other measures of fundamental value. While there is some agreement that value strategies produce higher returns, the interpretation of why they do so is more controversial. This article provides evidence that value strategies yield higher returns because these strategies exploit the suboptimal behavior of the typical investor and not because these strategies are fundamentally riskier.”

Josef Lakonishok Andrei Shleifer Robert W. Vishny

Contrarian Investment, Extrapolation, and Risk

“I don’t believe all the nonsense about market timing. Just buy very good value and when the market is ready that value will be recognized.”

Henry Singleton

Former Chairman of Teledyne

“Price is what you pay; value is what you get.”

Warren Buffett

It has been a unique year, that is for sure. Below are the indices we track.

| Data Series (As of 9/30/2020) | QTD | YTD | 1 Year | 3 Years | 5 Years | 10 Years |

| S&P 500 | 8.93% | 5.57% | 15.15% | 12.28% | 14.15% | 13.74% |

| Russell 2000 | 4.93% | -8.69% | 0.39% | 1.77% | 8.00% | 9.85% |

| Russell 2000 Value | 2.56% | -21.54% | -14.88% | -5.13% | 4.11% | 7.09% |

| MSCI World ex USA (net div.) | 4.92% | -7.13% | 0.16% | 0.62% | 5.32% | 4.37% |

| MSCI World ex USA Small Cap (net div.) | 10.12% | -4.05% | 6.88% | 1.42% | 7.35% | 6.55% |

| MSCI Emerging Markets (net div.) | 9.56% | -1.16% | 10.54% | 2.42% | 8.97% | 2.50% |

| Bloomberg Barclays U.S. Treasury Bond 1-5 Years | 0.13% | 4.37% | 4.72% | 3.23% | 2.21% | 1.72% |

| ICE BofA 1-Year US Treasury Note | 0.08% | 1.77% | 2.37% | 2.19% | 1.54% | 0.93% |

Lately there has been an increased focus on the S&P 500 and its outperformance. Most people “track” to that index, although that is only one asset class, which is large capitalization US stocks. While it is widely agreed upon that the S&P 500 is an adequate representation of the US large cap market, it still represents less than half of the total global market value. We take a more diversified approach.

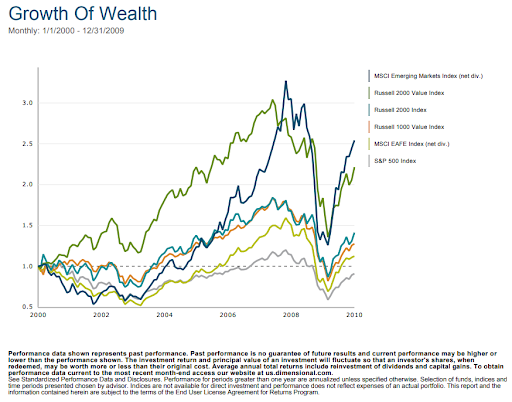

What people quickly forget is the S&P 500 was negative for the entire decade of 2000-2009. It was international, emerging markets, and value that carried the portfolios during that decade. See chart and graph below.

| Data Series | 10 Years (Jan 2000 – December 2009) |

| S&P 500 | -0.95% |

| Russell 1000 Value (Large Value) | 2.47% |

| Russell 2000 (Small) | 3.51% |

| Russell 2000 Value (Small Value) | 8.27% |

| MSCI EAFE (net div.) (Int’l) | 1.17% |

| MSCI Emerging Markets (net div.) | 9.78% |

Here is the growth of a dollar from 2000-2009 for each of the above indices.

As you can see from the first data series above showing current returns, both small (Russell 2000) and value (Russell 2000 Value) have suffered recently, especially over the past 3 years. A question that keeps getting repeatedly asked is “is value dead?”

We don’t believe so, and after our discussions with fund providers that track value, neither does Dimensional Fund Advisors, AQR, Avantis or BlackRock.

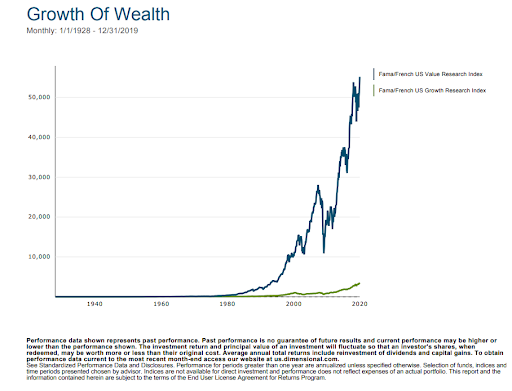

How does one define value versus growth? We define value by taking a quantitative approach using certain financial ratios, such as low price/book value, low price/earnings, low price/cash flow, etc. We normally define value as the top 30% of the total market that meets the sorting criteria above (growth would be the bottom 30% of the same criteria). All else being equal, one is buying more earnings, cash flow or value for a given stock price, book value or market capitalization. As measured by our current preferred ratio, book value/market value, value has beaten growth over the long-haul.

Based upon the difference between Fama/French Value versus Growth Indices since 1928, Value has beaten Growth by approximately 3.31% annualized. That is a pretty big difference. If one could invest in an index (one cannot, and disclaimer is below), a dollar would have grown into the following for each of the Fama/French Indices since 1928 through the end of 2019.

However, this year has been different. From January through August, the Fama/French Growth Index has beaten the Value Index by an astonishing 46%. What is going on?

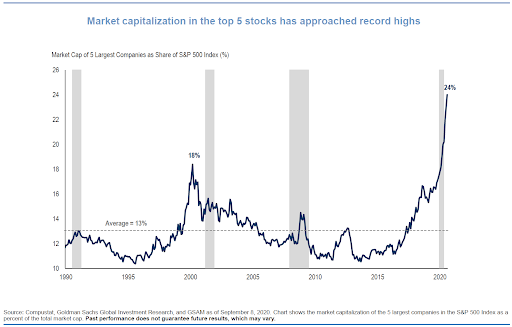

With any complex system with many variables impacting it, it is hard to cite one reason. However, the top 5 companies (Apple, Microsoft, Amazon, Facebook and Alphabet) of the S&P 500 increased their share of the total value of the S&P 500 to 24% as of September 8, which was near a record, and were at 22.8% as of September 30.

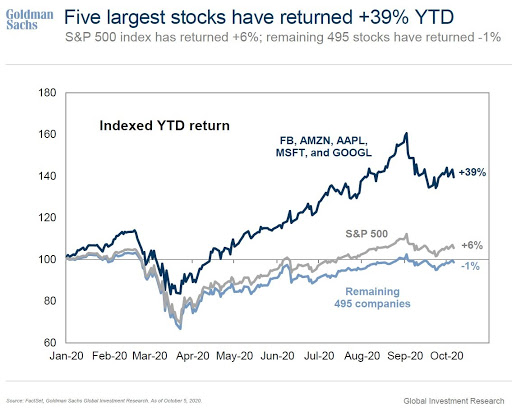

Further, as of October 5, those same stocks were up 39% year to date at that point, while the total index was up 6%, and the bottom 495 stocks in the S&P 500 were down 1%.

Part of the reason is most likely that work from home due to Covid caused a re-alignment of technology needs for corporations and businesses in general. Large companies (and small for that matter) had to increase their bandwidth, cybersecurity, VPN abilities, software licenses (office software) and cloud storage. Demand for the top 5 companies’ services increased greatly. An increased volume of business plus pricing power was great for sales and profits, and share prices were bid up as a consequence, leading to unexpected returns.

Variance of returns in any given year or time period around the average is large for both value and growth. Therefore, it is not uncommon for growth to outperform in any given year; it was the magnitude of the outperformance in 2020 that has been a bit eye popping.

What are the expected returns of those “growth” stocks going forward versus value stocks that have not had those same recent results?

We would argue that the expected return is greater for value stocks going forward versus growth, especially for the top 5 mentioned. As Professor Ken French recently wrote:

“Investment returns have two parts: the expected return and the unexpected return. The expected return is the best guess of what will happen based on all the information currently available. The unexpected return is the surprise, the difference between what does happen and what was expected. Investors should base their portfolio decisions on expected future returns, not recent realized returns, and the two can differ by a lot.”

“Given their great returns over the last 10 years, what is our best guess of how the FAANG stocks will do over the next decade? Should we expect an average annual return of almost 35% again? Absolutely not. Who wouldn’t buy these stocks if their expected returns were 35%? But buyers need sellers. The demand driven by such high expected returns would simply push prices up and drive expected returns down to a more reasonable level. For the same reason, I’m confident that if we could go back to August 2010, we would find few investors predicting the FAANG stocks would do as well as they did from 2010 to 2020.”

While there’s no way to know where stocks are going next, value has trailed growth numerous times in the past before rebounding strongly. A case in point was immediately before and after the tech bubble burst in 2000. Value was in the doldrums prior to 2000. However, value rebounded sharply and outperformed growth by over 18% annualized from January 2000 – December 2003. One never knows when the premium is going to surface, but if you are not exposed to it, you will not benefit from it either.

Finally, several years of returns tells one absolutely nothing about the skill of any money manager. As Ken French explains:

“It takes about 35 years of returns to say with any statistical confidence that stocks have a higher expected return than the risk-free rate [that means treasury bills]. Think about a hedge fund that has equity-like volatility. If the manager’s alpha was as large as the market risk premium — which would be huge — it would also take about 35 years to be confident the manager has any value added — and that’s before his fees of “2 and 20.” Even if that phenomenal manager is out there, is he likely to stick around long enough for us to be able to figure out he wasn’t just lucky?”

In other words, it takes a very long time to determine whether an asset manager has any skill to beat the market. Who is around that long? Basing investment decisions on returns over short periods of time is a mistake, as wide variance around the average tells one nothing about long-term returns.

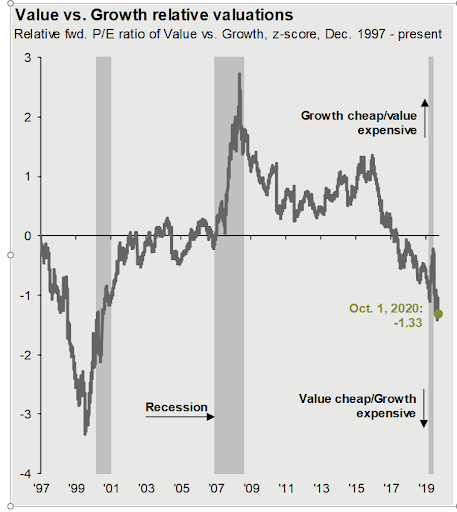

Value has not been this cheap compared to growth since 2000/2001. We believe it makes sense to continue to capture some of that in the long-term, while also practicing broad diversification. As our friends at Avantis have written:

“While we can’t know what the future will bring, we can say that now, more than any time in recent history, investors in growth stocks are baking in very high expectations of future earnings growth (that may or may not materialize) or extremely low expected returns.”

Source: FactSet, FTSE Russell, NBER, J.P. Morgan Asset Management. Growth is represented by the Russell 1000 Growth Index and Value is represented by the Russell 1000 Value Index. Beta is calculated relative to the Russell 1000 Index. U.S. Data are as of October 1, 2020.

Election

With the upcoming election we are cognizant of client concerns as to what impact this might have on the markets. Reflecting on our message back in 2016, which was a very contentious election, we will again consider data versus ideology, not take sides, and present our message, along with the main messages of other respected investment companies such as Dimensional Fund Advisors, Vanguard, Avantis and Goldman Sachs, no matter what side of the aisle you sit.

- Stock Market Volatility sometimes spikes a bit in presidential election years most likely due to uncertainty, but typically stops increasing shortly after the election is over.

- According to Vanguard research, stock market returns are virtually identical no matter which party controls the White House.

- Presidential elections have had little impact on bond markets as well.

- There is a strong case for investors to rely on patience and portfolio structure, rather than trying to outguess the market, in order to pursue investment returns.

- Many factors influence market behavior other than the party in office, including market valuations, globalization, technology, demographics, the Federal Reserve, the economy, and unforeseen events such as wars and natural disasters.

- The efficiency of the markets means expectations at any point in time are already reflected in market prices.

- The new President’s economic policies may not be fully enacted due to Congressional involvement, and no one knows how such policies will influence the marke

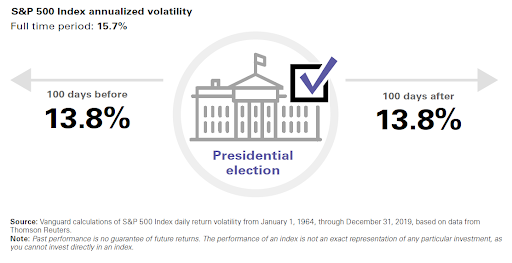

As the upcoming election has caused an increase in uncertainty as to the political parties who will be in power of the respective branches of our government, there is a chance for continued market volatility to be realized on top of the ongoing pandemic. However, a great piece published by Vanguard this week shows that historically markets actually tend to ignore the election relative to volatility. From January 1, 1964, to December 31, 2019, the Standard & Poor’s 500 Index’s annualized volatility was 13.8% in the 100 days both before and after a presidential election, which was lower than the 15.7% annualized volatility for the full time period.

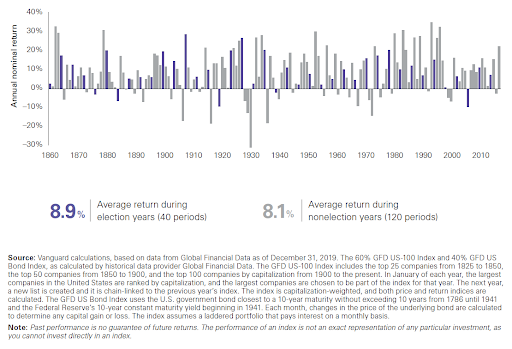

Further, Vanguard also shows that comparing election year versus non-election year (in a 60% stock, 40% bond portfolio) returns, there is no statistical difference in returns.

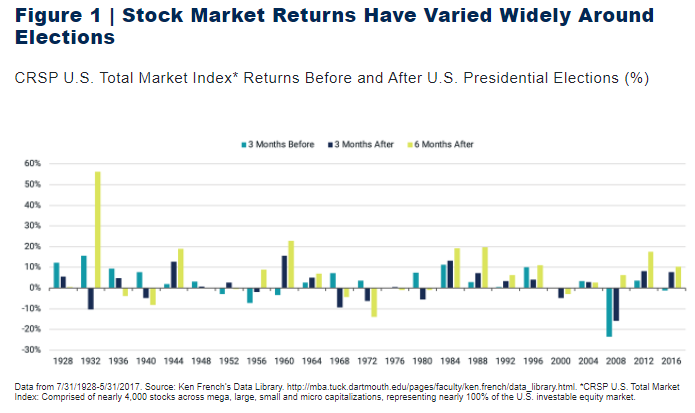

A similar view from Avantis Investors shows that stock market returns have varied widely around elections and there is no statistical significance that can help determine whether a particular party would lead to better stock returns.

Figure 1: Avantis: Stock Market Returns Have Varied Widely Around Elections

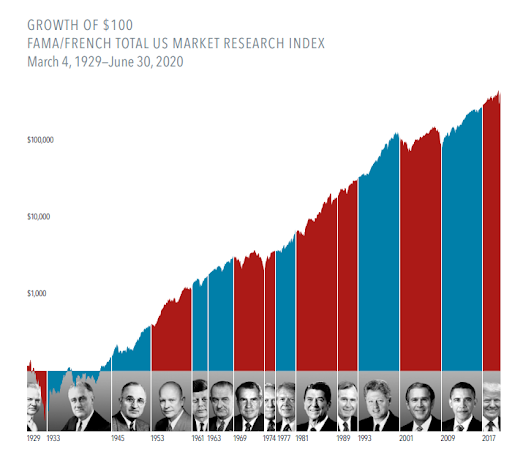

It’s natural for investors to look for a connection between who wins the White House and which way stocks will go. But as nearly a century of returns shows, stocks have trended upward across administrations from both parties.

Shareholders are investing in companies, not a political party. And companies focus on serving their customers and growing their businesses, regardless of who is in the White House.

US presidents may have an impact on market returns, but so do hundreds, if not thousands, of other factors—the actions of foreign leaders, a global pandemic, interest rate changes, rising and falling oil prices, and technological advances, just to name a few.

You can view an interactive version of this chart highlighting more details within each presidency and the impacts on markets here.

In the end, markets have rewarded disciplined, long-term investors, regardless of which party is in office. We believe it is important to remain diversified and focus on your long term goals and financial plan.

We hope you remain safe and healthy in this uncertain time.

Until next time,

Mike and Emily

DISCLOSURES

Past performance is no guarantee of future results. International investing involves special risks such as currency fluctuation and political instability.

Growth stocks are stocks trading at a high price relative to a measure of fundamental value such as book equity. Value stocks are stocks trading at a low price relative to a measure of fundamental value such as book equity. Value premium is the return difference between stocks with low relative prices (value) and stocks with high relative prices (growth).

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited.

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

The Fama/French Indices reflected above are not “financial indices” for the purpose of the EU Markets in Financial Instruments Directive (MiFID). Rather, they represent academic concepts that may be relevant or informative about portfolio construction and are not available for direct investment or for use as a benchmark. Their performance does not reflect the expenses associated with the management of an actual portfolio. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Actual returns may be lower.