Academic research and financial science lead the way in understanding risk and return in securities markets.

At McCartney Wealth Management, we utilize this research and science in the development of tax efficient, diversified portfolios for our clients.

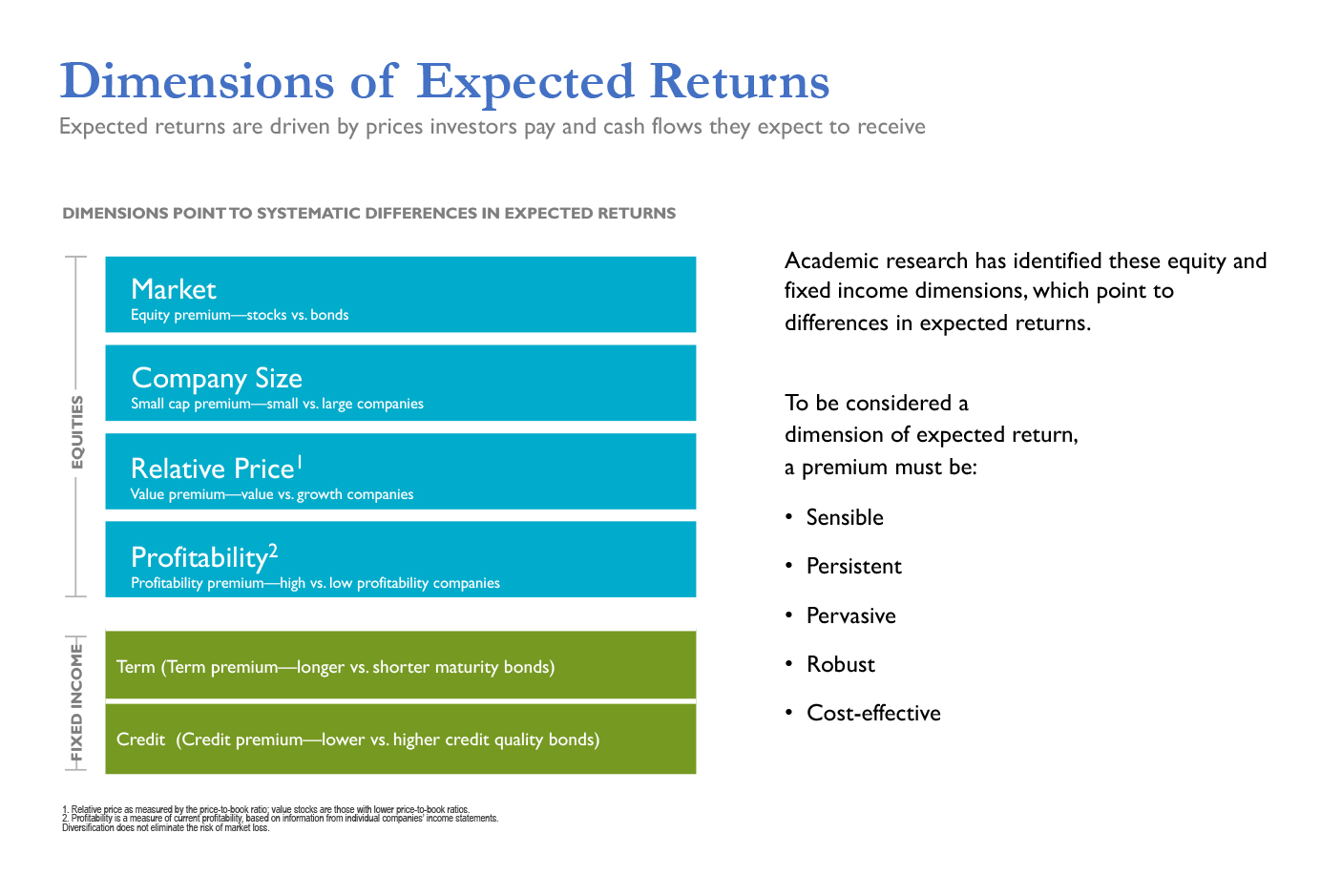

We build customized portfolios using low-cost, diversified mutual funds that capture dimensions of expected return. We focus on asset allocation strategy that is consistent with the client’s investment objectives, risk tolerance and investment time horizon. We provide performance reports at least semi-annually and will hold review meetings with clients to discuss these reports at least annually.

Investment Management Options

We work with clients to align their assets with their long term goals. By combining our evidence based investment approach with goals based planning we build customized portfolios that are optimized to capture dimensions of expected return.

Minimum Investment: $500,000